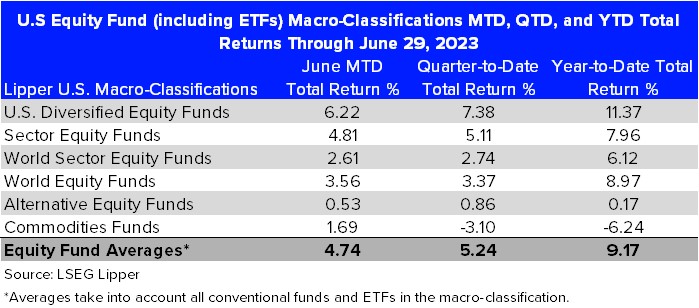

Despite rising concerns around future interest rate hikes, renewed global recessionary fears, and the possibility of new restrictions on technology sales to China by U.S. firms at the end of June, U.S. equity and taxable fixed-income mutual funds (including ETFs) rose 4.74% and 0.26%, respectively, for the month-to-date (MTD) period, ended June 29, 2023.

On the equity side, Lipper’s U.S. Diversified Equity (SPDR® S&P US Dividend Aristocrats UCITS ETF EUR Dis (BIT:USDE)) Funds macro-classification led the way, posting a 6.22% return MTD, followed by domestic Sector Equity Funds (+4.81%) and World Equity Funds (+3.56%), while Alternative Equity Funds (+0.53%) was the relative laggard of the equity macro-classifications.

Lipper’s Latin American Funds classification, posting an eye-popping 10.36% June MTD return, posted the strongest returns of the individual U.S. equity classifications, followed by Equity Leverage Funds (+10.13%), Industrial Funds (+9.20%), Small-Cap Value Funds (+9.05%), and Natural Resources Funds (+8.47%), while Dedicated Short Bias Funds (-7.92%) was the equity universe pariah, bettered by Precious Metals Equity Funds (-3.74%) and Commodities Precious Metals Funds (-2.06%).

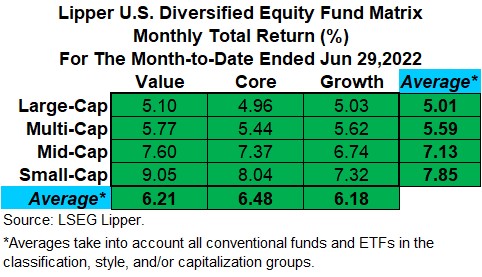

While mega-cap tech issues had a great run early in the month, small-cap and core-oriented funds outpaced the other capitulation and style boxes for the MTD period, with Small-Cap Values Funds leading the way, followed by Small-Cap Core Funds (+8.04%).

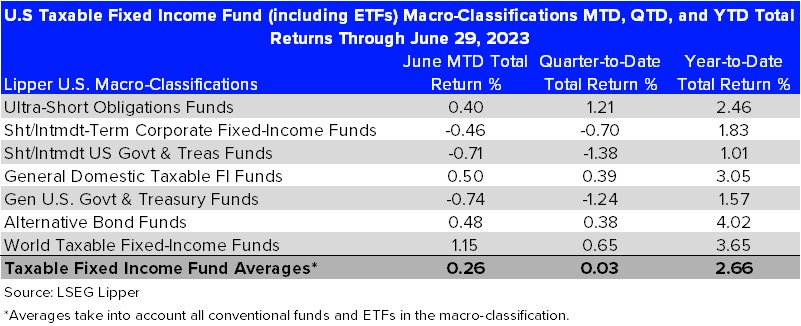

With Federal Reserve Chair Jerome Powell stating late in the month that senior Fed officials expect the Fed to hike interest rates “a couple of times” later this year and the Bank of England, Norway’s central bank, and the Swiss National Bank hiking their key lending rates on June 22, it wasn’t too surprising to see the taxable fixed income mutual funds (including ETFs) didn’t fare as well as their equity counterparts.

The World Taxable Fixed Income Funds (+1.15%) macro-classification posted the strongest returns for the June MTD period, followed by General Domestic Taxable FI Funds (+0.50%), Alternative Bond Funds (+0.48%), and Ultra-Short Obligation Funds (+0.40%), while the General U.S. Government & Treasury Funds (-0.74%) macro-classification and Short-/Intermediate-Term U.S. Government & Treasury Funds (-0.71%) were the outcastes in the taxable fixed income funds universe.

Lipper’s Emerging Markets Local Currency Debt Funds (+3.05%) classification jumped to the top of the taxable fixed-income funds list, followed by Alternative Currency Strategy Funds (+3.01%)—which were helped by strong MTD returns from select bitcoin and blockchain-focused ETFs—Emerging Markets Hard Currency Debt Funds (+2.24%), and Loan Participation Funds (+1.84%), while the General U.S. Government Funds (-1.09%) and Intermediate U.S. Government Funds (-1.08%) classifications suffered the largest losses in the taxable fixed income funds (including ETFs) universe. The average money market fund returned 0.35% for the MTD period, which equates to an average annualized return of 4.33%.

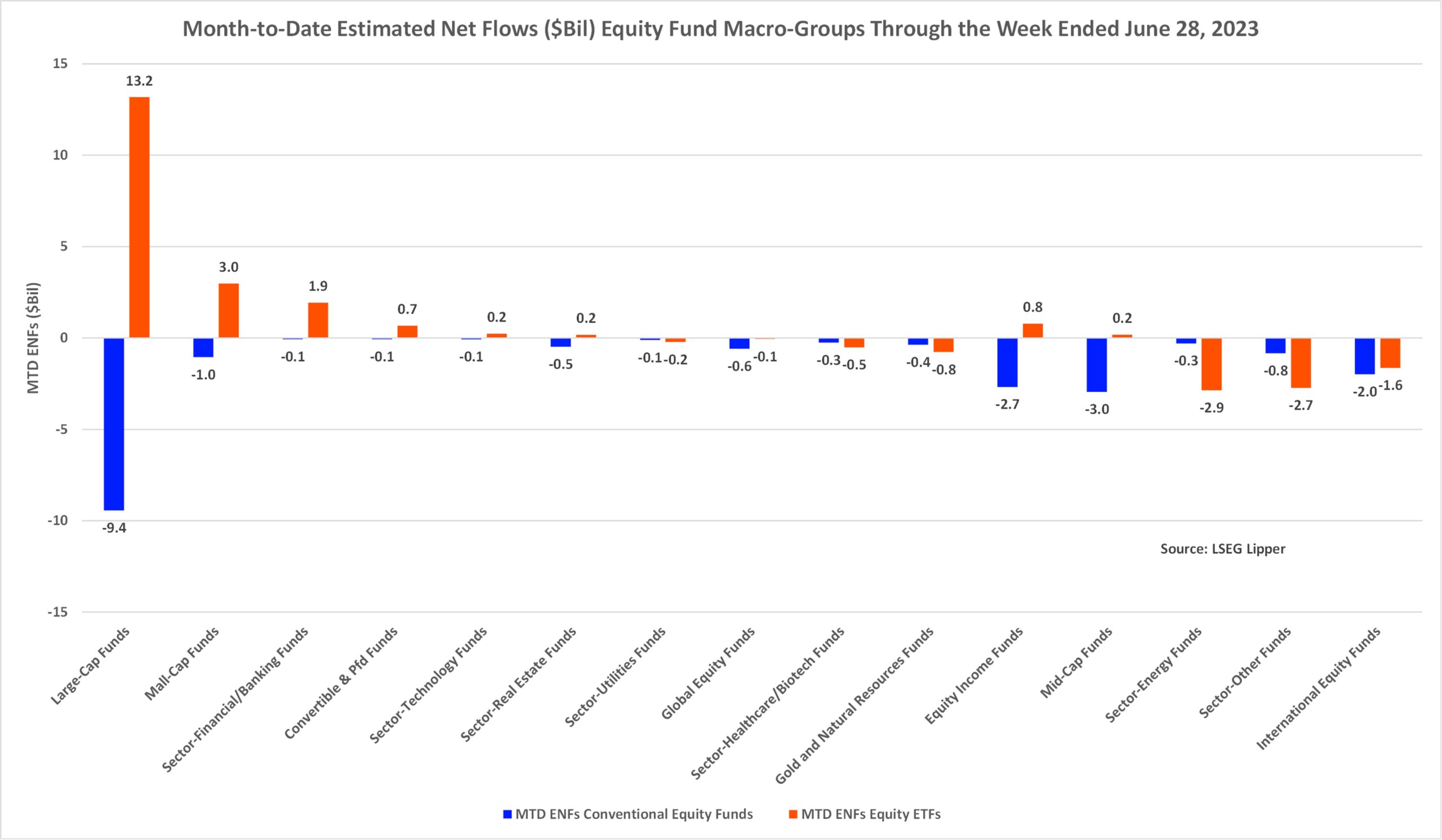

Turning our attention to MTD flows, investors were net purchasers of fund assets (including those of conventional funds and ETFs) injecting a net $10.4 billion through the LSEG Lipper fund-flows week ended Wednesday, June 28. Fund investors were net purchasers of taxable bond funds (+$10.7 billion), money market funds (+$8.7 billion), and tax-exempt fixed income funds (+$850 million) while being net redeemers of equity funds (-$9.9 billion).

That said, as has been the case, the dichotomy between conventional equity funds and equity ETFs continued in June, with conventional equity funds handing back some $21.2 billion MTD, while their ETF counterparts attracted $11.3 billion. None of the fund-flow macro-groups on the conventional equity fund side attracted net new money month to date. Large-cap funds (-$9.4 billion) witnessed the largest net redemptions so far this month, bettered by mid-cap funds (-$3.0 billion), equity income funds (-$2.7 billion), international equity funds (-$2.0 billion), and small-cap funds (-$1.0 billion).

On the equity ETF side, as a result of investors’ continued interest in artificial intelligence and the quasi-related rally by the Nasdaq Composite, ETF investors were net purchasers of large-cap ETFs (+$13.2 billion. Following large-cap ETFs at a distance, small-cap ETFs (+$3.0 billion) and sector-Financial/banking ETFs (+$1.9 billion) attracted the next largest draws in the equity ETF universe, while sector-energy ETFs (-$2.9 billion), the commodities heavy sector-other ETFs (-$2.7 billion), and international equity ETFs (-$1.6 billion) suffered the largest net redemptions of the group.

On the fixed income side, investors were almost as likely to inject net new money into conventional taxable fixed income funds (+$4.5 billion) as they were taxable fixed income ETFs (+$6.0 billion).

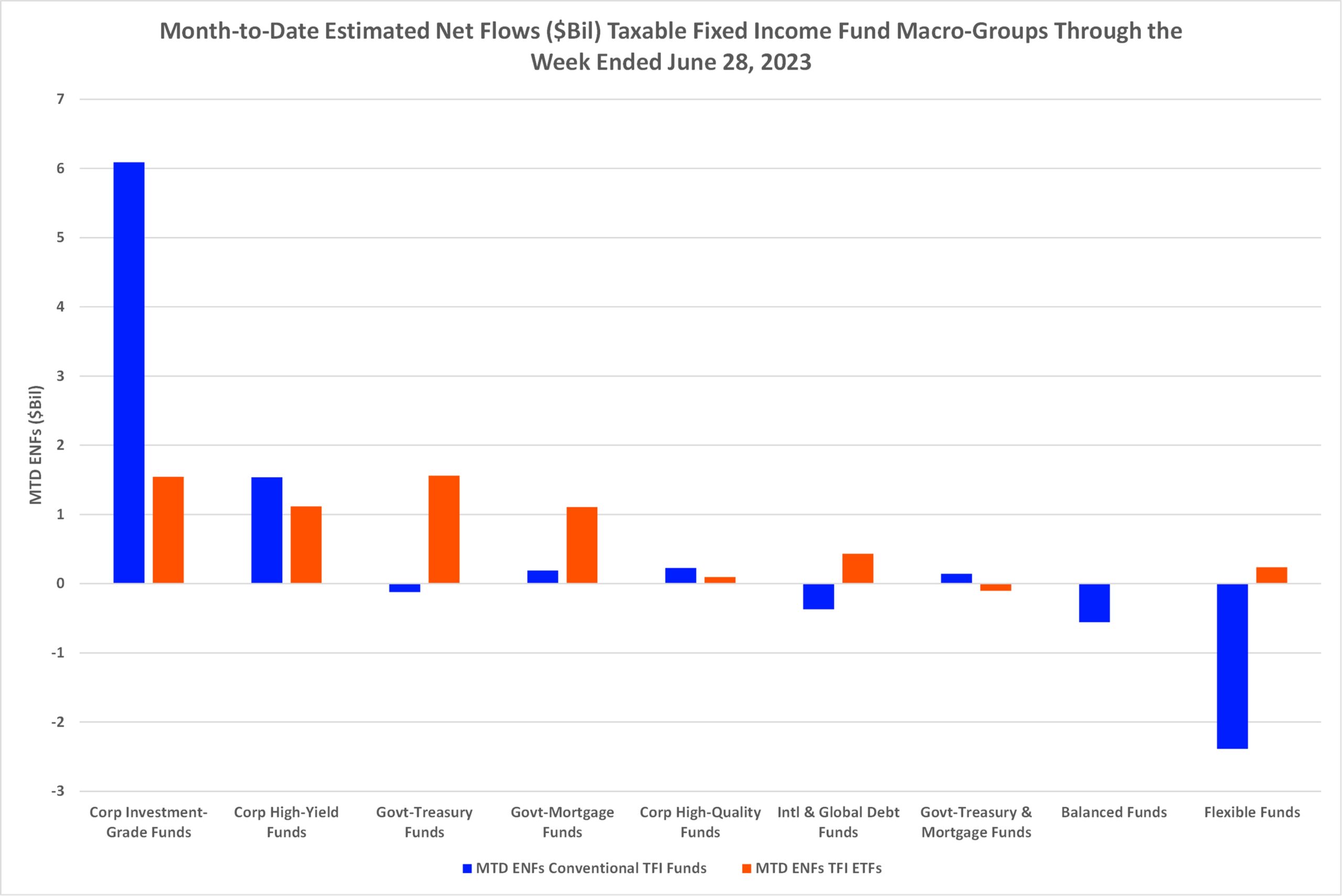

Corporate investment-grade debt funds (+$6.1 billion) attracted the largest draw of net new money on the conventional funds’ side MTD, followed by corporate high-yield funds (+$1.5 billion) and corporate high-quality funds (+$228 million). Meanwhile, flexible funds (-$2.4 billion) experienced the largest net redemptions, bettered by balanced funds (-$556 million) and international & global debt funds (-$371 million).

On the taxable fixed-income ETF side, investors injected $1.6 billion into government-Treasury ETFs for the month-to-date period, followed by corporate investment-grade debt ETFs (+$1.5 billion), corporate high-yield ETFs (+$1.1 billion), and government-mortgage ETFs (+$1.1 billion) while being net redeemers of government-Treasury ETFs (-$105 million).

Conventional municipal bond funds and ETFs attracted some $850 million for the MTD period, with conventional tax-exempt funds attracting $476 million and their ETF counterparts taking in $374 million so far in June.