Last November, the US stock market was making a seemingly risky bet that the economy would muddle through the soft patch that was weighing on output. The S&P 500 Index was making new highs, in sharp contrast with the stumbling ADS Index — the Philadelphia Fed’s real-time measure of the US business cycle was flirting with a recession signal at the time. As it turned out, the economy stabilized and the stock market has since soared to even loftier heights. But just when it looked like the macro danger had passed, the coronavirus that’s roiling on China, and spreading near and far, is increasingly seen as posing some as-yet-unknown threat for the global economy and perhaps the US as well.

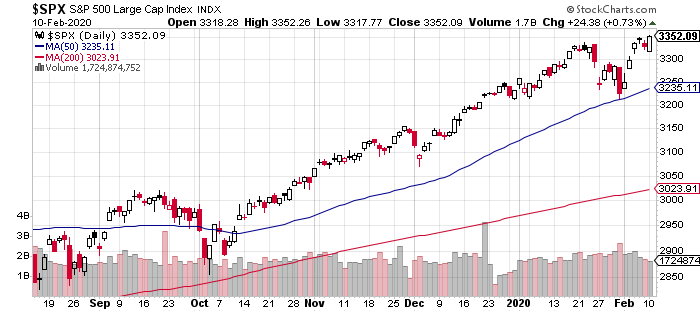

The US stock market, however, continues to climb a wall of worry. The S&P 500 yesterday (Feb. 10) rose to a new record. Meantime, the accompanying economic profile, based on data published to date, points to ongoing moderate US growth for the near term. The question is whether the incoming numbers are set to stagger as the economic blowback from China, the world’s second-largest economy, reverberates outward?

It’s clear that China has already paid a heavy toll in human lives (more than 1,000 deaths so far and counting) and the numbers published in the weeks and months ahead are sure to show an economic cost as well. With portions of the country closed down to battle the virus, it’s inevitable that shuttered factories and offices will trim growth in the country for some period of time. Given China’s key role in globalized supply chains, the price tag will show up around the world too.

“If the current coronavirus crisis continues to impact production capacity in China, it will ultimately impact auto assembly plants in the U.S. and Mexico,” says Razat Gaurav, chief executive of Llamasoft, which manages supply chain logistics for automakers and aerospace firms in North America.

What’s the risk for the US? More than trivial, according to a new CNBC survey of 11 economists, which predicts that first-quarter GDP growth will slow sharply to 1.2%–down from 2.1% in Q4. The good news, the dismal scientists add, is that a bounce-back will quickly follow in Q2, although the timing and degree of a bounce could vary once the full extent of coronavirus damage is known.

One hedge fund billionaire, however, thinks worries related to coronavirus could be overbaked. Speaking at a conference this week, Ray Dalio of Bridgewater Associates says the virus “probably had a bit of an exaggerated effect on the pricing of assets.” He added: “Because of the temporary nature of that, I would expect more of a rebound. It most likely will be something that in another year or two will be well beyond what everyone will be talking about.”

Meanwhile, Federal Reserve Chairman Jerome Powell is expected to provide upbeat testimony to Congress this week on the state of the US economy. The coronavirus, however, will likely be a topic of discussion as it relates to monetary policy.

“His message will probably be that, if rate cuts are coming, they would come solely in response to global disruptions associated with the virus,” predicts Robert Perli, an economist at Cornerstone Macro. But “he will likely say clearly that the US economy is inherently healthy.”

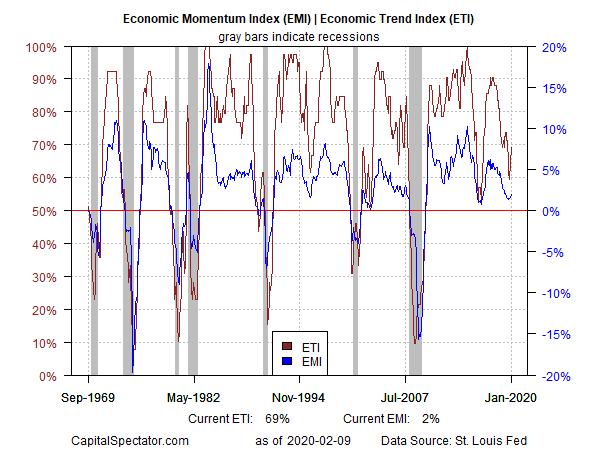

In fact, the US macro trend has stabilized following last year’s soft patch. Upbeat signs on this front were emerging last November, providing support for thinking that the slowdown in economic activity had run its course.

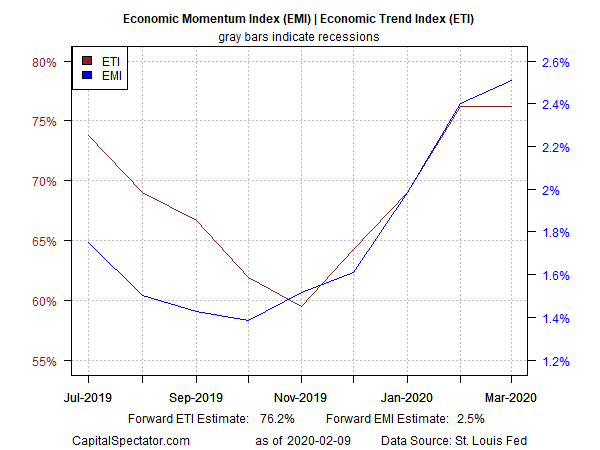

Fast forward to the current outlook: forward-looking estimates of the US business cycle show a moderate rebound through next month. As projected several months ago, The Capital Spectator’s proprietary business-cycle indexes have bounced lately. And now a conspicuous bounce is showing up in the macro trend.

Projecting the index values through March points to an extension of the recent rebound:

The caveat, of course, is that coronavirus risk isn’t yet reflected in the estimates. It’s anyone’s guess at this point how this risk will impact the US economy. For now, it’s reasonable to assume a relatively light and short-lived price tag. But forecasts that attempt to factor in this risk is mostly guesswork these days. Sometime in the next few weeks, the preliminary numbers will provide the first real results from the headwinds.

Meantime, watch the incoming data. There’s a convincing case at the moment for optimism that the US will sidestep most of the blowback. But the potential for downside surprises can’t be dismissed just yet.

“The Chinese economy is starting to reel from the effects of the epidemic and if this turns into a pandemic, then the world economy could be harmed greatly,’ advises Joel Naroff of Naroff Economic Advisors.