Several days ago we covered how the escalation of the European Debt Crisis had influenced U.S. Treasury yields since mid-2011. The crisis brewing across the Atlantic had kept a lid on yields despite the fact that the macro data in the U.S. improved later on that year.

Now that the European Central Bank has pledged to save the euro at all costs, it appears that concerns have abated for the time being. Whether they come through or not, it remains to be seen. For now, perception is everything in a time where volume is low and market players enjoy the last few weeks of the summer.

With Europe on the backburner, the focus is back on the improving U.S. macro picture which explains in part why yields have been rising. Since the all-time low set in late July, yields have increased by almost 50 basis points with the 10-Year trading at 1.85% according to Trade Monster’s Bond Trading Center.

While this explains much of the move, the view from 10,000 feet above does not tell completely everything. When we look at the trade blotters from the trenches, we can see that the workings between various bond players partly contributed to the recent increase in yields.

According to Nomura’s Fixed Income strategist group, the recent surge in corporate supply was another tailwind in the selloff of Treasuries. Given that corporate supply is a short-term event and will eventually be exhausted, the rise in yields may be short-lived. In their latest “Rates Weekly: Bond Market Selloff, The End is Near?” the research team provided the following:

We think market participants shouldn’t read too much into this latest selloff as there was a ton of corporate bond deal hedging and synthetic duration shedding via options markets and swaps/futures. Until we see a sizeable asset allocation out of USTs and investors give up on carry trades, this backup seems like a correction.

When market players like fund managers, pensions, banks, etc. are active in the new issue corporate market, they will sell futures, buy put options, or sell receive-fixed interest rate swaps (or buy pay-fixed swaps) to offset the duration or interest rate risk from the addition of the corporate bond. The benefits of utilizing these hedging instruments over traditional methods such as selling Treasuries is that they do not require any capital outlays.

In other words, these actions do not raise cash and are helpful for a bond fund manager. Here, they can control their risk in the portfolio while at the same time increase the portfolio size and keep pace with the well-documented inflows into bond funds from new investors.

A surge in use of these hedging instruments which exhibit negative durations, contributed to the recent rise in rates.

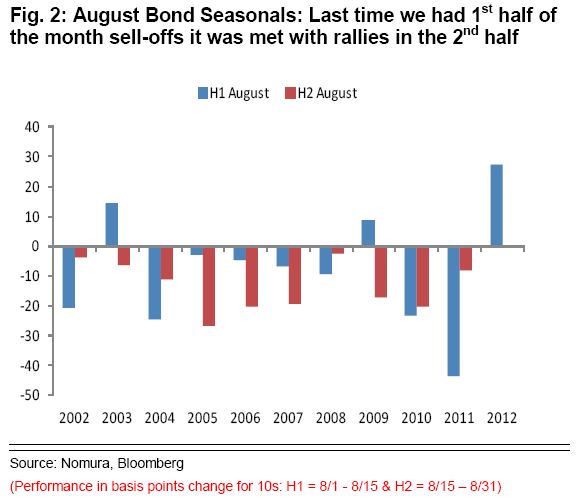

As far as what is in store for the bond market, the strategist team at Nomura provided some technical color for the latter half of August, leading up to the long holiday weekend in September.

Overall we find some solace that this is one of the worst mid-month selloffs in the month of August over the last ten years. There have only been two other sell-offs in the 1st half of the month of August during that time frame and they tend to result in a rally in the 2nd part of the month, with the rally continuing into September (Figure 2). The risk is that the backend performance is just the flip side of last year’s monster rally (triggered by twist speculation and Fed language commitment). We shall see.

While everyone enjoys the last days of summer, there are plenty of events coming up after the holiday weekend that could disappoint and be a catalyst for market volatility. On September 6, another test on Spanish solvency and credit-worthiness is scheduled as the Spanish government will auction more bonds with the hope that their borrowing costs will remain low. In addition, the ECB is scheduled to meet that day.

If policy action doesn’t result in some form of Quantitative Easing or “money-printing,” of sovereign debt support, disappointment could deflate risk-seeking market bulls. This could turn Treasury bears into buyers as the crisis heats up once again in Europe and the global markets with summer fading for the rest of the year.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Trades From The Trenches Explain Rise In Treasury Yields

Published 08/30/2012, 02:59 AM

Trades From The Trenches Explain Rise In Treasury Yields

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.