Yesterday – news broke that new home sales plunged nearly 6% in September. This was the worst month since December 2016.

This shouldn’t come as a surprise though.

We’ve seen the U.S. housing market suffer this year because of two main things.

First – rising interest rates are making debt burdens harder to service. And not allowing individuals to refinance their debts lower.

And Second – home prices continue to price out new buyers.

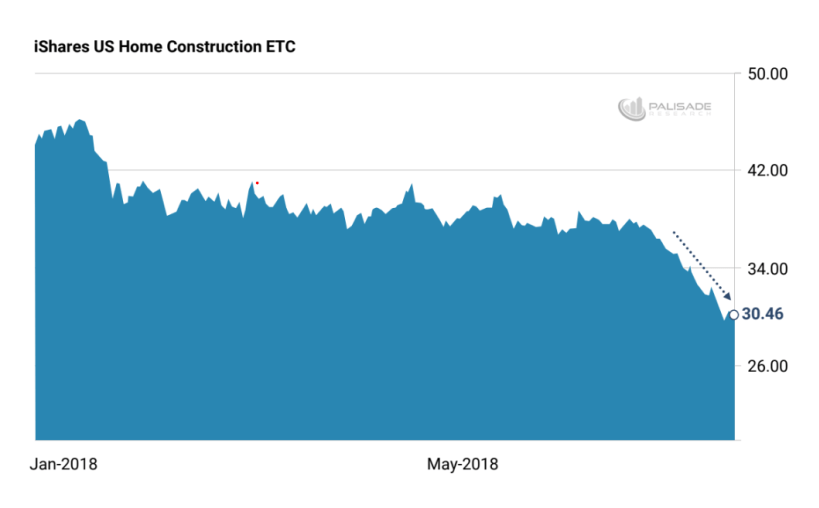

Because of these two things – home construction firms have done very poorly. Their worst year since 2008.

I wrote about the sinking housing market a few weeks ago – you can read here if you missed it. Things are still extremely relevant (if not more).

But – now – other things are starting to really irk me. . .

For instance – this similar environment happened right before 2008.

Alan Greenspan – former Federal Reserve Chairman – started raising interest rates during 2004. Just as home prices were soaring due to the real-estate bubble.

And eventually by 2006 – when short-term rates neared 6% – home prices peaked.

Home prices all over were so expensive that without being able to borrow more debt at lower rates – no one could afford it.

So both new home buyers and current home owners were squeezed by higher borrowing costs and expensive homes.

That’s when the trouble started. . .

“But when Greenspan raised rates in 2004—on which adjustable rate mortgages were based— the clock began to tick. The rates on tens of billions of dollars of ARMs would be reset upward in 2006. That year, default rates on mortgages started to rise rapidly and home prices for the first time started to fall…”

Sound familiar?

It’s a recipe for disaster. And eventually – soon – some big lending institution’s going to break.

I think we saw our first hint of this last week. . .

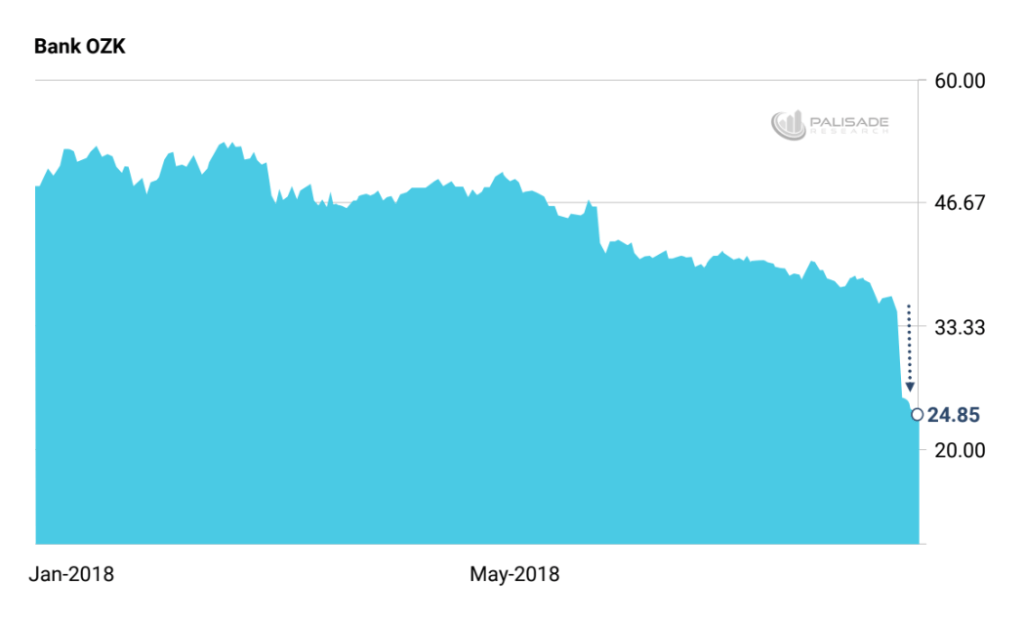

I’m talking about what happened with Bank OZK (formerly known as the Bank of Ozarks).

This multi-billion dollar bank has lost half its value this year. Most of it happening in just a few days.

Here’s a quick summary of these guys. . .

Once a small private bank in Arkansas – they went public in 1997. Through mergers and acquisitions (with years of low rates and bailouts) they quickly evolved into a billion-dollar bank. And now making loans across America.

The ambition from these guys excited the market – especially as they quickly started funding condo and apartment development in places like Miami.

But thanks to the teachings of Ludwig Von Mises and other Austrian economists – I remained skeptical.

Putting it simply – these types of rapid growth lending institutions do well when rates are low and credit is easy. But when interest rates rise – they implode (thanks for the insight Mises).

And finally – last week – we saw that happen. And it shows us just how fragile the entire market really is.

OZK’s share price sank roughly 23% in a single day – and down roughly 50% on the year.

In a single announcement – similar to what we saw in 08 – the company stated that two large loans were written down by 70%.

Or otherwise said – the banks rapidly growing real estate division got burned as loans sour.

It goes to show you that even in this supposedly ‘booming’ economy, huge losses are – and can – still happen.

I doubt Bank OZK will be the last to deal with these kind of write downs. . .

Many know that during the years of low-interest rates and easy credit – asset prices rise. But for some reason, many forget that during periods of rising rates – asset values decline.

And when asset values fall compared to debt balances – loans go ‘underwater’. And when many home owners or investors sell their properties to try and get out from under their debts – the whole market sours.

Even the most conservative ‘AAA’-rated mortgage loans will lose value when everyone is unwinding.

It’s just like Von Mises wrote 100 years ago – you need lower rates and continued cheap money to keep the boom going.

That’s why capital-intensive sectors – such as home builders and lending institutions – depend on easy money. They need ever-expanding credit and rising asset prices.

We’ve seen the U.S. banking sector and home builder equities do very poorly this year.

You can expect as the Fed forces up rates, these institutions will suffer funding issues.

Remember; banks ‘borrow short and lend long’ – thus they need short-term rates (tied to their liabilities) to stay low compared to longer term rates (tied to their assets). The difference between the two is their profit.

You can see how rising short-term rates by the Fed and falling home prices/loan values crush their ‘borrow short and lend long’ model.

The first few rate hikes by the Fed weren’t enough to bother markets – they were at zero for years. But now that the Fed Funds Rate is at 2.5% and rising – the cost of capital is getting expensive.

I’m certain that there’s serious systemic rot throughout the financial system. Brought on after years of low rates and easy money. Places like Bank OZK made reckless loans thinking that asset prices would continue trending higher forever. Always thinking shortsighted.

We should take the write down and sudden drop in Bank OZK stock as a warning of what’s to come. The system is still very fragile 10 years later.

And the higher ‘real’ rates go – the more exposed the rot will become.