While the yellow metal hit a new record high, the silver price remains below its post-pandemic peak.

While gold has dominated the headlines recently, silver and mining stocks have been material underperformers. And with the latter better barometers of investors’ enthusiasm, their relative weakness should concern the permabulls.

Likewise, with weak economic data unlikely to help silver when investors fully digest the ramifications (look past pivot optimism), a 2024 recession could push silver back to its 2022 lows.

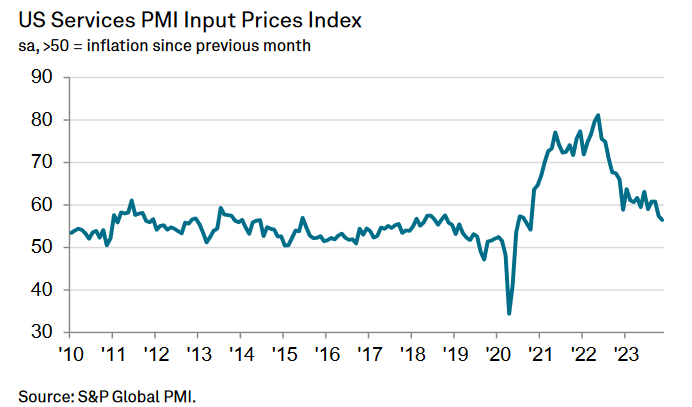

For example, S&P Global released its U.S. Services PMI on Dec. 5. Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“Firms providing both goods and services have become increasingly concerned about excessive staffing levels in the face of weakened demand, resulting in the smallest overall jobs gain recorded by the survey since the early pandemic lockdowns of 2020.”

Furthermore, after “evidence of spare capacity led to the non-replacement of voluntary leavers,” it’s another sign that the U.S. labor market has weakened. And while we warned that a recession, not inflation, is the next bearish catalyst, lower pricing pressures are normal when demand wanes at this part of the economic cycle.

Please see below:

To explain, services inflation has been the primary driver of the pricing pressures, as manufacturing PMIs have struggled. Thus, if (when) outright deflation occurs, risk assets like the PMs and the S&P 500 should come under heavy pressure.

Continuing the theme, Challenger, Gray and Christmas Inc. released its job cuts report on Dec. 7. An excerpt read:

“So far this year, companies have announced plans to cut 686,860 jobs, a 115% increase from the 320,173 cuts announced in the same period last year. It is the highest January-November total since 2020, when 2,227,725 cuts were recorded. Prior to 2020, it is the highest year-to-date total since 1,242,936 cuts were announced through November 2009.”

The report added:

“Companies are expecting slower growth in the coming months, particularly in industries that support consumers.”

Plus, with 2024 looking nothing like 2021 or 2022, the report provided more evidence of a labor market confronting serious problems, which should help spur the USD Index as volatility increases.

Please see below:

Uh-Oh Canada

The Bank of Canada (BoC) held its overnight lending rate steady on Dec. 6, as higher long-term interest rates have materially impacted the Canadian economy. The statement read:

“In Canada, economic growth stalled through the middle quarters of 2023. Real GDP contracted at a rate of 1.1% in the third quarter, following growth of 1.4% in the second quarter. Higher interest rates are clearly restraining spending: consumption growth in the last two quarters was close to zero, and business investment has been volatile but essentially flat over the past year.”

And with demand destruction poised to hit its neighbor next, the BoC added:

“In the United States, growth has been stronger than expected, led by robust consumer spending, but is likely to weaken in the months ahead as past policy rate increases work their way through the economy.”

So, while risk assets have celebrated this weakness, oil prices have run for cover. And with crude’s collapse likely to filter into other assets once they catch on, silver and mining stocks should be among the hardest hit when the drama unfolds.

Finally, Walmart (NYSE:WMT) CEO Doug McMillon said that unpredictability could reign in 2024, even as deflation unfolds across the U.S.’ largest retailer. Thus, while securities are priced for a perfect landing, plenty of indicators signal a much different outcome.

Overall, silver’s strength is much more semblance than substance, as rate cuts typically occur when economic growth falters. And while investors assume they can skip the recession volatility, history suggests otherwise. As such, we believe assets like silver, the GDXJ ETF and the S&P 500 should face selling pressure in the months ahead.