by Moriah Costa

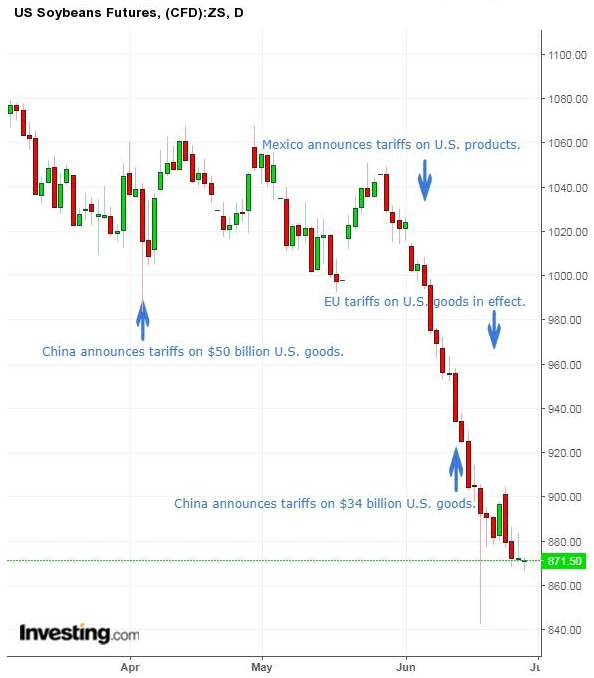

Soybean futures for August have plummeted to a two-year low since US President Donald Trump's trade war began in earnest. Indeed, agricultural commodities as a group have slumped.

Though Trump's opening salvo is barely remembered now—he imposed tariffs on washing machines and solar panels in January—his next move, levies in March on aluminum and steel imports from trading partners including China, the EU and Canada, raised the stakes and put the focus squarely on losses to US businesses.

But since April 4, when China, followed in late May by such allies as the EU, Canada and Mexico among others, retaliated with a roster of their own tariffs aimed at US goods, another, less closely watched sector of the US's economy has been pummeled: agricultural commodities.

Among the $50 billion in US goods that China targeted in its first retaliatory round, soybeans were conspicuous.

They've fallen 14.36%. And they're not the only US agricultural goods China focused on. The list also includes corn, fruit, sorghum, wheat, dairy and vegetable products as well as nuts. Grain and some livestock prices have also fallen. Lumber futures have whipsawed as traders fear Chinese tariffs could jeopardize US exports of that commodity.

Mexico has also taken aim at US agricultural commodities including apples, bourbon and pork, while the European Union imposed levies on American crops including rice, corn, and orange juice.

Corn has fallen 5.30% since April while soybean oil has fallen 8.28%. Wheat has risen 5.80% since April 4 but is still down 11.25% from an 11-month high of $548.06 on May 28.

Lean hogs dropped drastically to $51.73 when the early April tariffs were announced, from $67.60 in mid-March.

However, they've recovered to near a ten-month high of almost $81 as the summer season and upcoming Fourth of July holiday have increased demand domestically. Nevertheless, recent tariffs imposed by China and Mexico on pork products could impact the commodity after the summer ends. As well, many of the other already announced tariffs have not yet been implemented. If and when that happens it will weigh even more heavily on agricultural commodity prices.

Heartland Squarely Hit

Chinese and European tariffs on the US weren't implemented randomly. In response to Trump’s “America First” agenda, trading partners carefully calculated which goods are manufactured or grown in the key states that delivered Trump's victory. Since many of the president's base are in the US's farming heartland, it's not surprising agricultural commodities have been so severely hit.

According to Moody's, as reported in USA Today, "Iowa exported nearly $2 billion in soybeans to China in 2016, making up about 4 percent of the state's economy — the largest exposure of any state in the nation. Iowa runs a close second to Illinois in soybean production but has much more economic exposure to the crop."

China is the major purchaser of US soybeans, having bought $14 billion worth of the commodity last year, or 62% of American soybean exports. “Soybean prices are declining as a direct result of this trade feud,” confirmed John Heisdorffer, Iowa soybean grower and president of American Soybean Association. “Prices are down almost a dollar and a half per bushel since the end of May – and continue to plummet. That represents a loss of more than $6.0 billion on the 2018 soybean crop in less than a month.”

“To say that the last few weeks were tough for corn and soybeans producers is a bit of an understatement,” agricultural economist Brent Gloy wrote in a research note. He estimates that a 2,700-acre farm would have lost $210,600 in the last month due to price swings in the grains markets.

It doesn't seem as if either Trump or China, the EU, Mexico and even Canada will be backing down any time soon. The damage to all sides may still be minimal. Though parts of the US heartland might be an early casualty, if hostilities ramp up, farmers and small manufacturers could see drastically shrinking revenues or even be forced to shut down. As well, the higher cost of imported raw materials will cause most US consumers to feel the sting of more expensive goods.