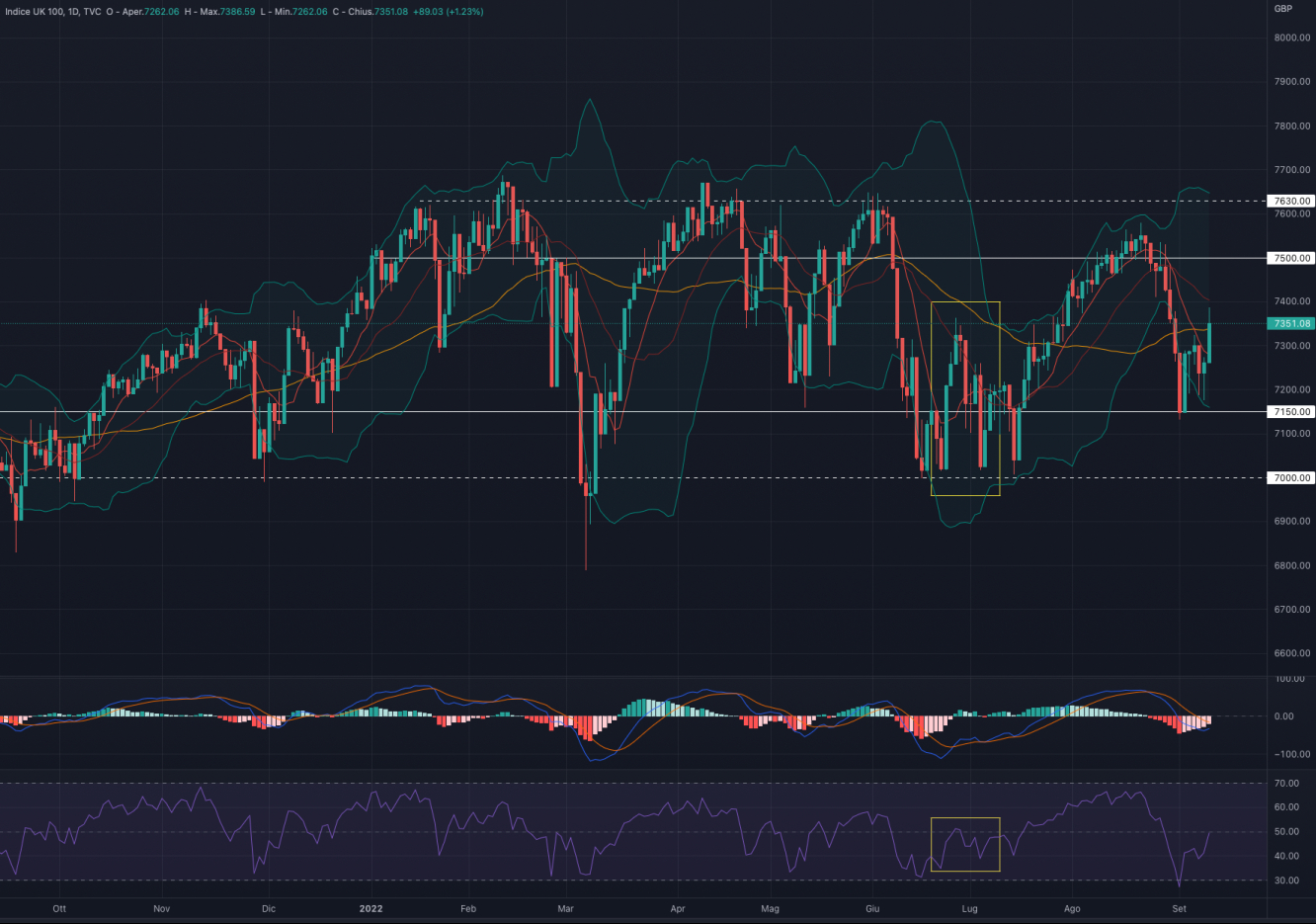

FTSE 100

The FTSE 100 ended the week up by + 0.96%. For the coming week, we could see consolidation between 7,200 and 7,400.

Indicators

Positive week for the FTSE 100, which saw the index respecting the support area at 7.150 and reversing to the upside.

On one hand, this scenario is optimistic because it is forming a higher price, especially if compared to June-July 2022.

On the other one, we believe proceeding with caution is needed because a June-type scenario is still possible: where the support level reversal led to further downside pressure.

MACD and RSI are both improving, the former is close to an upward crossing, and the latter is very close to the 50 (bullish) line.

We remain neutral on the FTSE100.

- Support at 7,150

- Resistance at 7,500

FTSE MIB

The FTSE MIB Futures had a week up by + 0.79%. The following week, we could see a consolidation in the 21,600 - 22,400 zone.

Indicators

Positive week that, despite a substantial consolidation performance, denotes an interesting price action.

Specifically, we believe that the failure to reach new lows in the 20.700 - 20.000 area and a continuation on the upper part of the bearish channel are very positive.

However, a break of 22,400 followed by a consolidation above 23,200 (highs of August 2022) will confirm the abovementioned hypothesis.

If, on the one hand, we are encouraged by this scenario, on the other, we must not forget the March-April 2022, which saw a similar price action: consolidation with bullish hopes, quickly vanished by further downside pressure in June.

We remain neutral on the FTSEMIB

- Support at 20,700

- Resistance at 23.650

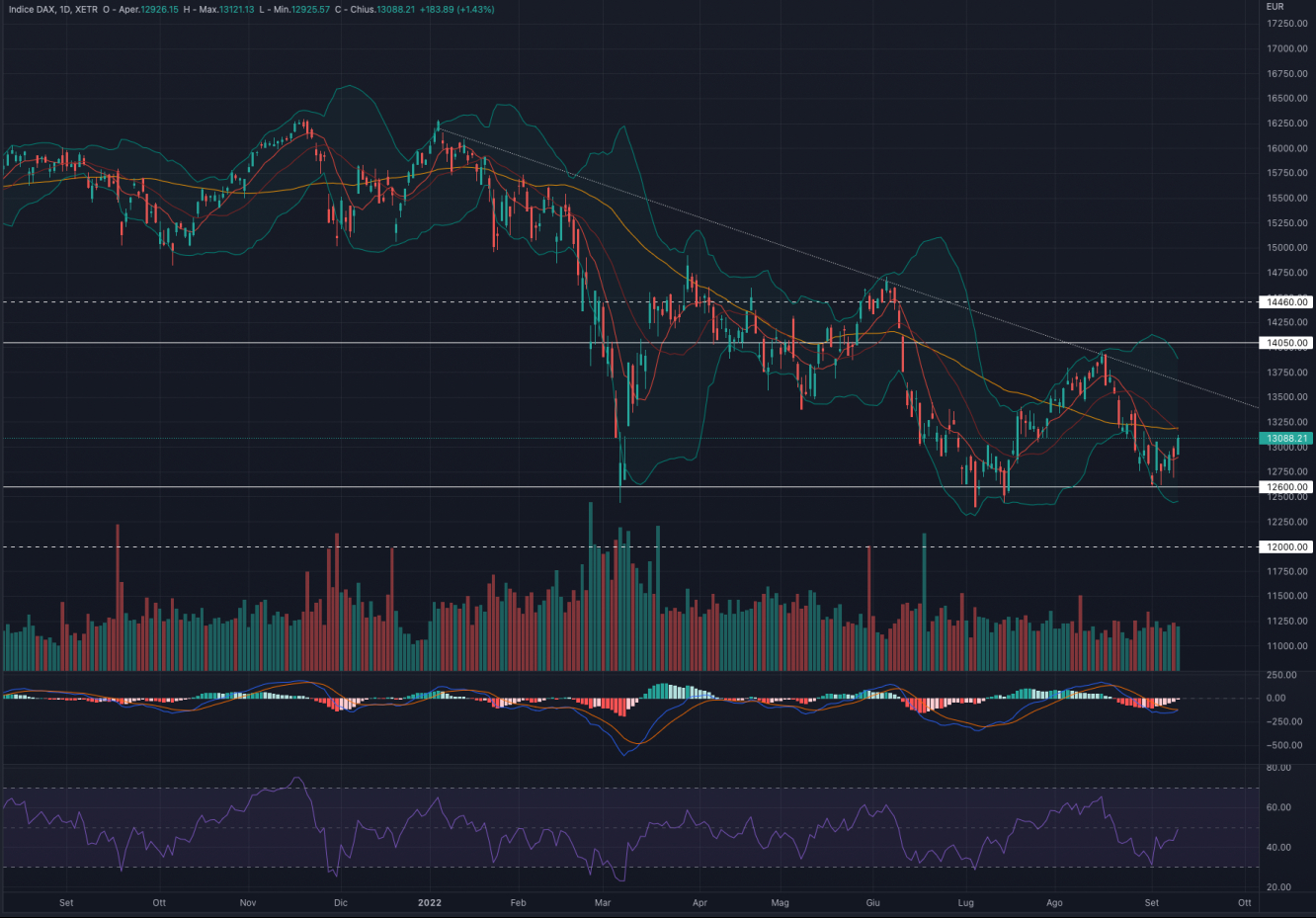

DAX 40

The DAX ended the week up by + 0.29%. For the week ahead, we could see consolidation between 12,900 and 13,400.

Indicators

Positive week on the DAX, which sees the general picture still substantially unchanged: the downward trend underway since January 2022 is intact and well confirmed.

MACD and RSI, also due to the strong downward extensions, seem to suggest a resumption of vigor which could push the price to test the 13.500 level.

It is undoubtedly positive that the support of 12.600 acted as a reversal area, but at the same time, we do not want to give too much weight given the strong bearish trend.

We remain neutral on the DAX.

- Support at 12,600

- Resistance at 14,050

S&P 500

The S&P 500 had a week up by + 3.65%. For the coming week, we could see a possible consolidation in the area of 4.070 - 4.160.

Indicators

Positive week that sees the strong support of 3.900 respected but does not exclude a scenario like that of May-June 2022, where an apparent recovery has led to new lows.

MACD and RSI seem to support the price action: the former is close to an upward crossing, and the RSI has just crossed the 50 mark (bullish).

Given the rises over the last three days, it is desirable to expect a slight retracement from which we could have additional information on the strength of this latest recovery.

We remain neutral on the S&P500 and waiting for the price to consolidate.

- Support at 3,900

- Resistance at 4,300

NASDAQ 100

The NASDAQ ended the week up by + 4.05%. We believe the index will consolidate in the 12,250 - 12,750 zone for the coming week.

Indicators

Positive week for the Tech index, which thus sees recovered the declines of the beginning of September, we have returned to the level of 31 Aug. 2022.

The recent rises confirm the strong support level at 12,000 but do not rule out further falls. It is important to note that this level acted as intermediate resistance in June 2022.

MACD and RSI appear to support the price rally, with the former close to a bullish cross and the latter breaking out of the 50 levels.

We remain neutral on the NASDAQ 100

- Support at 12,000

- Resistance at 13,500

Dow Jones

The Dow Jones Industrial Average had a week up by + 2.66%. For the coming week, we could see a possible consolidation in the area of 31,600 - 32,000.

Indicators

Positive price action substantially recovered the declines of the beginning of September.

The price is now close to the 50MA (yellow line), which has repeatedly played the role of dynamic resistance.

MACD and RSI appear to support the upward move despite being both in bearish territory.

Looking at past action, the 50MA (yellow line) has repeatedly rejected the index, and we do not rule out such a scenario even in this case.

In particular, we note a negative divergence between (increasing) price and (decreasing) volumes.

We still prefer to remain neutral on the Dow Jones

- Support at 31,200

- Resistance 34,000