Market Brief

The S&P 500 broke another record yesterday as it closed at an all-time high, breaking the previous record from August 23rd this year. The blue chip index closed at 2,198 points on Monday as investors continued to cheer the election of Donald Trump but was unable to break the symbolic 2,200 points resistance.

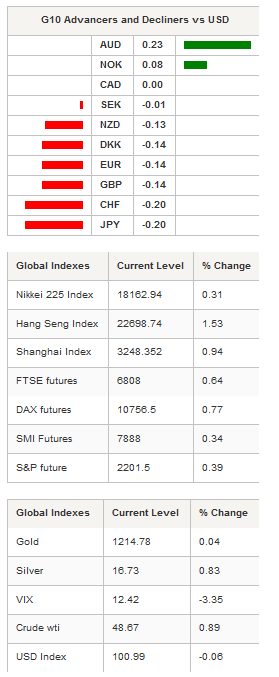

On Tuesday, Asian equities followed Wall Street’s lead with the Shanghai Composite surging 0.94% and Hong Kong’s Hang Seng jumping 1.51%. In Japan, the Nikkei and Topix indices edged up in spite of a 7.4 magnitude earthquake, sparking tsunami fears. Both indices ended in positive territory, with the former edging up 0.31% and the latter rising 0.32%. New Zealand shares were the ones to move below the neutral threshold with the S&P/NZX falling 0.48% to 6,816.40 points.

In the FX market, investors are struggling to find a new driver as the US dollar remains in overbought territory. EUR/USD slid 0.15% in overnight trading after surging 0.30% on Monday. We maintain our view that the pair should correct to the upside in the short-term. However, the upcoming ECB meeting on December 8th will likely prevent traders from reloading long EUR positions.

Looking at option positioning, investors have turned extremely bearish regarding the single currency with the 6-month 25 delta risk reversal measure freefalling to -2.50%, the lowest level since June 2015, which indicates that put options are in great demand compared to call.

The Japanese yen remained stable overnight in spite of the earthquake. USD/JPY fell to 110.27 in the early Asian session before recovering to 111.24 in the early European one. The pair is still struggling to break the 111.91 key resistance level from April this year. Just like EUR/USD, we believe that a correction may be healthy as the pair is also trading in overbought territory.

The pound sterling stabilised this morning after rising around 1.40% yesterday after British Prime Minister Theresa May promised to lower corporate tax, most likely below 15%. Following her speech it did not take long to see a sharp appreciation of the pound against most of its peers. GBP/USD climbed back to 1.25, while EUR/GBP collapsed to 0.8495, the lowest level since mid-September.

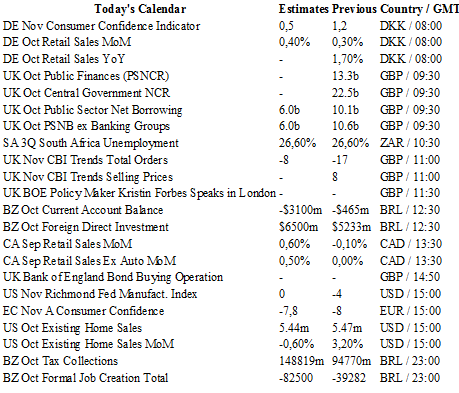

Today traders will be watching retail sales from Denmark; current account balance from Brazil; unemployment rate from South Africa; retail sales from Canada; existing home sales and Richmond Fed manufacturing index.

Currency Tech

EUR/USD

R 2: 1.1259

R 1: 1.0954

CURRENT: 1.0616

S 1: 1.0521

S 2: 1.0458

GBP/USD

R 2: 1.2857

R 1: 1.2674

CURRENT: 1.2467

S 1: 1.2302

S 2: 1.2083

USD/JPY

R 2: 113.80

R 1: 111.45

CURRENT: 110.85

S 1: 106.14

S 2: 104.97

USD/CHF

R 2: 1.0328

R 1: 1.0257

CURRENT: 1.0107

S 1: 0.9632

S 2: 0.9537