The economic calendar is normal, but there are plenty of cross-currents from other major events. Bitcoin futures, the FOMC meeting, more debate on the tax legislation, the Alabama special Senate election, and an avalanche of 2018 forecasts.

It is the time of year when the punditry looks for the nearly-annual Santa Claus rally. This year, that jolly old elf may need a GPS system to navigate the cross-currents. I expect many to be asking:

Is a Santa Claus rally possible?

Last Week Recap

In the last edition of WTWA I took note of the strengthening economic outlook and predicted that attention would turn to the effects of the tax cut legislation. That shot hit the mark, but Mrs. OldProf was not impressed. She said the shot did not require Steph Curry! (And I thought she was skipping the basketball section of PTI).

The pundits pondered, and the market reacted. Little was determined, and there are plenty of tax implications to wonder about in the week ahead.

The Story in One Chart

I always start my personal review of the week by looking at a great chart of the S&P 500. Investing.com has a nice interactive version of futures trading with news. Check out the site to have some fun.

Compared to recent days, it seemed like there was a lot of volatility. The range was actually only 1.5%. Some week we will see some real volatility. The market weathered questions about problems in the tax bill and the debt limit.

Personal Note

Readers often ask how I prepare for WTWA. I read many sources. Even when I share many links, most of the material does not make the cut. Part of my approach is to save and organize material as I read it. For this, I like to use Pocket and a system of tags. This week I got a message from Pocket summarizing my reading saved on this particular source. Readers might find it interesting, and might want to try Pocket. I also use Feedly to monitor all my sources along with OneNote and Evernote.

Policy Wonks

Are you really interested in tax reform? Are you willing to put aside self-interest and prejudice, emphasizing broad principles? If so, I highly recommend the analysis by my friend, retired econ prof, and former colleague, Marty Finkler. Dr. Finkler provides a thoughtful, objective framework. Many of my readers will appreciate this approach. You will find it difficult to disagree with the key principles! Hint: Think broad base, low rates, simplification, and little distortion of private activity. What is not to like?

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The economic news continues to be strong. New Deal Democrat notes a slight improvement in his wide array of indicators.

The Good

- Commercial property leading index remains strong. (Calculated Risk).

- Progress in the Brexit talks (Fortune). This helps the European financial sector and global growth. It is important.

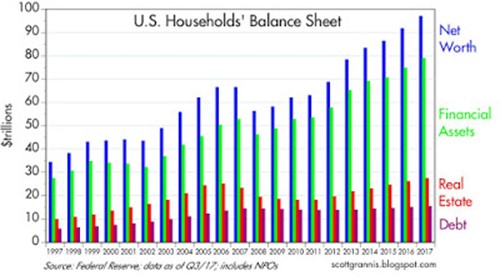

- Households are wealthier. Scott Grannis regularly follows household net worth. Here is the current look.

- Government shutdown averted. (Politico via Wealth Advisor). Plenty of issues remain, but this is a clear sign of progress.

- Rail traffic registered another small improvement. (Steven Hansen at GEI)

- Home prices increased 7% y-o-y. (Calculated Risk).

- Employment

- ADP reported net private employment growth of 190K. This strong number also beat expectations.

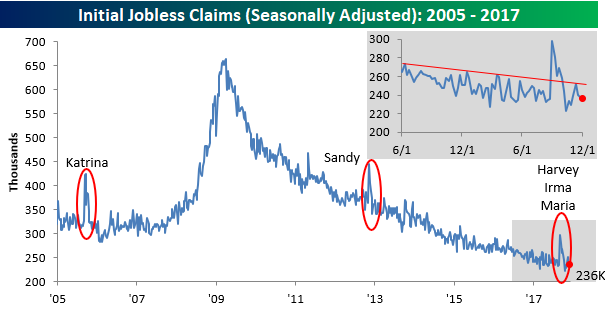

- Initial Claims fell more than expected. Bespoke has the story and an informative chart.

- Payroll employment increased and beat expectations with a net gain of 228K jobs. The WSJ has a nice collection of comments from leading economists.

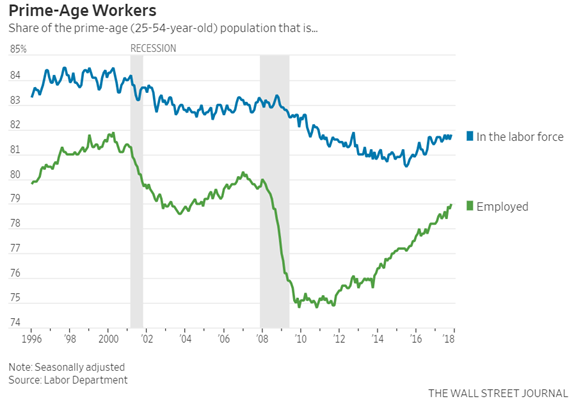

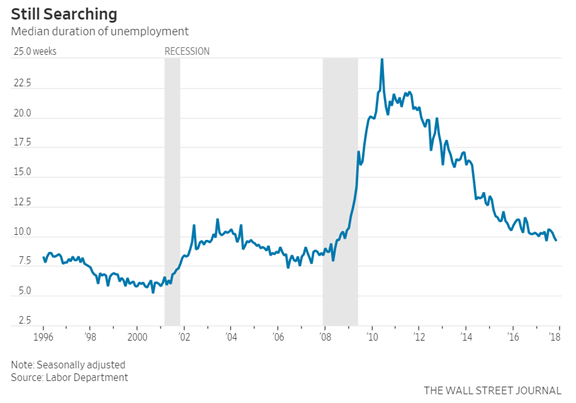

- Unemployment remains low and labor force participation is improving. The WSJ has a nine-chart package. The look at prime-age workers is representative of the overall story, as is the look at the median duration of unemployment.

The Bad

- Factory orders registered a slight decline. Steven Hansen (GEI) reports the data from his expected wide range of perspectives.

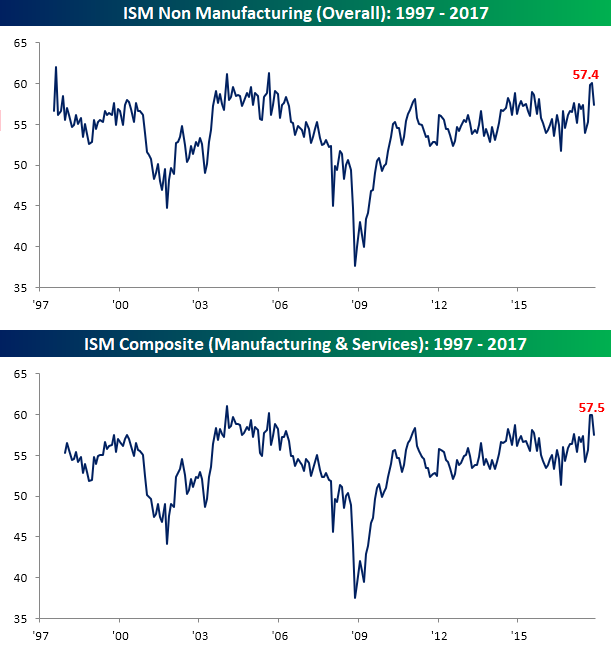

- ISM services pulled back from the multi-year high, declining from last month and missing expectations. Bespoke puts the story in context.

- Tax policy changes may reduce housing supply (Calculated Risk). On the other side of the ledger is the reduction in mortgage foreclosures to 0.68% from 0.99% a year ago.

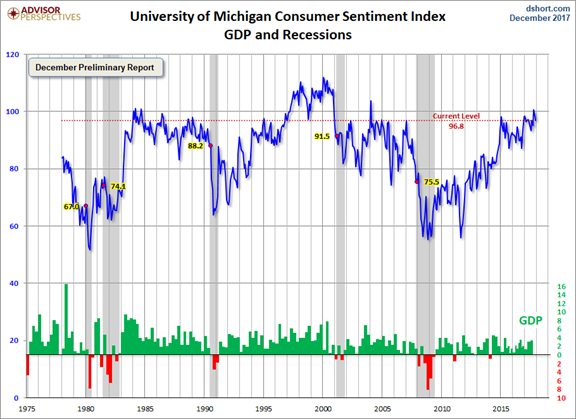

- Michigan sentiment declined from the prior high. Jill Mislinski has the best chart on this subject, pulling together multiple factors in a single look.

The Ugly

Bitcoin trading hazards. Many are doing quite well. Unless you are careful, you can be tripped up by several hazards:

- Server failures and wide bid-ask spreads

- Hacks

- Difficulty and delays in getting payment

The Coinbase founder advises “responsible investing.”

I recommend that anyone interested in trading Bitcoin (it is not an investment) watch this brief, informative, and helpful video from Josh Brown. You will learn how to execute trades and what to watch for.

Seeking Alpha also has excellent coverage of this topic, reflecting many approaches and ideas. If you are not reading SA, you are missing out.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react.

The Calendar

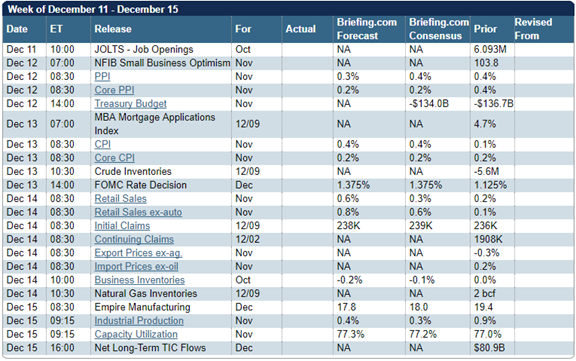

We have a normal calendar, but with plenty of extra news. The data features retail sales and the much-misunderstood JOLTS report. Inflation is creeping higher, but not yet an important consideration. (See Carola Binder).

We also have Bitcoin futures, the Alabama Senate election, possible changes to the tax legislation, and the December FOMC meeting. And this is not an exhaustive list!

Briefing.com has a good U.S. economic calendar for the week (and many other good features which I monitor each day). Here are the main U.S. releases.

Next Week’s Theme

This time of year would normally lead to some quiet markets and often, a Santa Claus rally. The cross-currents raise doubts.

Here is the litany of possible year-end surprises:

- Tax cut effects. This is especially important, since there is active trading based upon the current version. There is selling of winners as well as tax-loss losers. Why? Concern about FIFO rule changes and carried interest. There is also great concern about the corporate AMT which was apparently retained by accident. John Rekenthaler has a good assessment of the current situation and risks. Brian Gilmartin has a good analysis of the potential earnings effects – a key metric for investors.

- The Fed. Widely expect to hike rates on Wednesday. What will be the future signals?

- Bitcoin futures trading. There is a wide divergence of opinion about the likely effects.

- The Alabama election. This is especially important since the GOP Senate majority is so thin.

And of course, the start of the year-end market forecasts, already begun in Barron’s with their cover story. I will discuss this topic in more detail next week.

As usual, I’ll have more in the Final Thought, where I always emphasize my own conclusions.

Quant Corner

We follow some regular featured sources and the best other quant news from the week.

Risk Analysis

I have a rule for my investment clients. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

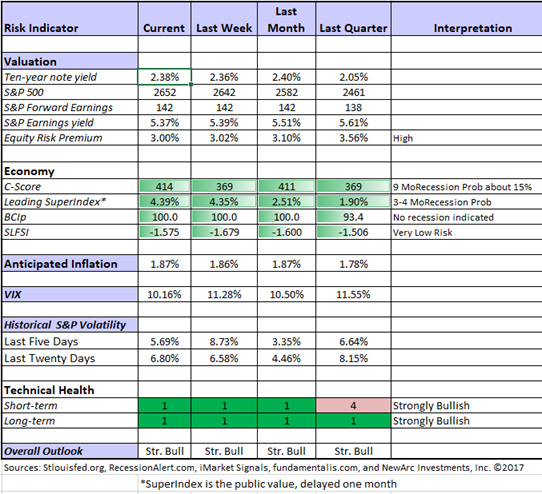

The Indicator Snapshot

Recession odds remain low and many economic indicators are improving.

The Featured Sources:

Bob Dieli: Business cycle analysis via the “C Score.

RecessionAlert: Strong quantitative indicators for both economic and market analysis.

Brian Gilmartin: All things earnings, for the overall market as well as many individual companies.

Georg Vrba: Business cycle indicator and market timing tools.

Doug Short: Regular updating of an array of indicators. Great charts and analysis. Let’s take another look at the regular update (via Jill Mislinski) of the Big Four indicators most influential in recession dating. The recent strength in these indicators is clear from the chart.

Guest Sources

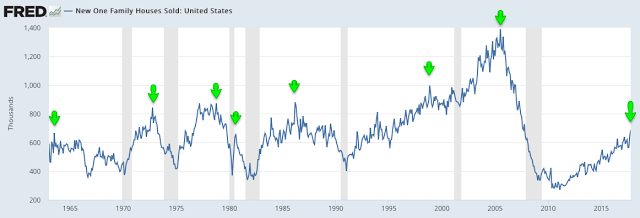

Urban Carmel (The Fat Pitch) discusses the overall macro strength and especially the prospects in housing.

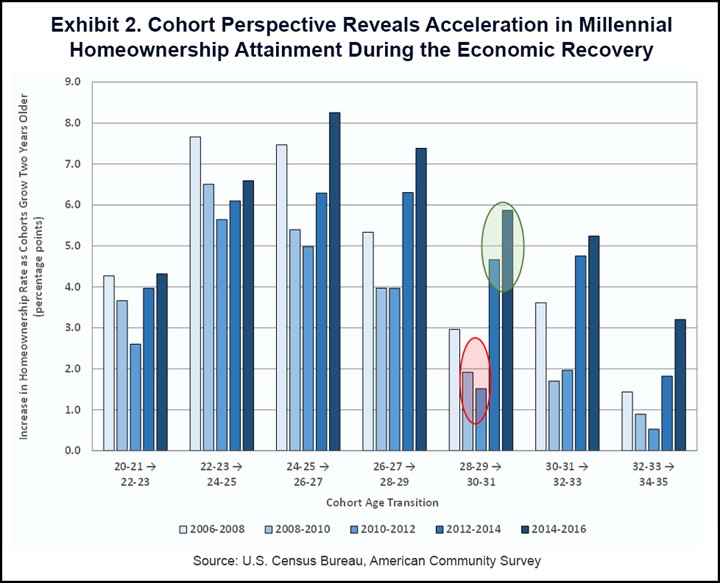

Fannie Mae sees an “Awakening of Millennial Homeownership Demand.” Their clever approach uses moves in age cohorts rather than static ranges.

Insight for Traders

Our discussion of trading ideas has moved to the weekly Stock Exchange post. The coverage is bigger and better than ever. We combine links to trading articles, topical themes, and ideas from our trading models. This week’s post illustrates how technical approaches can spot trades you would not find through fundamental analysis.

As always, we include trading tips from experts like Dr. Brett Steenbarger and Larry Swedroe, who both describe ideas relevant for our own trading models. Model performance updates are published, and of course, there are updated ratings lists for Felix and Oscar, this week featuring the DJIA. Blue Harbinger has taken the lead role on this post, using information from me and from the models. He is doing a great job.

Insight for Investors

Investors should have a long-term horizon. They can often exploit trading volatility!

Best of the Week

If I had to pick a single most important source for investors to read this week it would be Guggenheim Partners analysis of forecasting the next recession:

First, it is important.

The business cycle is one of the most important drivers of investment performance. As the nearby chart shows, recessions lead to outsized moves across asset markets. It is therefore critical for investors to have a well-informed view on the business cycle so portfolio allocations can be adjusted accordingly. At this stage, with the current U.S. expansion showing signs of aging, our focus is on projecting the timing of the next downturn.

Second, there are some patterns in pre-recession times.

The last several expansions have shown similar patterns leading up to a recession. The charts on the following pages help to tell this story by identifying six indicators that would have exhibited consistent cyclical behavior, and that can be tracked relatively well in real time. We compare these indicators during the last five cycles that are similar in length to the current one, overlaying the current cycle. Taken together, they suggest that the expansion still has room to run for approximately 24 months.

Finally, there are several key indicators in a model-based recession probability. One must be wary of results determined strictly by a back test.

The last several expansions have shown similar patterns leading up to a recession. The charts on the following pages help to tell this story by identifying six indicators that would have exhibited consistent cyclical behavior, and that can be tracked relatively well in real time. We compare these indicators during the last five cycles that are similar in length to the current one, overlaying the current cycle. Taken together, they suggest that the expansion still has room to run for approximately 24 months.

It is nice to see a prestigious firm joining into a campaign I have championed for over seven years. There are excellent warnings before recessions (and the major market declines linked to them). Our favorite methods have worked in real time, not just in back tests. Most people do not understand how to recognize an overfit model.

[If you are concerned about major declines, you might be interested in my paper on risk. Just write for our free information on these topics. While they describe what I am doing, the do-it-yourself investor can apply the same principles. Both the concepts on recessions and how we used it to forecast Dow 20K are available for free from main at newarc dot com].

Stock Ideas

Internet stocks maintain the uptrend (Andrew Thrasher) despite the rotation out of tech.

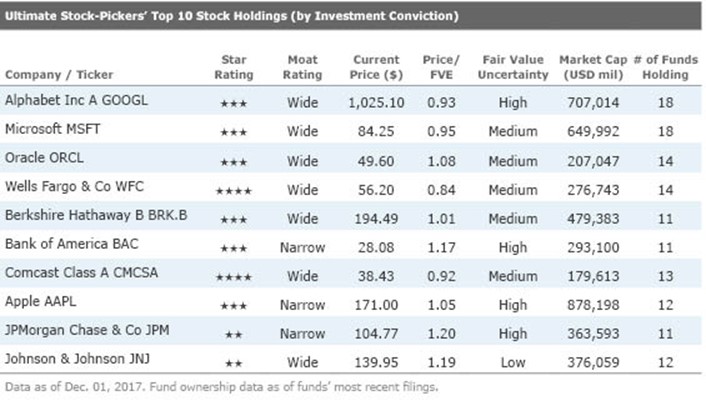

Morningstar’s ultimate stock pickers – conviction buys, and sales. Here are the current top holdings.

Playing Bitcoin via stocks instead of direct purchases.

What stocks might take the lead in the DJIA. (24/7 WallSt) Hint: Think beyond current winners!

Finding dividend aristocrats among retail stocks. This is a nice analysis of the merits of some likely Amazon (NASDAQ:AMZN) survivors. (Dividend Sensei)

Top picks from Merrill Lynch, with a view toward the long-term investor.

How about some biotech? Some even qualify on “value screens.”

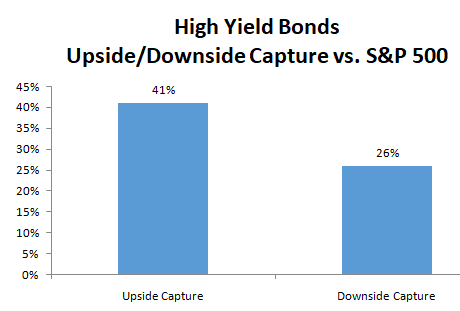

Junk Bonds

Maybe not as risky as we thought? (Charlie Bilello).

Personal Finance

Seeking Alpha Senior Editor Gil Weinreich has an interesting topic every day. While his series’ theme emphasizes financial advisors, the topics are usually of more general interest. His own commentary adds insight and ties together key current articles. It is a valuable daily read. My favorite this week is his discussion of the values and pitfalls of market forecasts. This is a first-rate analysis, which I will take up in greater detail. Meanwhile, check out his links – one of which I have cited below.

Sector rotation

Eddy Elfenbein has his normal, level-headed approach to current developments. He has a good take on the rotation from tech stocks to cyclicals. His new buy list, a widely-anticipated annual event, will be published in two weeks.

Watch out for

Mall REITs. Brad Schwer (Morningstar) discusses the reduced the “moat rating” for malls.

Excessive focus on the expense ratio in ETFs. The holdings themselves are much more important. (Todd Rosenbluth).

High-commission products. Investment News reports on what happened to the values of non-traded REITs after the DoL forced commissions lower.

Final Thoughts

I have my own conclusions about the cross-currents.

- On tax cuts, I expect another compromise. It will preserve the basic business breaks. It is premature to make big sector bets based upon the original House and Senate versions. The first, knee-jerk moves looked like algorithmic trading, spreading into ETFs. There was a lot of “collateral damage.”

- On Bitcoin, I have no idea about the effect of futures trading. This is a trade, not an investment. If you plan to trade it, make sure your position size is appropriate. Think about what you can risk, rather than what you hope to gain!

- On the Fed, I expect no effect. An increase is widely anticipated. While Chair Yellen’s conference may include some thoughts, these will be spun by anyone who prefers a switch to the new chair. Despite the policy change, this should have little effect.

- If we believe the polling, Judge Moore will win the Alabama election. Even if he loses, the GOP will get the tax bill through, perhaps via some additional modest changes.

My expectation is that we will see a year-end rally, but the story is much more complicated this year. Repositioning your portfolio requires attention to sector strengths and potential, not just the overall market.

In short, the many cross-currents are not likely to disrupt Santa’s course.

What worries me:

- Continuing budget issues when government agencies need new computers and better protection against hacking.

- Josh Brown disagrees with my take on the Mueller investigation. I am not yet convinced, but look for yourself.

And what doesn’t:

- Automation and employment. Poor analyses focus on existing jobs with little attention to what will probably grow.

- The debt ceiling deadline was on the “not worrying” list last week. While there is still a deadline, it has once again been moved.