Since the end of the Great Recession, I have been warning that our economic recovery (both U.S. and global) isn’t a genuine recovery because it’s driven by debt and the inflation of new economic bubbles. I’ve been calling it a “Bubblecovery” or a bubble-driven economic recovery. We’re repeating the same mistakes that led to the 2008 financial crisis in the first place, basically. This week, Bloomberg published a piece called “The Decade of Deleveraging Didn’t Quite Turn Out That Way” that confirms my warnings:

This was the decade of de-leveraging that wasn’t. A decade ago, as the world began to piece the financial system back together after an epic credit crisis, there was agreement on one thing: Too much debt had caused the crisis, and so there must be a huge de-leveraging. It has not worked out like that.

Everyone knew that leverage was too high. In 2007, as subprime lenders went bankrupt and the crisis took hold, sinister charts circulated around Wall Street. Shooting upwards, on one side, was U.S. household debt as a proportion of total GDP. Shooting downwards, on the other side, was the U.S. savings rate, plunging near zero.

Consumers had grown overleveraged because the financial sector bombarded them with cheap credit, funded on absurdly generous terms by the markets. European banks, often the ultimate lenders (or “suckers” as Wall Streeters tended to call them), suffered terrible losses.

Prolonged and painful deleveraging seemed inevitable. Debt would have to be paid down or written off. Disputes over who should retrieve what from the wreckage would have to be resolved. Economic growth would be difficult if not impossible. Central bankers, trying to minimize the pain, cut interest rates to zero or below.

Behold the result of their labors: Leverage has increased. U.S. consumers and the Western banking system have cut back somewhat, but leverage has just moved elsewhere. Their retrenchment was far outstripped by a rise in borrowing by companies and particularly by governments.

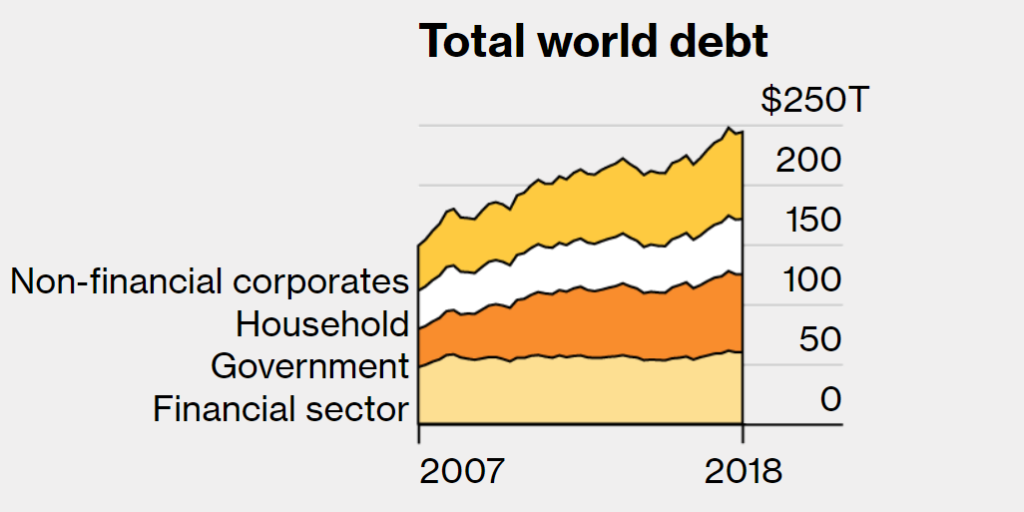

The Bloomberg piece included a chart that shows that total world debt increased by approximately $100 trillion from 2007 to 2018:

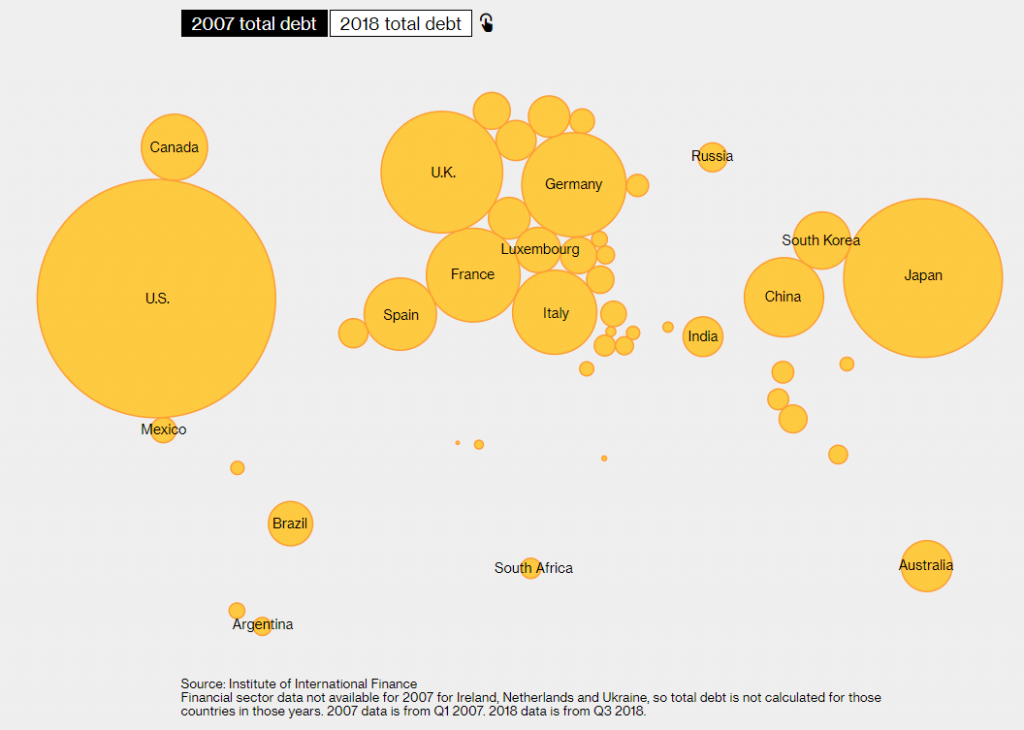

The Bloomberg piece also included an interactive graphic that shows how much debt each country owed in 2007 and 2018 (visit the link to use the interactive graphic). The chart below shows total debt in 2007:

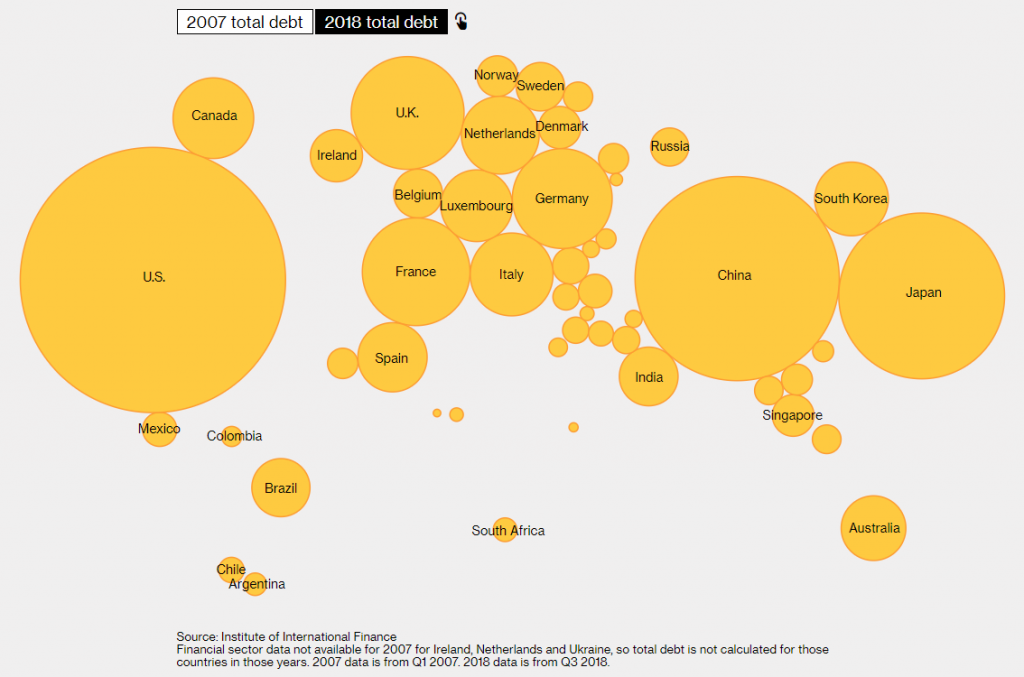

The chart below shows total debt in 2018:

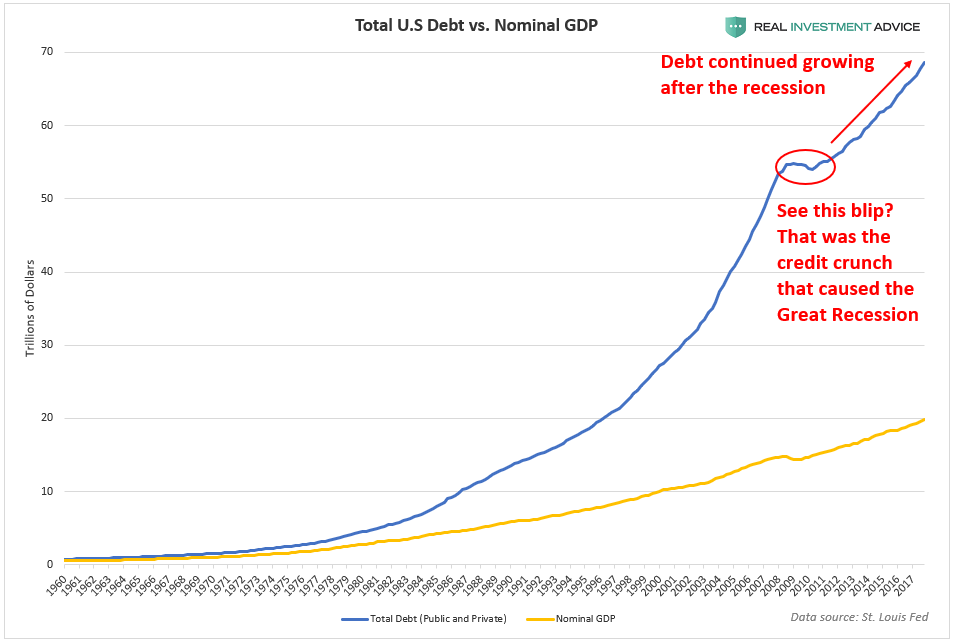

Deleveraging only occurred for a very brief time in the U.S. during the credit crunch that caused the Great Recession. Though it only registers as a mere “blip” on the chart of the inexorable growth of debt, that blip was enough to put 8.7 millions of Americans out of work, push our financial system to the brink, and cost the economy at least $22 trillion. As a result of trillions of dollars worth of intervention from the U.S. government and Federal Reserve, America’s debt bubble has continued to grow again – and that is the very reason why we have a so-called economic “recovery.”

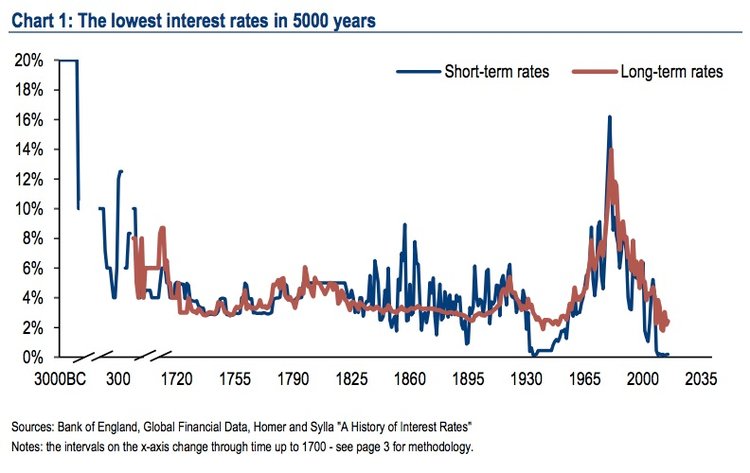

Global debt has continued to explode after the global financial crisis because central banks cut interest rates to 5,000 year lows, which has made it much cheaper to borrow. So, governments, corporations, and households have been throwing a giant debt party for the past decade, which is creating artificial economic activity, and voilà – GDPs continue to grow.

As the saying goes, “the definition of insanity is doing the same thing over and over and expecting different results.” We are doing exactly that by continuing to lever up the global economy and expecting sustainable economic growth without 2008-style crises. With global debt up an incredible $100 trillion since the global financial crisis, anyone who thinks that another crisis is far-fetched is incredibly naive. Unfortunately, I believe that the next one will be even worse simply due to the fact that we have an additional $100 trillion worth of debt to deal with now.