This past week in the markets was like a good gangster movie.

- It contained high drama (how much will the Fed raise rates),

- a love affair with the results (market rally Wednesday),

- a quick turn in sentiment, and then…

- the villain getting shot (the market on Thursday),

- gangsters needing new people and recruiting (the jobs, employment, and labor participation reports), and…

- another shooting (continued sell-off on Friday).

All this weighed heavily on the markets (stocks and bonds), resulting in stocks at new lows, and interest rates at new highs when the market closed on Friday afternoon.

It's a mixed bag. There are negatives and positives. Let's go through them one by one:

The Negatives:

1. The Fed took action

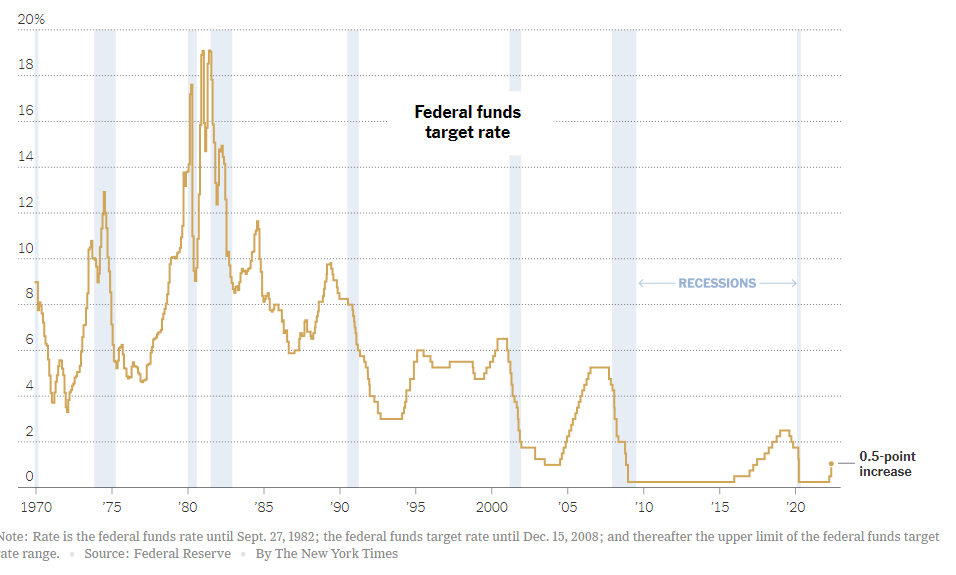

In March, with the first rate hike since 2018, the Fed clearly broadcast that it would aggressively raise rates again in May. Investors anxiously waited to see exactly how aggressive they would be. They ONLY raised rates by 0.50% on Wednesday. Fed Chairman Jerome Powell said that similar raises were "on the table" in the future, thus eliminating more aggressive 75 bp rate hikes in the future. This was the market's worst fear.

Reflexively, investors initially cheered and sent the market up almost 1,000 points on the day of the news.

However, Wall Street has nervously been waiting for Fed action for some time now. Many economists believe that Mr. Powell and company are late in raising rates.

Worried that the Fed may now become more hawkish, the idea that 75 basis points is off the table gave investors something to cheer about at the time of the announcement, but by the next morning, another concern drove the market in the direction of its current trend, down.

Wall Street woke up on Thursday realizing that this was the most aggressive the Fed has been since 2000, and in response, concluded that it was time to sell stocks.

2. Draining excess liquidity from the system

What probably spooked investors after reality set in was the aggressive path that the Fed is planning to take in draining excess liquidity in their $9 trillion portfolio of bonds (especially mortgage bonds). Since the financial crisis of 2008, the Fed has injected easy money into the system.

This was accelerated in 2020 with the shutdown during the COVID pandemic. According to the Fed, this excess liquidity now needs to be drained from the system along with the Fed Fund rate hikes.

These Fed Fund rate hikes are what exacerbated the market's turmoil on Thursday and Friday!

This period has seen the fastest rise in interest rates in decades (since 1994). The 10-year Treasury rate that began 2022 at 1.5% has risen 100% to over 3% in 4+ months.

The new level of interest rates is now being factored into stock market valuations by analysts on Wall Street. Instead of using high P/E multiples of over 20, they now believe that the market should be pricing in mid-teen multiples. This, along with fears of a future recession, weigh heavily on the market.

As you know, many stock prices have been cut in half or more in just 6 months since the euphoric top.

A rapid rise in interest rates (see above), in addition to lingering supply chain problems, rising crude, and other commodity prices, and geopolitical risk, have all contributed to ongoing investor nervousness.

Now, investors realize that they are facing not only inflation but Stagflation.

For those not familiar with this insidious economic condition, Stagflation is a lingering period of rising and high inflation coupled with slowing economic growth or negative GDP.

Stagflation is usually unkind to stock prices as the growth rates of companies (and revenues) begin to decline while input costs (labor and raw materials) rise. Our last experience with Stagflation occurred from 1972 to 1981 when stock prices went nowhere for about ten years.

3. Aging population and emotional fear

Last year 4.5 million people left their jobs, and many of them decided to retire. Many of these people were depending on their retirement accounts to fund their ongoing income needs, believing that the last ten years of sizable gains would contribute to a comfortable lifestyle. Then the market turmoil began in earnest this past January.

Many of these investors cannot take the pain of watching both their stock and bond market investments fall in value. Therefore, sadly these investors have been pulling the trigger in liquidating their investments and moving to cash.

The move into preservation mode may be just starting. Bank of America reported last week that $3.4 billion came out of stocks, and $9 billion moved out of bonds as investors moved to the sidelines. This has amplified volatility and sparked daily volume spikes as some investors feel forced to retreat. This may be further causing volatility and capitulation in the markets.

The Positives:

1. The Fed has begun the tightening cycle

This was action investors all expected to help fight inflation and slow the economy down. Usually, the first few triggers are met with negative market action, but eventually, this is baked into the cake and the market finds its footing.

2. Earnings are very good

According to FactSet, 87% of S&P 500 companies have reported earnings, with 79% beating their earnings estimates and 74% reporting revenues above estimates. This should provide a floor for how much the market can and will go down.

3. Inflation may slowly subside

The global supply chain, exacerbated by China's recent shutdown due to COVID, may resume soon. Also, if the post-COVID buying sprees slow down due to businesses cooling off a bit and higher borrowing costs, we could return to more normal supply chains. This may cool inflation a bit and reduce some of the stress to the system (especially in housing).

4. Consumer demand may be slowing

This is the principal reason for higher inflation.

5. A healthy and good job market

Unemployment is at 50-year lows, and we are living with a massive number of job openings (11.5 million). This should keep the job market strong even in the face of a slowing economy. A healthy job market should keep wages high (and growing) and help offset some of the economic slowdown.

6. Stock market valuations are becoming more attractive

Perhaps we were due for this type of correction. Please note that normal corrections of 10% or greater typically occur once in every 4 years. This is normal and so long as we don't see an additional 5-10% drop, this is nothing more than a correction. Stocks are beginning to look attractively priced to investors and it may not take much for the market to find a bottom here.

7. Investor sentiment is very negative

A host of firms are showing extremely negative/bearish sentiment measures at levels that tend to be where market bottoms are formed. Extremely negative sentiment is a good contrarian indicator. If we see even a slight rally in the bond market, we may find the investment sentiment becoming more positive. This could fuel a substantial rally.

8. Commodity prices should begin to retreat

If the economy cools off from aggressive Fed tapering and rate hikes, commodity prices should also come down. Demand has a lot to do with influencing commodity prices. While we may be in for elevated prices for some time, the trend could begin to lose some momentum. Much of this depends on the price of crude oil.

9. Geopolitical risk

The Russia-Ukraine situation has exacerbated the commodity price story and inflation risk. If this battle gets sorted out in the next few months (likely), then we might well see a positive impact on some of the global supply chain issues.

Having said all that, we do want to remind you that we are going into the most unfavorable period of the year for investing. May to October can be tricky. Additionally, mid-term election years have, in the past, been much more volatile than years not having a mid-term election. Be careful.

Here are some ways that you could protect your own portfolio (create your own drawbridge):

- Make sure you include CASH as one of your asset classes. It is far better to rotate into cash and preserve capital when the market is overly volatile and you feel uncertain. Don't let anyone (even your advisor) tell you that you should not park your assets in cash. Riding a downward market may put you in a deep underwater position that could take years just to get back to even.

- Diversify, diversify and diversify. Several of our investment strategies have been investing in agricultural, energy and metals ETFs since the latter part of 2021. These strategies are mostly positive on the year.

- Look to markets other than the United States. Don't get put into a corner of only investing in our markets. Oftentimes, when our markets are faltering, another country may be doing well. We have a strategy for this.

- Utilize hedges and put on appropriate ways to minimize wild swings. A few of our investment strategies have invested in an inverse ETF which is effectively putting the investor in a position to prosper during a downward moving market. These ETF instruments can be traded in seconds during the trading day, have huge volume and are easy to get in and out of.

- If you own stocks, even with a low cost basis, DO NOT be afraid to sell some of the shares. Far better to pay the IRS than Mr. Market, which can be ruthless when you have nice profits given up very quickly. Look at the NASDAQ stocks, of which 49% of them are down more than 50% in 2021.

- Consider using derivatives to hedge your positions. This would include "writing" call options, buying puts, or purchasing other instruments that will hedge your whole portfolio. Mish recently had her subscribers put on a volatility instrument which is effectively investing in a trade that focuses on insurance against an ugly market. (and it got very ugly this week).

Market Insights from our Big View service.

Risk-On

- Market internals for SPY improved despite the lower close in price on the key indices. (+)

- The Volatility Ratio improved despite the selloff. (+)

- The number of stocks above their 10-day moving average actually improved as well. (+)

- The Dollar (NYSE:UUP) continues to maintain leadership across all foreign currencies as a result of an aggressive Fed and geopolitical stress. (+)

Risk-Off

- The 4 major indices continued their downward trajectory this week and yet are still not oversold according to Bollinger® bands on price and momentum according to RealMotion. (-)

- Energy across the board including United States Natural Gas Fund, LP (NYSE:UNG), SPDR® S&P Oil & Gas Exploration & Production ETF (NYSE:XOP), and United States Oil Fund, LP (NYSE:USO) dominated this week. (-)

- Interest rates continue to rise, with mortgage rates hitting levels not seen in well over a decade. (-)

- The mean reversion setup we pointed out for TLT last week failed, crashing down harder (-)

- Value stocks (VTV) continue to outperform Growth (VUG), a prevailing risk-off theme (-)

- Despite a phase change for Soft Commodities (DBA) to a weak Warning phase, it improved relative to the SPDR® S&P 500 (NYSE:SPY) and continues to maintain its leadership. (-)

- Despite the selloff in Gold (GLD), it is still maintaining leadership relative to equities for most of 2022. (-)

- The most explosive chart on the board is Oil (USO) which looks poised to break out of a month-and-a-half long compression pattern. (-)

Neutral

- Despite the selloff, volume patterns improved to neutral for the most part with the exception of iShares Russell 2000 ETF (NYSE:IWM) which is still under distribution. (=)

- 5 sectors were positive on the week led by Energy (XLE) +10%, an obvious improvement over last week in which all sectors were negative. Also interesting was that Semiconductors (SMH) +1.2% was up on the week, a risk asset. (=)

- The S&P was strong on a relative basis when compared to the internals for NASDAQ (QQQ). (=)

- The number of stocks within the S&P that made new 52-week highs improved marginally this week. (=)

- Risk Gauges remained neutral despite further selling. (=)

- Despite the drop in equities, Volatility (VXX) actually sold off although still in a Bullish phase. (=)

- From Mish’s Modern Family, Retail (XRT) and Biotech (IBB) are hitting potentially oversold levels, implying the potential for mean reversion to the upside. (=)

- Emerging markets (EEM) backed off and are no longer leading on a short-term basis over US equities. (=)