Weekly Technical Analysis For October 29th to November 2nd, 2018

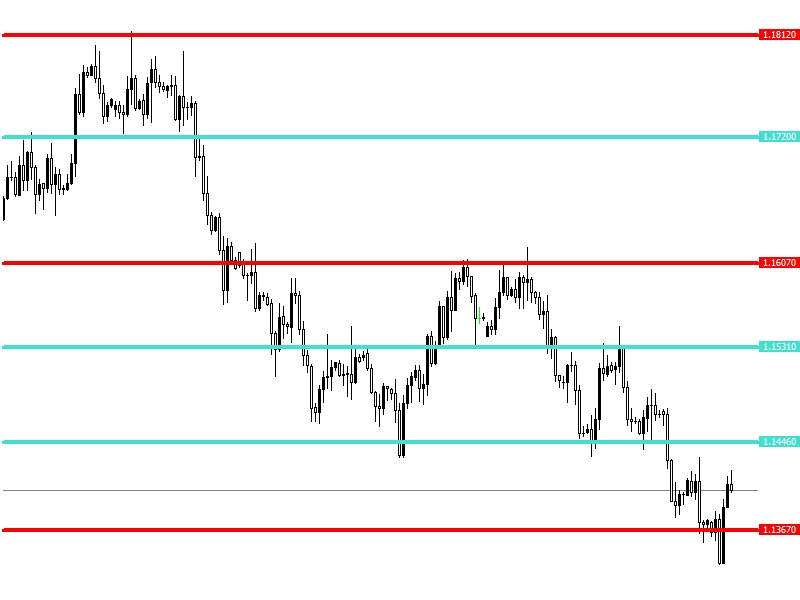

EUR/USD:

The Euro dropped significantly after last week’s European Central Bank Rate Decision. The ECB held rates steady at 0% as expected. The ECB also confirmed that its €15 billion in monthly asset purchases was still on track until the end of December, but it doesn’t mean other programs won't start up.

Additionally, the US Dollar was supported by strong US GDP numbers last week. The US Economy grew by 3.5%, above the 3.3% expected. The EUR/USD pair showed a downward movement and hit its lowest level in nearly two months.

Looking ahead, this week will be quite busy. The Eurozone GDP and CPI data will be a priority. The GDP is expected to come out at 0.4% q-o-q growth, the same as the previous number, this would lead to an annual realization of 1.9%. On the year-on-year basis, the Eurozone CPI is expected to stay at 2.1%. A lower than expected reading would be negative for the single currency.

Finally, the US Jobs Report for October will be released on Friday. The US Nonfarm Payrolls is expected to show the creation of 191K jobs in October, after rising 134K the previous month. The Unemployment Rate is expected to rise to 3.8% from the 49-year low level of 3.7%. Average hourly earnings will be another release to be followed closely at the same time and are expected to ease to 0.2% from 0.3%. An upbeat employment report will point to an improving US Economy and support the US Dollar.

Keep your eye on the daily support level of 1.1367. In order for the EUR/USD downward movement to gain more momentum, it needs to break down 1.1367 and stay below that level on a daily basis. Otherwise, we will see 1.1446 and 1.1531 as key resistance levels.

Support: 1.1367 - 1.1262 - 1.1188

Resistance: 1.1446 - 1.1531 - 1.1607

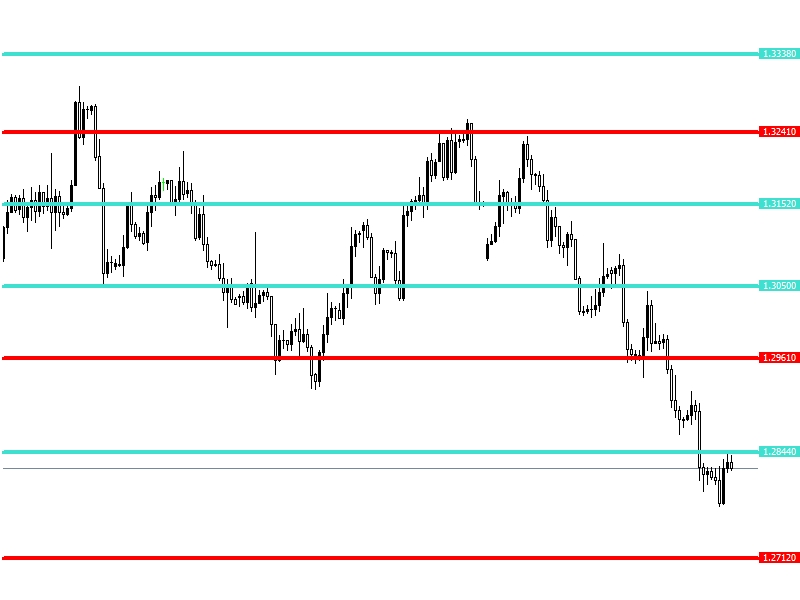

GBP/USD:

The BoE will announce its rate decision and inflation report on Thursday. The market expects the BoE keeps unchanged their benchmark interest rates at 0.75%. If the BoE projects a more aggressive interest rate hike outlook, it can drive the Sterling higher.

The GBP/USD pair has been falling for three weeks. As long as the pair stays below 1.2844 on a four hourly basis, the bearish action may continue and we will face 1.2712 as a daily support level. On the other hand, if the price rise above 1.2844, the next daily resistance level will be at 1.2961.

Support: 1.2712 - 1.2624 - 1.2494

Resistance: 1.2844 - 1.2961 - 1.3050

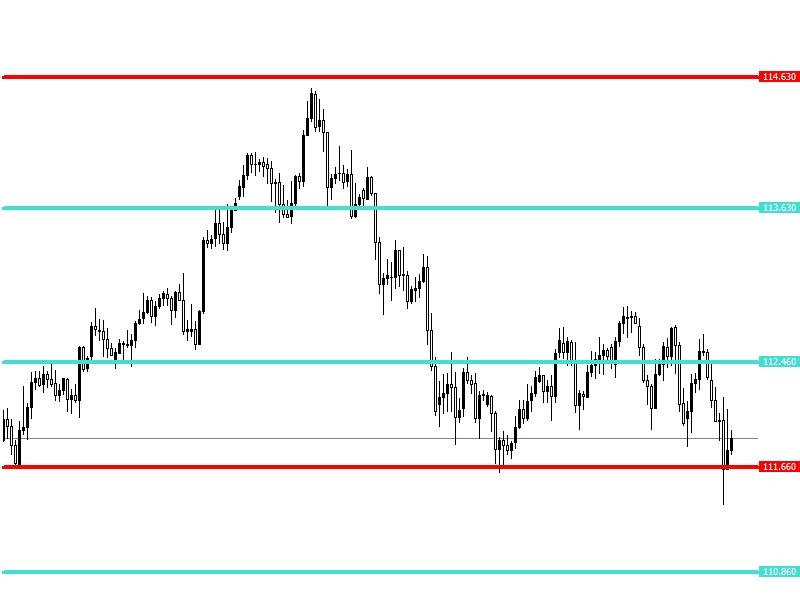

The Bank of Japan Monetary Policy Decision will be announced on Wednesday. No rate change is expected from the BoJ, but we might see a change to the timing of its government debt purchases to encourage more trading activity between financial institutions. Additionally, the central bank may also consider reducing the frequency of its purchases of mid- and long-term debt. The BoJ Governor Haruhiko Kuroda will hold a press conference afterward to discuss the decision. His comments will be significant for the Yen.

The USD/JPY pair dropped to the major support level of 111.66. However, as long as the pair stays above 111.66 on a daily basis, the fall may be limited and we will see again the key resistance level at 112.46. On the other hand, if the currency breaks down 111.66, the next support level can be found at 110.86.

Support: 111.66 – 110.86 - 109.90

Resistance: 112.46 – 113.63 - 114.63

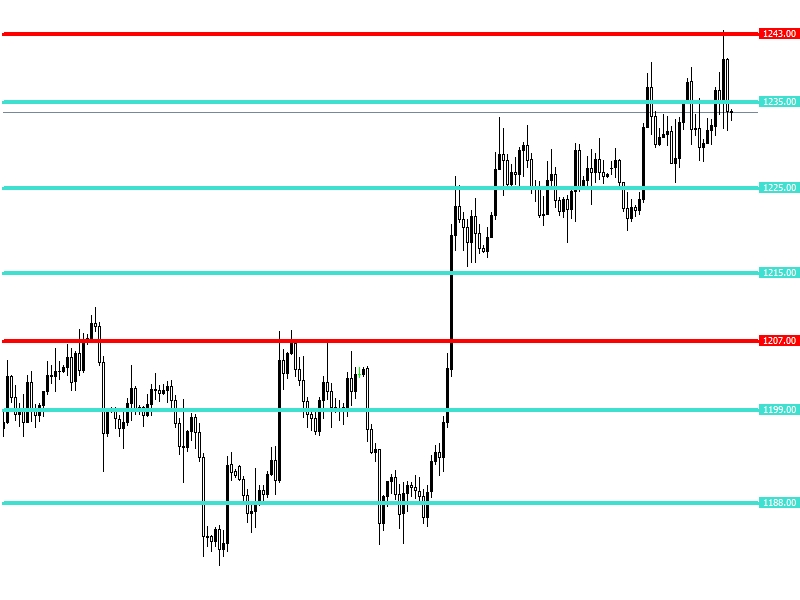

GOLD:

The Gold Price has shown a bullish action for a consecutive four weeks session and the precious metal price hit the daily resistance level of 1243, its highest since mid-July.

As long as the price stays below the 1235 key level, on a four hourly basis, we might see some taking profit actions. Should this occur, the support level can be found at 1225. On the other hand, if the price goes beyond 1235, we will see 1243 as a daily resistance level again.

Support: 1225 - 1215 - 1207

Resistance: 1235 - 1243 1249