After an extremely active economic calendar last week, highlighted by major earnings reports, central bank meetings, and jobs reports, this week is decidedly quieter on the data front. Accordingly, it’s not surprising to see most major markets consolidating last week’s moves while traders await the next catalysts.

One market that is seeing some significant movement is oil. As my colleague Joe Perry noted yesterday, WTI crude oil was pulling back from 6-year highs after hints of a de-escalation between Russia and Ukraine. It remains to be seen whether the ongoing geopolitical tensions in Eastern Europe will continue to recede, but as long as there isn’t an outbreak of military action, oil bulls may continue to take profits after a nearly 50% rally from the December low.

Of course, when FX traders hear oil, they immediately think of the Canadian dollar. Oil is Canada’s most important export, so the gyrations in the oil market have a big influence on the value of the loonie, and sure enough, the CAD was the weakest major currency yesterday.

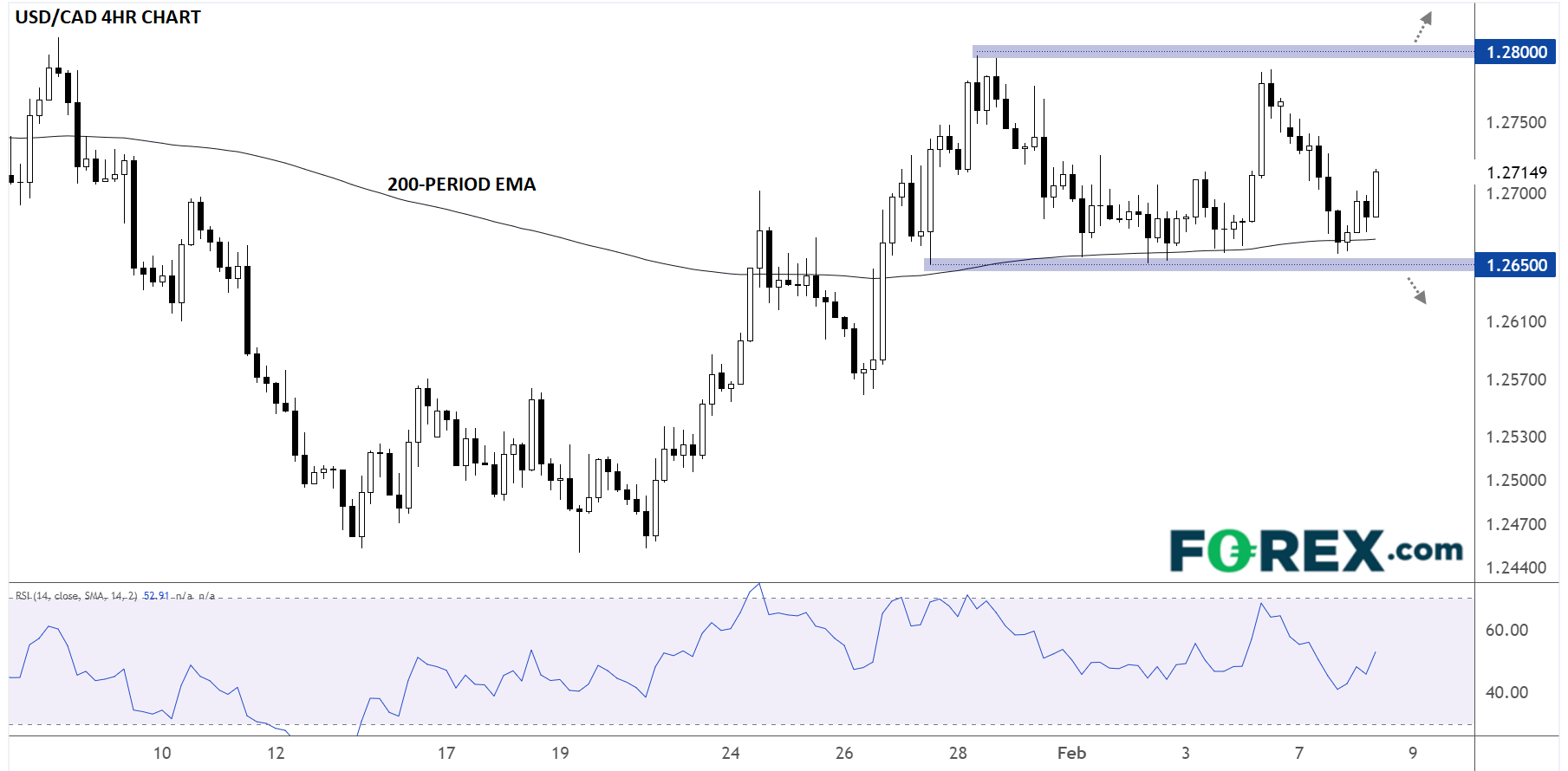

Technically speaking, USD/CAD is bouncing from the bottom of its 2-week range between 1.2650 and 1.2800 on the news. For short-term range traders, buying near support at 1.2650 and selling near resistance at 1.2800 has been an effective strategy in recent weeks; that range even held through Friday’s combination of a much-stronger-than-expected US jobs report and a much-weaker-than anticipated Canadian jobs report, a combination that would usually break any short-term technical structures:

Source: TradingView, StoneX

As it stands, USD/CAD is trading back near the middle of its range, leaving no immediate technical bias, but even putting aside any potential moves from its correlation with oil prices, the pair is likely to see some significant volatility around fundamental data releases as we move through the latter half of the week.

Today brings the US EIA crude oil inventories report, as well as speeches by BOC Governor Tiff Macklem and FOMC voter Loretta Mester, followed up by the highly-anticipated US CPI report on Thursday and the UofM Consumer Sentiment Survey on Friday. Of these, the US CPI report will be the most important release to watch: A hotter-than-expected reading could boost the US dollar against both the loonie and oil, whereas a soft print could take USD/CAD back to 1.2650 support or even below that key area to its lowest levels of the month.

In other words, USD/CAD traders who have grown accustomed to the pair regularly oscillating between 1.2650 and 1.2800 should remember that the past is not always prologue, and USD/CAD is set up for a potentially volatile end to the week.