- DOLE’s initial public offering last year was poorly received, and the stock now is threatening all-time lows

- In the context of inflation and execution missteps, the stock’s valuation looks extraordinarily favorable

- The discount to peer Fresh Del Monte looks particularly strange; if that gap narrows, DOLE can skyrocket

Dole PLC (NYSE:DOLE) seems like it should be a winner in this market. The food business (at least to some degree) is both defensive and inflation-resistant.

Overall consumer trends in the West seem to lean away from processed foods and toward healthier eating: bananas, pre-packaged salads and fresh vegetables would seem to fit the bill.

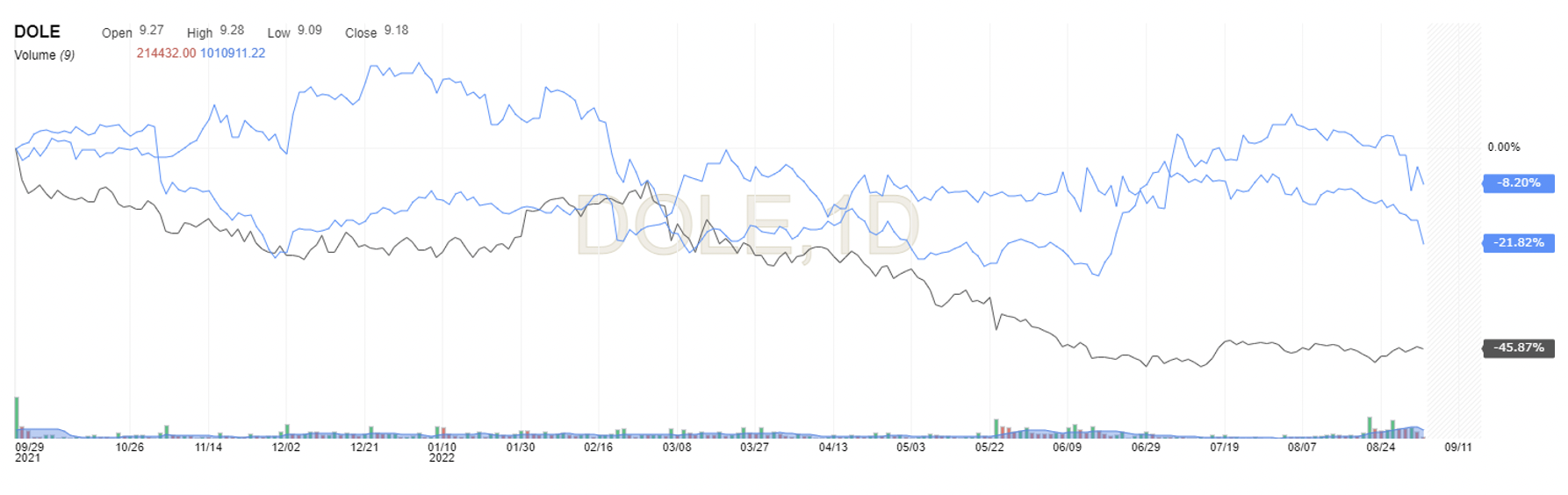

But since DOLE went public last year after a merger of Dole Holdings and Ireland’s Total Produce, that story has not played out at all:

Even with a lowered IPO price, DOLE has badly underperformed the market, as well as peers Fresh Del Monte Produce (NYSE:FDP) and Greenyard (BS:GREENb). To be sure, there are some reasons why.

Dole’s execution has not been completely on point, most notably with a pair of recalls in its salad business. The balance sheet is more leveraged than those of peers. Inflationary pressures and the strong dollar have pressured margins; in its Q2 report last month, Dole cut its full-year profit outlook for the second consecutive quarter. Guidance now assumes EBITDA (earnings before interest, taxes, depreciation and amortization) will decline not only against pro forma results for 2021, but for 2020 as well.

But looking closer, the recent results — even this year — are stronger than they might appear. In fact, it seems as if the long-term case here is reasonably intact. Meanwhile, valuation is surprisingly low for a defensive business, and three 5%-plus owners have entered since mid-June. As always, there are risks, but below $10 there are solid rewards as well.

The Bull Case For DOLE Stock

DOLE is a stock for which the investment process is based on understanding the risks to the bull case, rather than finding some hidden value. Particularly in terms of valuation, the bull case is essentially self evident.

At Friday’s close of $9.21, Dole has a market cap of $874 million. Net debt, including $142 million in pension obligations, totals $1.181 billion, for an enterprise value just more than $2 billion.

Adjusted EBITDA guidance for this year is now $330 million to $350 million. And so EV/EBITDA, even conservatively measured, sits just below 6x. Normalized free cash flow, based on the details of the outlook, should be $125 million, suggesting a P/FCF at 7x.

Yes, Dole is a leveraged business, but at 3.1x net it’s not disastrously leveraged. This is a business valued as if earnings are headed for a decline and/or are receding from a recent peak. Yet, again, there should be some degree of defensiveness here: consumers need to eat. In that context, the balance sheet is perhaps risky, but far from unwieldy.

Importantly, those multiples also suggest a sharp discount to peers. Based on trailing 12-month results, DOLE trades at a bit under 7x EBITDA. FDP is above 11x; Greenyard (based on results through calendar Q1) is a touch below 6x, albeit with lower EBITDA margins and ~95% exposure to Europe. And it’s not an apples-to-apples comparison given Dole’s merger with Total Produce last year, but Dole went private in 2013 at just over 10x EBITDA.

Simply put, DOLE looks too cheap.

Why DOLE Is ‘Too Cheap’

The question is: why is DOLE “too cheap?” One possible reason is that DOLE stock is trading at a discount to FDP, in particular, because the Dole business isn’t as good as that of Fresh Del Monte. Another is that a pair of recalls of pre-packed salads late last year and early this year have damaged the company’s business going forward.

Neither explanation really holds up, however. Again, Dole’s profits this year should be below those of 2020, pro forma for the Total Produce merger. But the reason profits are declining is because of inflation and the resulting volatility in the business.

Indeed, Fresh Del Monte is dealing with the same problems. Dole’s first-half adjusted EBITDA declined 31% year-over-year; FDP’s Adjusted EBITDA fell 29%. That aside, there’s no evidence in Fresh Del Monte’s results that Dole’s recalls have led FDP (which operates the Fresh Express brand) to take market share.

Indeed, there’s little apparent reason for the discount to FDP. The debt on both companies’ balance sheets is similar relative to underlying profits. Both companies are dealing with inflation and the stronger U.S. dollar; Dole has modestly higher currency exposure, but nothing to suggest that FDP should trade at a premium.

There are worries that persistent inflation could lead to trading down even within fruits and vegetables (more bananas, fewer berries), but, again, that’s an industry-wide problem, not a company-specific one.

To be sure, it may be that the market is telling us something about the respective businesses. And, again, DOLE has disappointed pretty much since the jump; even without inflation (and a bear market), the stock struggled. It has traded above its $16 IPO price for a total of nine trading sessions in more than 13 months as a public company.

It’s certainly possible DOLE stays “dead money” and that the valuation gap relative to FDP doesn’t close. But particularly in this market, that seems a risk worth taking. This isn’t exactly “heads I win, tails I don’t lose much,” but the upside clearly outweighs the downside.

Disclosure: As of this writing, Vince Martin has no positions in any securities mentioned. He may initiate a position in DOLE this week.

Read the full article at Overlooked Alpha.