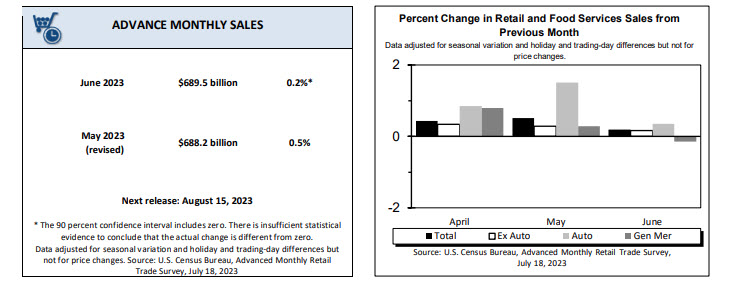

- Both the advance and core (ex-auto) retail sales monthly reading post third straight gain

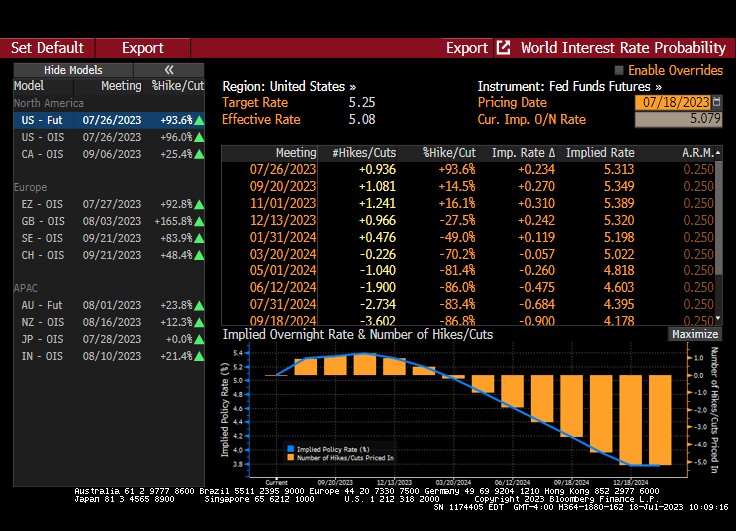

- Fed rate hike odds stand at 93.6% for July 26th meeting

- ECB odds for a July rate hike stand at 93.2%. while September falls to 60.1%

US stocks are lower after a retail sales report confirmed the US economy is still healthy and ready for another quarter-point rate rise by the Fed.

It was a busy morning as Morgan Stanley (NYSE:MS) posted mixed results, while Bank of America (NYSE:BAC) impressed. We are done with the majority of the big banks and the overall takeaway is that they did ok despite all the turmoil that stemmed from the regional banking crisis last quarter. Wall Street knows this earnings season will have everyone calling this a challenging market environment, but optimism might remain that a resilient US economy should translate into decent spending despite all the headwinds.

US Data

Last major data check paves the way for one more quarter-point rate rise by the Fed. The June retail sales report was mixed, but overall painted a picture of a resilient US consumer. Headline retail sales gain of 0.2%, was less than both the 0.5% consensus estimate and upwardly revised prior reading. This was the third straight monthly increase, which was bolstered by online sales. The headline was dragged down by gasoline and building material demand weakness, but clear signs are emerging that the economy is slowing down.

Industrial production tumbled in June as auto production slumped for a second month as the economy weakens. Demands for goods are weakening and the strong auto production numbers are coming back down.

Fed swaps initially were fully pricing in a quarter-point rate rise by the Fed. If inflation continues to come down, labor market resilience should drive expectations that Americans will still consume, albeit at a slower pace.