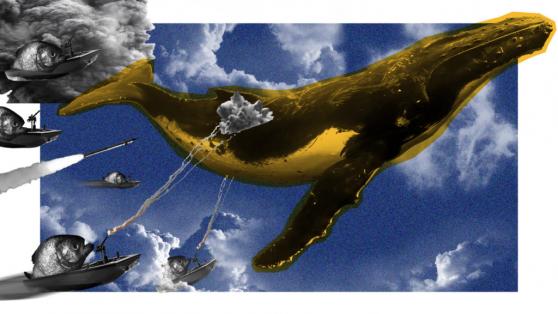

- Binance, the world’s largest cryptocurrency exchange, has come under heavy fire from regulatory agencies around the world.

- The IRS, the DOJ, and the CFTC are conducting investigations into Binance’s operations in the US.

- Regulatory agencies in the UK and Japan have stifled the operations of the exchange, demanding that it seek written consent to operate.

- The reason for the global “crackdown” on Binance could be coming as an attempt to regulate the decentralized cryptocurrency sector.

Founded in 2017, Binance won the hearts of cryptocurrency users, becoming the most used cryptocurrency exchange in the world. Binance regularly exceeds daily trading volumes of $10 billion, dwarfing competitors such as Coinbase and Huobi Global amongst others.

Since its launch, Binance has been embroiled in a tug-of-war with regulatory agencies around the world.

In recent months, events have come to a head with agencies in the U.S, Canada, Japan, and Thailand all launching investigations into the platform and stifling their operations. As Binance faces one of the most turbulent times in its history, cryptocurrency experts are confident that Binance will wriggle its way out.

Binance under Fire in the U.S

Binance has had a rocky relationship with the U.S, leading to the creation of Binance.US, an arm of Binance that is allowed to operate within certain jurisdictions of the U.S. The turbulence reached a crescendo in the U.S following the launch investigations by three agencies: the IRS, the DOJ, and the CFTC.

In particular, the IRS and the Department of Justice are concerned about the application of the exchange as a vehicle for money laundering and tax evasion, leading to the eventual decision of bringing Binance Holdings Ltd. under investigation.

Binance has strongly refuted allegations that it is lax on money laundering after it released a statement asserting that it had “worked hard to build a robust compliance program that incorporates anti-money laundering principles.”

Binance Holdings Limited is similarly under investigation by the Commodity Future Trading Commission (CFTC) over the concerns of allowing US residents to trade derivatives.

Pressure Mounting around the Globe

The noose around Binance’s neck is getting tighter following an announcement by the Financial Conduct Authority which precluded the exchange from undertaking any regulated activity in the UK.

It also required Binance to clearly display the FCA’s restriction on its platforms. Meanwhile, In the Far East, Japan’s Financial Services Agency (FSA) has also issued a stern warning to Binance that it is not authorized to carry out business in the country.

The exchange recently announced its decision to shut down operations in Ontario following the stiff regulations of Ontario securities laws.

The announcement states that “Binance can no longer continue to service Ontario-based users” and advised users to close any active positions by December 31, 2021.

On the Flipside

- Despite its size, Binance has proven to be quick and incisive in making great decisions that have been instrumental for its growth and survival.

- Binance has previously demonstrated its ability to change its headquarters and its corporate structure to meet regulatory demands.

Can Binance Weather the Storm?

The big question on the minds of crypto enthusiasts is whether Binance can survive this regulatory onslaught. One thing remains a clear sign of hope: Binance is steered by dynamic leadership, which is a huge advantage in such turbulent times. The sheer size of Binance and its global reach will also be instrumental for its survival.

With huge daily volumes, expert opinion is that Binance is too big to fail, but to weather the storm, certain changes have to be made.

To remain in the good books of regulatory agencies, Binance will have to adapt and tweak its setup. The entire community is watching with keen interest to see how the situation unfolds.

EMAIL NEWSLETTER

Join to get the flipside of crypto

Upgrade your inbox and get our DailyCoin editors’ picks 1x a week delivered straight to your inbox.

[contact-form-7] You can always unsubscribe with just 1 click.