Historically it has been a positive to see Financials doing well as the broad market is pushes higher. If financial stocks are lagging, should stock bulls be concerned?

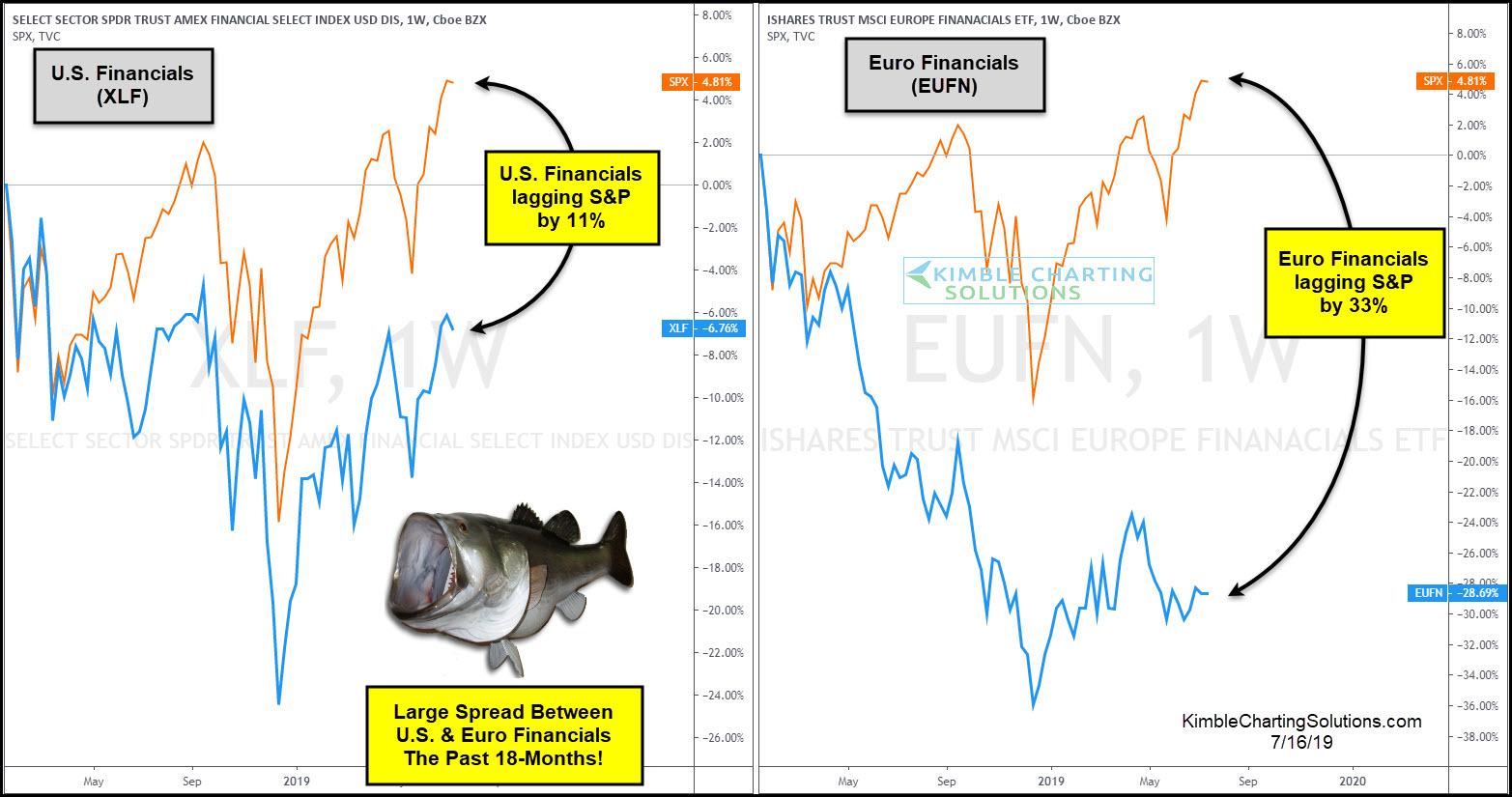

This chart compares banks in the U.S. (NYSE:XLF) and Europe (NASDAQ:EUFN) to the S&P 500 over the past 18 months.

Currently, XLF is lagging the S&P by more than 11% and EUFN is lagging the S&P by over 33% (since January of 2018).

In 2007 and 2014 the S&P 500 was hitting all-time highs and banks were lagging for well over a year. Both times the S&P 500 wound up declining in value.

History would suggest that these spreads will narrow in the near future. Stock bulls hope that banks play a game of “upside catch-up”. If they do, it will send a very positive message to the broad markets.

Stock bulls hope this doesn’t happen; The S&P 500 plays a game of “downside catch-up” with the banks.

Keep a close eye on these large spreads going forward, as they will most likely send a key message to the broad markets.