Stock indices ended a choppy week right on their lows

The major American stock indices were down ~2.5% from their All-Time Highs, with the S&P 500 closing Friday just a hair under the 50 DMA, for only the 3rd time since the Pfizer (NYSE:PFE) vaccine announcement on Nov. 9, 2020. Is it time to Buy The Dip, or is this The Big One?

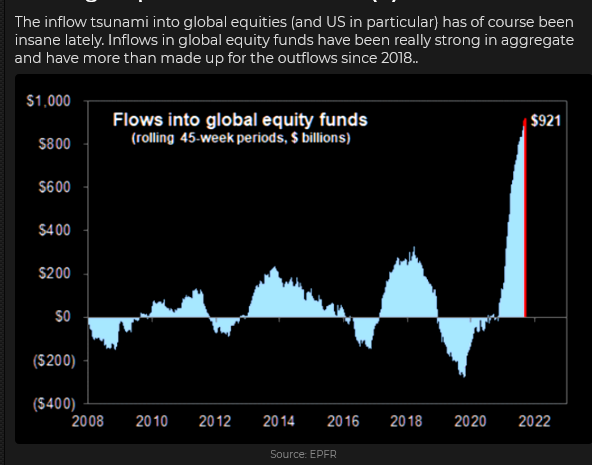

This year the public has noticed that the stock market was rising and they have decided to get in. In a big way. They have also discovered that you can make more money in a rising market by borrowing money to buy even more stock.

The US dollar rallied as stock indices fell

In my recent writings, I’ve expected that “summer complacency” would be replaced by “stress” as we moved into the fall. When Mr. Market feels stressed, he likes the US Dollar. The US Dollar Index closed the week at its 2nd highest weekly close since the Federal election last November.

Gold usually struggles when the US dollar rallies

Gold was down ~$90 the past two weeks, down ~$175 (9%) from its June highs. VanEck Gold Miners ETF (NYSE:GDX), the gold miners ETF, closed the week at a 17 month low. Silver fell ~$6 (21%) from its June highs and closed the week at a 14 month low.

The Canadian dollar fell as the US dollar rallied

The CAD had a choppy week, with intra-day trading almost step-for-step with the S&P, but with the US dollar rallying and the stock market trending lower the looney closed the week at a one-month low. Without the CRBC commodity index at 6-year highs on strong energy markets, the CAD would likely have been much lower this week.

Energy markets – up, up and away

WTI crude oil has rallied ~$10 from the Aug. 19 Key Turn Date but has not traded above its early July highs. Gasoline and heating oil have rallied above the July highs on refinery outages. Goldman Sachs was forecasting WTI over $80 in Q4/21 on the expectation of OECD stocks hitting 6-year lows. They also expect steep backwardation in the WTI market. Other people have different ideas.

New York Natural Gas futures surged ~50% from their August lows to this week’s highs.

United Kingdom Natural Gas futures nearly doubled from their August lows to last week’s highs. Electricity prices in Europe hit record highs.

Various uraniam markets jumped 60 – 70% from their August lows to this week’s highs.

Bond prices fell despite weakness in stocks

It’s not unusual to see bonds catch a bid when the stock market wobbles—but not this week—the 10-year Treasury briefly touched a 2-month low on Friday.

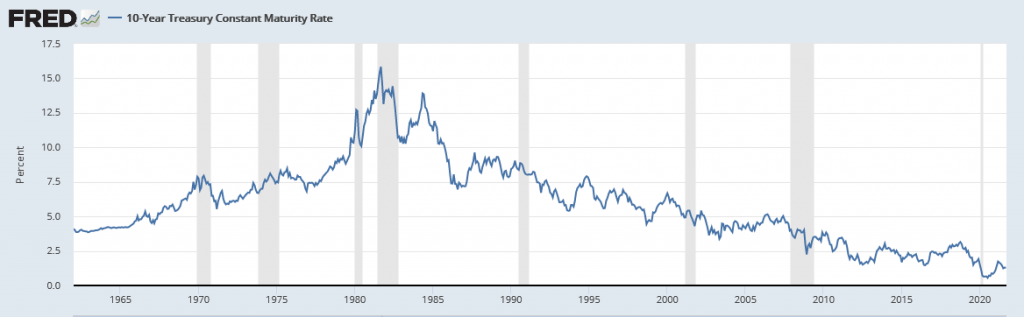

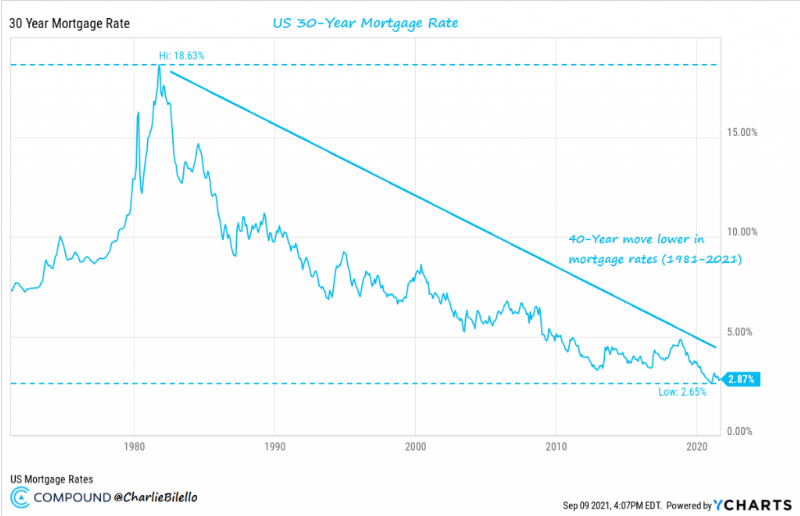

Maybe the most important chart in the world

If you had to find one chart that explained why asset prices have been trending higher for the last 40 years you might pick this one. 10-year Treasury yields were ~15% in 1981—today they are ~1.5%.

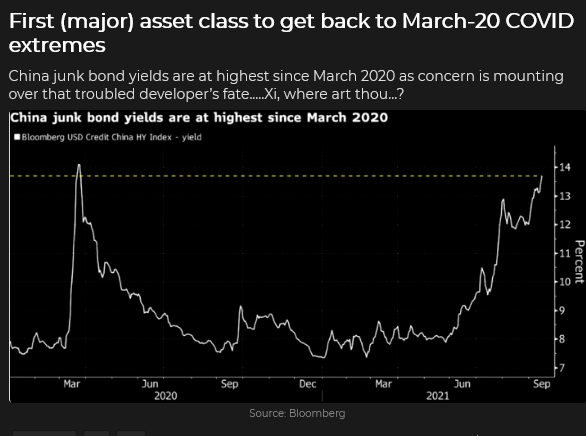

China

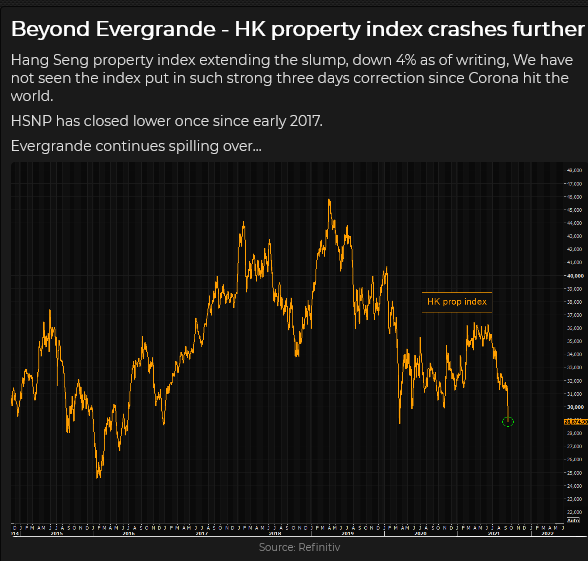

In several recent articles, I’ve questioned whether the severe weakness in Chinese tech shares would be the catalyst for a tumble in the (tech-heavy) American markets. In August, the answer appeared to be “No,” but now that the “stress” of September has arrived the answer might be, “Yes, but with a delay.”

Evergrande (OTC:EGRNY), the HUGE Chinese real estate developer has a $300 billion debt problem (their bonds are trading for dimes on the dollar) and some folks are talking about Evergrande as China’s Lehman. The Hong Kong property market is not amused.

My short term trading

I started the week with a clean slate. Stock indices had closed on their lows the previous week and I thought that if the selling didn’t follow through into this week that the markets might bounce. I also decided to experiment with trading off nothing but the intra-day price action.

I bought and shorted the Dow and/or the S&P a few times with the net result that my P+L was down ~0.5% on the week; I gave back about a third of last week’s gains.

My “big miss” on the week was not getting short the stock indices on Friday. I had bought the S&P Thursday morning as it rallied back from its early lows, and held the position overnight. The market looked like it could make new highs for the week. But Friday’s day session started with a quick leg down, I was stopped for a small loss and I couldn’t get “turned around” to get short.

My problem was different time horizons. I’ve been expecting a downturn to develop in September after the complacent summer—which would be a Swing trading time frame of a few days to a few weeks—but I was experimenting with some intra-day trading and, “Didn’t see the forest for the trees!” Trading is not a game of perfect.

My redeeming trade this week (so far) was shorting the CAD on Friday. (The trade is actually a covered write. I sold the futures around 7875 and sold 7825 puts for 20 ticks. The puts expire on Friday. Delta 35%, IV 9.25% when I sold them.) My short CAD position may benefit from weaker stocks and crude oil and a stronger USD.

On my radar

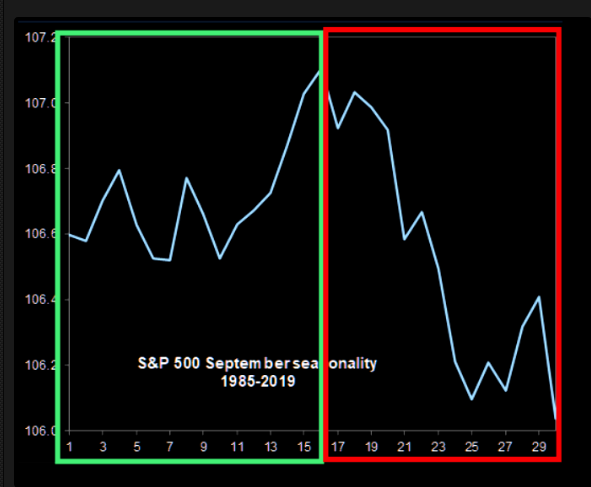

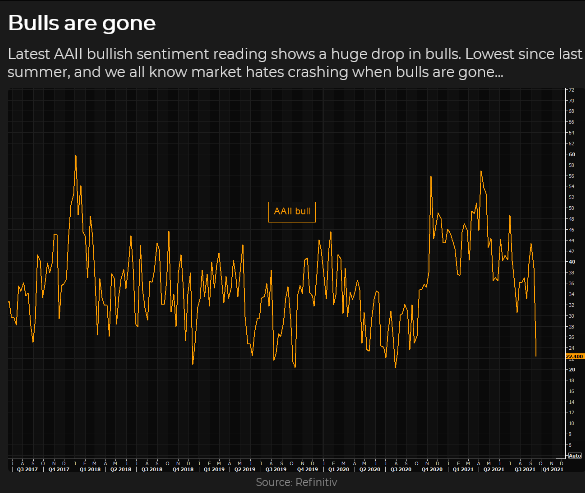

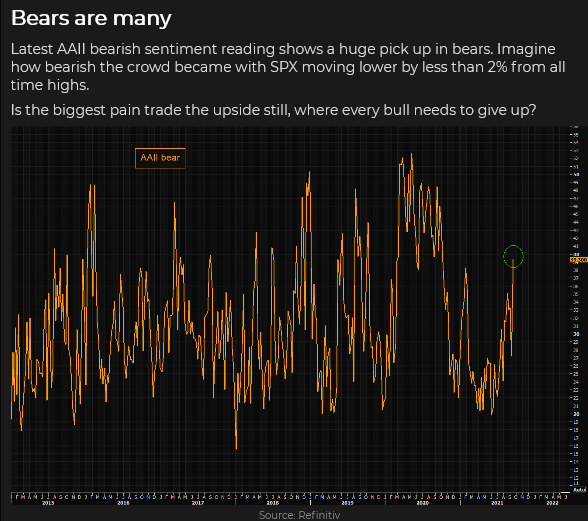

Mr. Market has gone from summer complacency to “somewhat stressed” in early September (a 2.5% drawdown from ATH is not a REAL crisis!) The 2nd half of September has historically been a weaker time of the year for equities but the very quick shift in sentiment from bullish to bearish may have jumped the gun. If the stress intensifies, I’ll be looking for stocks down, and USD up. If stocks catch a bid the BTD crowd may jump in and drive stocks higher.

A lot of options expired on Friday—quad witching. I’ve read commentary which suggests this expiry could “free up” the market to make bigger moves.

The FOMC meeting this coming week may (or may not) give the market a jolt if there are any indications of policy changes. (And, speaking of the Fed, President Joseph Biden will likely announce whether or not he is going to re-appoint Fed Chair Jerome Powell within the next few weeks. If Powell isn’t reappointed then expect an even more dovish FED—which would probably be bullish for stocks and gold, bearish for the USD.)

Within a short-term time frame, the bond market is an enigma trading lower as stocks fell. It was also puzzling to see the haven currencies, yen and Swisse trading lower as stocks fell. I guess the USD was just that strong.

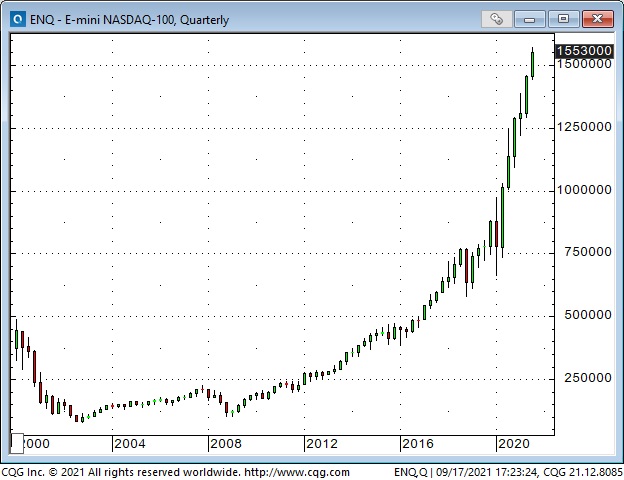

On a longer-term time frame, when I see a chart that looks like this I usually think that sooner or later it will look like the second chart.

Thoughts on trading

I usually think of “managing risk” as “avoid taking a big loss.” In practical terms, for my short-term trading, I don’t want to lose more than 1% of my trading capital on any one trade. When I see a trade I’d like to make the first thought I have is, “Where would I be wrong? Where would I have to exit the trade and how much would that cost?” If the correct stop-out point would cost me more than 1% of trading capital, I (usually) won’t make the trade.

For example, let’s say I’m bearish the S&P. Could I sell it “in the hole” as it was closing Friday? (Some people like to sell new lows and buy new highs, and for some people that works really well.)

That would be a hard trade for me. If I had been long, and the trade was underwater, I would sell it to avoid the possibility of a greater loss—but it would be hard to initiate a new short position because I would have to allow for some “bounce back” this week before I threw in the towel. How much? I don’t know. I would certainly have to cover a new short if the market rallied back above Friday’s opening range. That would be about a 50 point loss, or $2,500 per E-mini contract.

If I just “had to be short—in case this was the trade of the century,” I could buy an OTM put—but puts have been bid aggressively, VOLS have jumped and if the S&P rallied, any value in the puts would evaporate in a heartbeat (and I would be guilty of dumb FOMO—hard to forgive myself for that!)

So, I like to put on a trade close to where I know I’m wrong on the trade—close to the spot where I will stop myself out. I’ll get a lot of small losses, but if the trade goes my way the gains will be WAY bigger than the losses.