Today we’re going to click our way to a dividend stream that matches the average household income stream in America—$70,784 per year—and we’re not going to do it on a much smaller nest egg than most people think is possible.

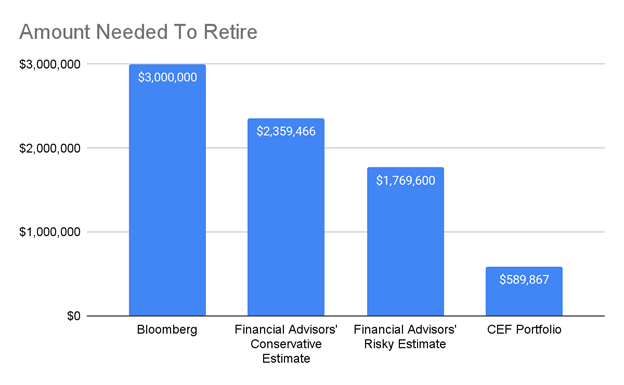

This is important now because the financial media continues to pump out ridiculous answers to the question of how much most folks need to retire. A recent Bloomberg story, for example, said we’d need $3 million saved to clock out comfortably!

Luckily for us, that number is way off. Consider this chart:

Source: CEF Insider

Here you see four different scenarios for getting that $70,784 in yearly dividend income, including two Trinity University studies showing risky and conservative estimates, based on 3% and 4% withdrawal rates. And all but one is pretty unrealistic for most folks. That would be the closed-end fund (CEF) portfolio, which you’ll see on the right above. It consists of the “instant” three-CEF portfolio we’ll talk about in a little bit.

First, though, a bit more on these (too) often-overlooked high-yield assets.

With CEFs, you can push your overall yield higher (thanks to these funds’ 8%, 10%, and yes, even 12%+ yields). In addition, CEFs hold everything from blue chip stocks to bonds and real estate investment trusts (REITs), so you can diversify across asset classes, thereby cutting your risk.

That’s how we can produce a middle-class income stream with just $600K—and set ourselves up for fast capital gains, too!

How CEFs Work

CEFs are bought and sold on the open market, just like stocks. Most are issued by firms with billions of dollars under management: I’m talking about household-name investment houses like PIMCO, BlackRock (NYSE:BLK), and Goldman Sachs (NYSE:GS) here.

Another thing to bear in mind with CEFs is that they often trade at levels that are different (and regularly lower) than the per-share value of their net asset value (NAV, or the value of their underlying portfolios).

By purchasing at discounts—or at least at levels that are below recent trends—we can give ourselves an additional opportunity for upside.

Now let’s move on to that three-CEF portfolio I mentioned a second ago. These funds, as mentioned, yield 12% today, trade at reasonable valuations, and give us strong diversification across asset classes. Once you’ve bought them, you’ll be on your way to a high-yielding portfolio that could get you retired with far less than a million bucks.

Retirement CEF Pick No. 1: 13.8% Payouts Backed by Income-Gushing Assets

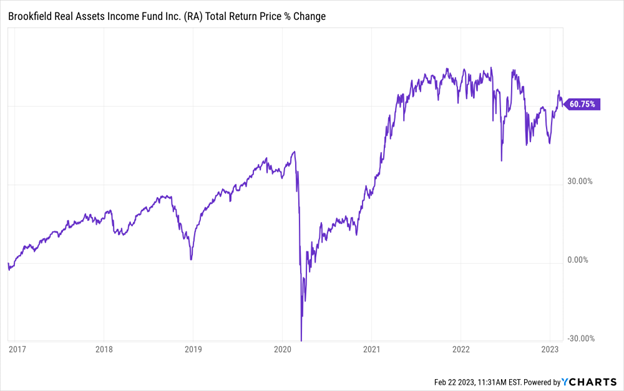

We’ll open with the Brookfield Real Assets Income (NYSE:RA), which has been around for a bit more than six years, making it the newest fund in our “instant” retirement portfolio. Since then, through COVID, inflation, and geopolitical stress, it has held its payout steady and delivered a nice 61% total return, too.

RA’s High Payouts—and Profits—Roll Through a Tough Few Years

RA’s portfolio of over 500 assets gives it broad diversification. At the same time, its corporate bonds, real estate, and utilities—T-Mobile USA (TMUS) and entertainment-venue owner VICI Properties (NYSE:VICI) are top holdings—have secured the fund’s big income stream for years.

And I do mean big: RA yields 13.8% today and pays dividends monthly, too. And future gains in the fund’s market price are likely to lower that yield in the future. That means investors who buy now are securing that high-income stream and positioning themselves for gains as latecomers join the party.

Retirement CEF Pick No. 2: An 11.8% Yield From a Bond-Market Pro

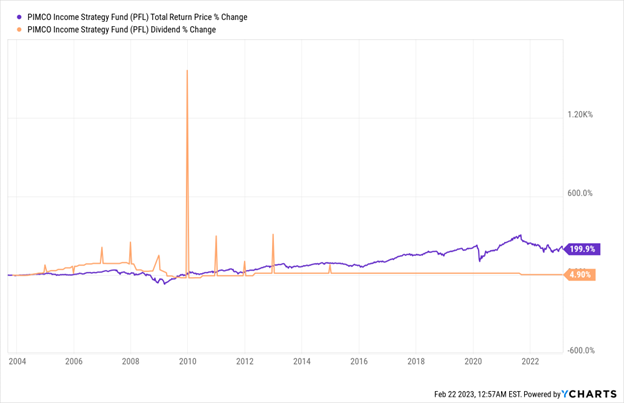

The Pimco Income Strategy Closed Fund (NYSE:PFL) is an 11.8%-yielder holding 385 bonds issued by a variety of corporations, as well as a number of other income-producing assets that have pushed PFL to a triple-digit gain. Moreover, its massive dividend has grown in that time, while management has paid regular special dividends, too!

Big Gains for Investors

This goes to show how a strategy of mixing different bonds with different durations, issuers, yields, and so on can secure your income stream and help insulate you from big losses during crashes. PFL has survived the dot-com bubble bursting, the Great Recession, the 2011 debt-ceiling fiasco, the pandemic, and last year’s spike in inflation. In other words, it’s a great fund for the long term.

One thing to bear in mind about PIMCO funds is that they almost always trade at premiums due to the firm’s strong reputation in the CEF world. But PFL trades at a lower-than-usual premium: 2.3% as I write this, compared to a 7.4% average over the last five years. That’s another good reason to pick this one up now.

Retirement CEF Pick No. 3: A 10.4% Yield From a Value-Investing Master

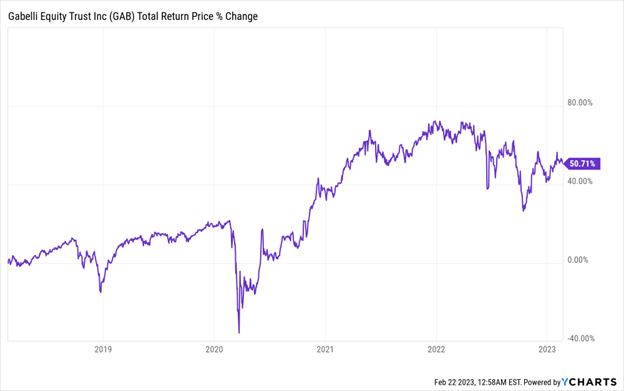

Our third great long-term play is the Gabelli Equity Trust Closed Fund (NYSE:GAB), managed by Mario Gabelli, one of Wall Street’s best-known investment pros. Gabelli has been in the game for decades, and his fund yields 10.4%, thanks to its fundamental value-driven approach, which has driven profits for years.

GAB Delivers Through the Rough Early 2020s

With stocks oversold and value stocks even more oversold, getting a fund like GAB makes a lot of sense. And with a whopping 759 holdings, you’re about as diversified as you can be with this one.

GAB, too, trades at a premium now, at around 7.5%. But that premium was as high as 13% last December when the market outlook was worse than it is today, making this one 7.5% premium we’re okay with paying.

The Final Word

Rounding the portfolio up, we’ve got three funds with an average 12% yield, and you can buy all of them in a matter of seconds through your broker. That could put you on track to bringing in the average American income in dividends alone—$600K or less!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."