(Bloomberg) -- One country, two systems has come to the world’s largest steel industry. As China’s great environmental cleanup takes effect during the winter months, the stringent curbs being implemented across the north are hurting mills’ output, while giving free rein to producers in the south.

“Southern steel mills unaffected by the output restrictions are generally running at full speed,” brokerage Nanhua Futures Co. said in a note. “They’re seeing better demand for their products as order volumes spike. Inventories are rapidly shrinking.”

Mills, miners and investors have been tracking China’s bid to rein in pollution this winter by imposing restrictions on steel supply, in addition to curbs on other industrial activity such as construction. The policy makers’ efforts are targeted at mills in the colder north, zeroing in on the so-called 2+26 cities, which refers to Beijing and Tianjin plus other centers. As well as skewing production, the drive is impacting raw materials, especially iron ore.

“You could say it is one country, two systems,” said Hong Hao, chief China strategist at Bocom International Holdings Co. in Hong Kong, using the phrase applied to China after the former British colony of Hong Kong was returned to mainland rule in 1997, yet was allowed to retain its autonomy.

Largest Buyers

There’s been stronger demand for iron ore “from the southern Chinese steel mills, offset by weaker demand from the northern mills due to environmental restrictions,” RBC Capital Markets said in a Nov. 15 report. The country’s mills are the largest buyers of seaborne ore, taking cargoes from miners including Brazil’s Vale SA and Australia’s BHP Billiton (LON:BLT) Ltd. and Rio Tinto (LON:RIO) Group.

The green push in China comes toward the end of a year when steel prices have rallied, with gains sustained by better-than-expected demand as well as efforts by the government to tackle overcapacity. Spot reinforcement bar rose to 4,391 yuan ($662) a ton on Tuesday, near the high of 4,396 yuan on Sept. 4, which was the most since 2011. That’s sent profits soaring at Baoshan Iron & Steel Co. and Hesteel Co., the listed units of the country’s top mills.

Wood Mackenzie Ltd. charted the policy’s uneven impact. The curbs will probably cut so-called hot-metal supplies by about 34 million tons this winter, with a reduction of 14.2 million tons this quarter and 20.2 million tons in the first three months of 2018. Still, “the loss will be partly offset by production hikes from capacity outside the 2+26 region,” it said in a note this month. The net decline this quarter may be just 4 million tons, it said.

Nationwide production has started to slow, official figures show. In August, China mills churned out a record 74.6 million tons. The next month it dropped to 71.8 million, and the total was little changed in October at 72.4 million.

‘Already Declining’

“Output in the north is already declining, demand for iron ore will be affected,” said Bocom’s Hong, who estimated steel production may drop by 30 million to 50 million tons. “The south tends not to have restrictions normally due to weather conditions and less concentration of production.”

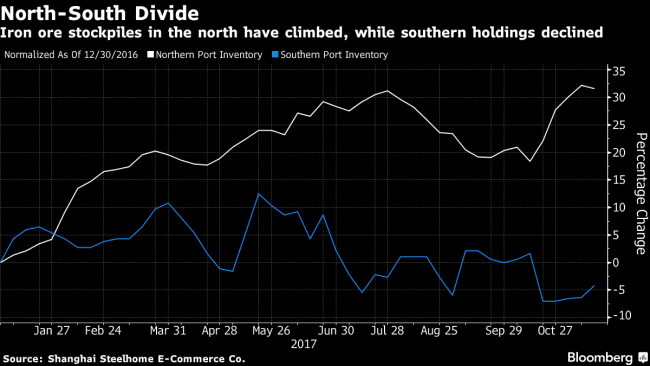

In a sign of that trend, inventories of iron ore at ports in northern China climbed to a record 100.1 million tons this month, according to Shanghai Steelhome E-Commerce Co. At the same time, stockpiles in the south are near a one-year low after bottoming at 8.6 million tons in October.

The industry and investors are also tracking nationwide holdings of steel, including rebar, a basic product used in construction. These have shrunk for five of the past six weeks to 3.61 million tons, the lowest level since November 2016, according to Steelhome figures. Steel inventories won’t rise meaningfully until the end of winter cuts in March, buoying prices in the meantime, Goldman Sachs Group Inc (NYSE:GS). said in a report received Wednesday.

“This year, especially in the northern part, there are strict controls,” said Shen Jianguang, chief Asia economist at Mizuho Securities Asia Ltd., noting steel demand and prices have been strong, while supply’s limited. “Producers who don’t face restrictions, they’ll definitely want to produce more.”

(Updates with comments from Goldman in penultimate paragraph.)