Bitcoin price today: dips to $92k ahead of PCE inflation, potential Fed cut

Americans pile up credit card debt as surging inflation causes a record increase in consumer debt.

As American consumers increasingly rely on credit amid sky-high inflation, credit card debt surged by 13% annually in the second quarter of 2022. The $46 billion increase, 5.5% higher than the first quarter’s value, marks the most significant increase since 1999, with an uptick in new credit card accounts recorded.

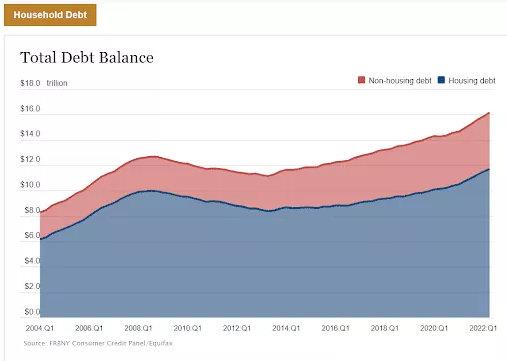

The Federal Reserve Bank of New York’s quarterly report on Household Debt and Credit, released yesterday, noted this increase. It further indicated that household debt at the end of June was $16.15 trillion, up $312 billion from the same quarter a year earlier. The communique noted that rising mortgage, car loan, and credit card balances contributed to the increase.

Source: Federal Reserve Bank of New York’s quarterly report on Household Debt and Credit

Surging Inflation Propels Increased Borrowing

The report highlighted that surging inflation and the corresponding price increase resulted in more Americans borrowing. It noted:

“Americans are borrowing more, but a big part of the increased borrowing is attributable to higher prices,”

Consequently, the figures reported gives new context to the consumer spending data issued by the Bureau of Economic Analysis last week. It showed that spending increased by 1.1% in June as Americans continued to absorb the skyrocketing prices in groceries, gasoline, and staple items.

Since the turn of the year, Americans and the entire world have battled rising inflation caused by loose monetary policies enacted during the Covid-19 pandemic. The situation in the US is critical, with the inflation rate surging to levels last seen over four decades ago. The Consumer Price Index (CPI) for June was 9.1%, beating analysts’ expectations.

The US government has been up in its arms trying to tame the raging inflation, with the Federal Reserve raising interest rates all year. The aggressive nature of the hike has led to growing calls of a possible recession, a sentiment which the White House has vehemently debunked.

Household Debt on the Rise

While credit card debt surged in Q2, the Feds quarterly report indicated household debt increased. The data showed a $312 billion or 2% increase in Q2 compared to Q1 2022. Accordingly, overall balances are now $2 trillion higher than before the pandemic.

Furthermore, mortgages that saw falling demand and a drop in rates saw the highest increase in their balance. Car loans also rose by $33 billion in the second quarter, keeping pace with gains seen since 2011. Speaking about the numbers, Joelle Scally, administrator of the Center for Microeconomic Data at the New York Fed, said:

“The second quarter of 2022 showed robust increases in mortgage, auto loan, and credit card balances, driven in part by rising prices. While household balance sheets overall appear to be in a strong position, we are seeing rising delinquencies among subprime and low-income borrowers with rates approaching pre-pandemic levels.”

Consequently, the challenge of keeping up with growing inflation for consumers is reflected in credit card debts. Increasingly, Americans are forgoing clothing and technological products while shopping for household essentials amidst the surging prices.

Upcoming CPI Critical

The upcoming July CPI data release would be critical, with investors, analysts, and consumers all invested. Scheduled for release on Aug. 10, 2022, Americans would be hoping to know if the aggressive interest rate hikes by the Feds have had any impact on inflation.

A reduction in overall CPI would indicate that the economy is responding to the Federal Reserves policies. This would like to see them reduce the aggressiveness of expected hikes for 2022 while also increasing the likelihood of a soft landing. However, if inflation is not curtailed, further aggressive hikes would ensue, eliminating the possibility of a soft landing.