The US dollar was seen posting declines after price turned flat in the previous two sessions. Lack of any economic data from the US saw investors focusing on Friday’s payrolls report and Fed Powell’s speech. The Fed Chair did not commit to easing but cautioned against the risks of lowering interest rates prematurely. Elsewhere, safe-haven assets took a breather with investors looking for news from the US and China trade talks which are due to resume in October.

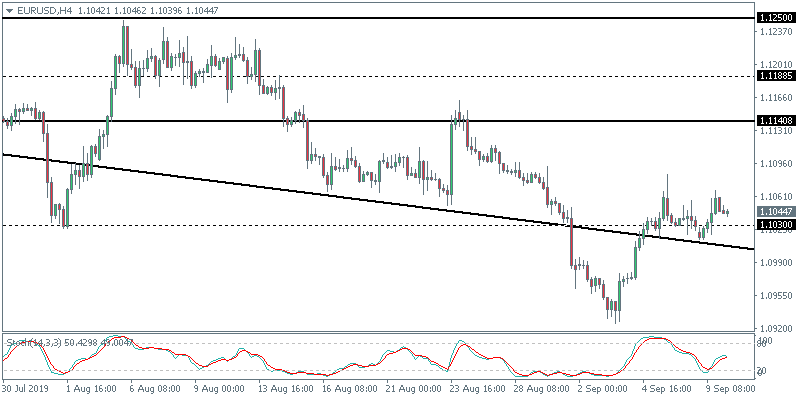

Euro Rises on Germany’s Plans

The common currency was seen taking advantage of a weaker USD and some fundamental developments. Germany’s government is reportedly looking at ways to increase government spending. Dubbed as a shadow budget the plans are underway to circumvent the strict debt rules. Reuters reports that officials are looking at ways to set up public entities in order to take advantage of cheap borrowing costs to boost the economy.

EUR/USD Bounces Off Support

The EUR/USD currency pair bounced off the support level near 1.1030. Price action was also supported by the falling trend line. The currency pair promptly turned higher. However, in the runup to this week’s ECB meeting, the gains come under question. The next main resistance is at 1.1140.

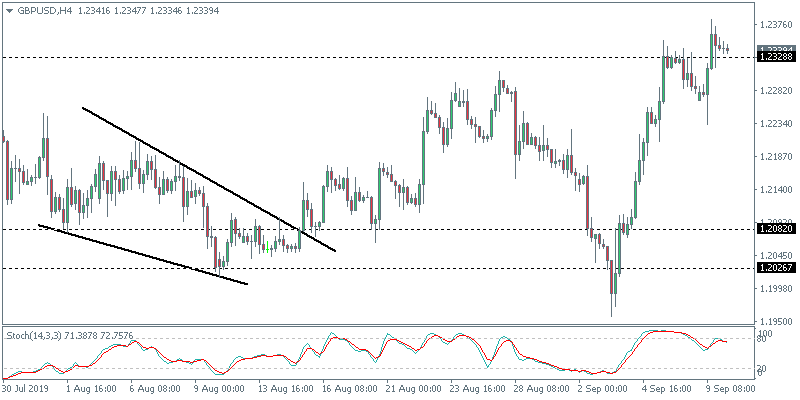

UK July GDP Eases Concerns of a Recession

The UK’s Office for National Statistics released the monthly GDP figures yesterday. In the month of July, the UK’s GDP grew 0.3% on the month. This beat estimates of a 0.1% increase. Manufacturing production was also stronger, rising 0.3%. Despite the beat on estimates, ONS cautioned not to read too much into one month’s data. Meanwhile, the Brexit saga continues as PM Boris Johnson vowed to part ways with the EU on October 31st. This comes as lawmakers passed a no-deal Brexit law.

GBP/USD Posts a Bullish Engulfing Pattern

The currency pair was seen logging strong gains on Monday. This led to price action posting a bullish engulfing pattern on the daily time frame. However, divergence on the other time frames continue to keep the currency pair a bit uncertain. The support level has now moved to 1.2328 which could be tested in the near term ahead of further gains.

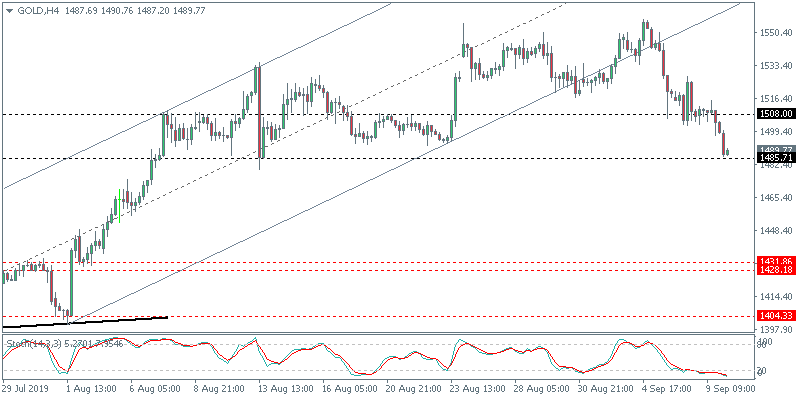

Gold Stays Muted as Risk Appetite Stays Firm

The precious metal was trading weaker on Monday as investors’ moods remained upbeat. Equity markets continued their march higher following up from Friday’s gains. However, the ECB’s monetary policy meeting weighs on investors. Gold prices are likely to remain subdued in the run-up to this Thursday’s meeting.

XAU/USD Hugs the Support Level

XAU/USD remained weak, following through from Friday’s declines. However, prices were largely muted with gold testing the support area of 1508. With price breaking below the 1500 support, gold is now testing the lower support area of 1485. We expect the declines to stall at this level in the near term as gold prices could now move within the range of 1485 and 1508.