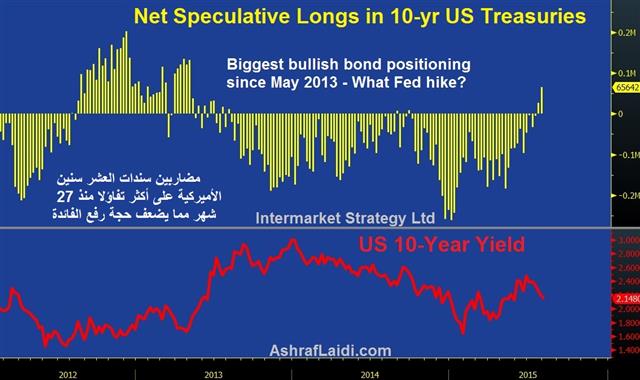

Why is positioning in U.S. 10-Year treasury notes at its most bullish levels in 27 years despite several FOMC members calling for at least one rate hike this year? The latest positioning figures from the CFTC show longs exceeding shorts by 65,642 contracts, the biggest net long position since May 2013. Such growing bullishness on the 10-year treasury is consistent with the 5-week decline in bond yields, which coincided with plunging oil prices.

Ten-year treasury yields are testing the crucial 6-month trendline after breaking below the 200-week MA. A break below 2.08% this week should invite bond bears to further selling, until the psychological 2.00% is likely to hold.

Today's weaker than expected US reports on Jul ISM manuf (52.7 from 53.5), prices paid (49.5 from 44.0), employment (52.7 from 55.5) and June construction spending (0.1% from 0.8%) are not sufficient to remove the case from the Fedhike camp after core PCE rose to 1.3% in June.

But taking a look at speculative positioning among bond traders might give us an idea about forward-looking trades. Last week's release of record low ECI q/q has diminished odds for a Sep hike for now. The negative impact of tumbling oil on stocks and the economy outweighs the windfalls to consumers and non-energy companies, which explains the clearly direct relationship between yields and oil prices. This point is hugely debatable, but the capex realities between energy and non-energy firms as well as the use of cash for buybacks helps explains those implications.

Friday will reveal the crucial release of NFP and average hourly earnings, which will be followed by the latest Fed pronouncements at the Jackson Hole symposium later this month, before the August NFP is released on Sep 4th. Meanwhile, speculative positioning among treasury speculators should be added to your watch list.