I’ve uncovered two high-yield closed-end funds (CEFs) that are perfect for this “earnings down, stocks up” market.

I’m going to show you both of these bargain-priced, cash-spinning plays—one of which yields an incredible 9.2%, five times more than the typical S&P 500 stock—shortly.

First, we need to talk about where stocks stand now. Because you’re probably wondering how the market can keep ticking up when first-quarter earnings are actually down from a year ago.

You’re right to be concerned, because it makes zero sense—on the surface. But dig deeper and you’ll see that this is a good news story, and a perfect opportunity for contrarians like us to grab big gains (and dividends).

Let’s get into it.

When A Loss Is A Gain

With earnings season half over, profits have fallen 2.3% year over year. That sounds bad, but it’s actually better than the 4% drop analysts predicted before the season started.

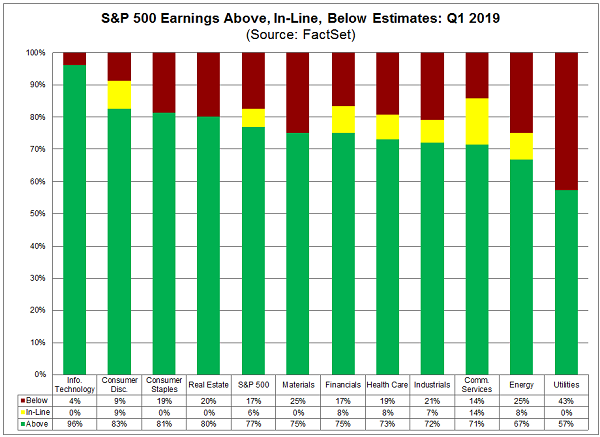

The reason? Surprises. A total of 77% of companies are reporting earnings above estimates, thanks to better-than-expected 5.1% sales growth. Sales are the lifeblood of profits, so this makes it easier to beat profit expectations.

Those earnings beats are also evenly distributed across sectors, with over half of companies in all sectors showing better-than-expected results:

Beating Expectations Across The Board

Again, the common theme is that sales are growing across sectors: people are buying more stuff, and that’s helping earnings across the market.

But Why Are Earnings Down?

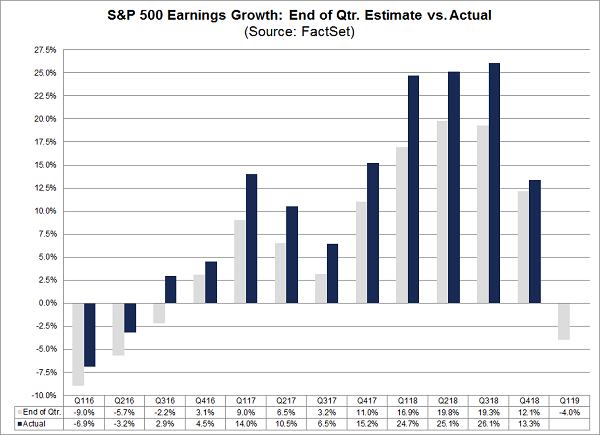

That brings us to the question of why earnings are down at all. If things are so good, why aren’t profits up? There are two answers: the first is that year-ago profits were so strong that they’re tough to build on.

A Big Hill To Climb

In the first quarter of 2018, earnings jumped 24.7% and stayed at that level for the next two quarters. As you can see above, such growth is unusual—and a tough act to follow.

That’s why analysts were modest in their earnings estimates for this quarter. But now earnings are coming close to the mark set a year ago, showing that the economy is still strong, and companies are still in great shape.

The second reason for the lack of earnings growth is that the first quarter tends to be weak. The post-holiday period is no time to load up the credit card, so Q1 expectations are often modest.

In fact, any growth in the first quarter following growth a year earlier is exceptional. That makes 2018’s 24.7% profit jump unusual, since it followed 14% growth a year previous. To expect three straight years of first-quarter growth would be very optimistic indeed.

The takeaway? The economy isn’t getting overheated but isn’t cooling down, either.

Next Leg Of Growth About To Kick Off

With first-quarter economic growth ticking along at 3.2%, according to the Commerce Department, it’s no surprise that companies are seeing sales jump 5.1%. That growth also positions them up to expand their operations and set themselves up for higher sales and profits in the future. And companies are doing just that: they spent more on buying, building and upgrading assets in 2018, and that trend is continuing.

But the market hasn’t priced this growth in—not even close. And this is where our opportunity shows up.

A Buying Opportunity In Disguise

Stocks are up less than 10% since before earnings saw three consecutive quarters of 25% growth, which is below the average return stocks deliver in the long term. That means it isn’t too late to get into the market, even if the rebound we’ve seen this year makes it feel that way.

And you’ll be able to buy in even cheaper with the two CEFs I mentioned off the top. Let’s move on to those now.

Two CEFs To Ride The Market Higher (And Bag Yields Up To 9.2%)

Our first high-yield play is the Boulder Growth & Income Fund (NYSE:BIF), which focuses on bargain-priced large caps. This fund holds much of its portfolio in Warren Buffett’s Berkshire Hathaway (NYSE:BRKa) (BRK.A, BRK.B), along with other top-quality stocks like JPMorgan (NYSE:JPM) and American Express (NYSE:AXP).

So why buy BIF instead of cutting out the middleman and just buying its collection of well-known names on your own?

Simple: as I write, BIF trades at a massive 16.8% discount to net asset value (or NAV, another name for the value of the stocks the fund owns). That means you’re getting these top-quality large caps for 87 cents on the dollar! And while BIF’s 3.7% dividend yield is low for a CEF, it’s still double what the typical S&P 500 name pays.

Finally, you can juice your income stream more with the 9.2%-yielding Cohen & Steers Income Builder (NYSE:INB), holder of some of the best companies in America, with Microsoft (NASDAQ:MSFT), Visa (NYSE:V), Philip Morris (NYSE:PM) and Amazon (NASDAQ:AMZN) standing out among its top holdings.

Here’s the key point to remember about INB: its NAV has returned 14.2% this year (including dividends and price gains). But investors are giving it very little credit, because the fund still trades at 10.8% below its NAV! That’s one of the widest gaps in the CEF space, and it points to more upside as that discount narrows.

NEW: The 4 CEFs You Must Buy Now (8.7% Dividends, Double-Digit Gains Ahead)

As I just showed you, stocks are still a great buy as investors (slowly) discover there’s still time to get in on this “goldilocks” economy.

And as you saw with BIF and INB, you’ll do better (and grab far higher dividends) if you make your move through a CEF. The best of these funds give you the best of all worlds: huge dividends, market outperformance and bargain prices—often all in one buy.

I know that sounds crazy: a fund that’s still cheap even after a monster gain. But it’s a familiar story with CEFs, thanks to their weird discounts to NAV.

Consider one of my four favorite CEFs. This fund focuses on high-yield utilities and real estate stocks, yields an impressive 7.9% and has thoroughly bested the market this year, with a 23% return:

A Market-Beating Fund

Here’s the surprising part: despite that gain, this fund is still cheap! It trades at a 13% discount to NAV, which gives us two advantages you’ll never get buying stocks individually or through an ETF. That’s why I’m forecasting 20% price upside in the next 12 months, to go with that rich 7.9% payout.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."