Over the past week, the financial world has been rocked by the news of Silicon Valley Bank's failure - the largest bank to go under since the 2008 financial crisis.

The shock announcement came last Wednesday when the company revealed it needed to raise $2.25 billion to strengthen its balance sheet. To compound matters, it had sold all of its available-for-sale bonds, incurring a $1.8 billion loss.

Despite efforts from the bank's executives to reassure investors, a panic set in, and by the close of business on Thursday, depositors had withdrawn over $42 billion. US banking regulators were forced to step in and shut down the bank on Friday.

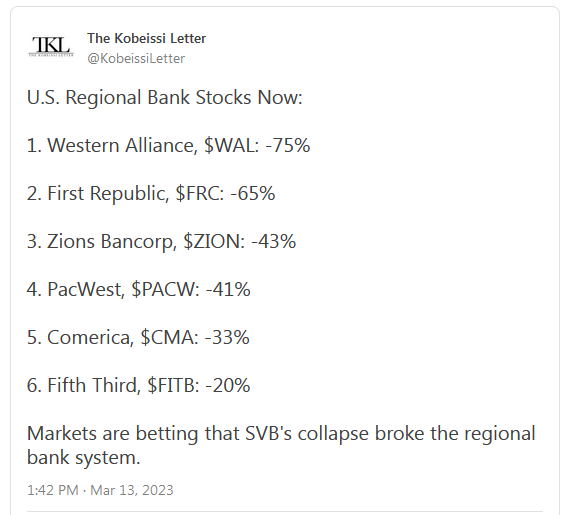

The shockwaves were felt throughout the financial sector, with fears rising that other regional banks could face similar trouble.

And those fears were not unfounded, as US regulators closed Signature Bank (NASDAQ:SBNY) on Sunday, citing systemic risk, barely a week after crypto-friendly bank Silvergate (NYSE:SI) also collapsed.

US Authorities Swing In to Save Clients

On Sunday, the Biden administration took an extraordinary step to restore confidence in America's banking system. The administration guaranteed that customers of the failed Silicon Valley Bank and Signature would have access to all their money starting Monday.

The markets reacted positively to this news, with risk-on assets such as Bitcoin gaining 14% since Sunday evening and rising almost 10% on Monday.

It remains to be seen how long the positive effect will last, but it could be a strengthening of BTC’s main narrative as the alternative to centralized banking and payment systems. After all, this was the environment Bitcoin was borne for.

These events provide some reminiscent of the ‘economic bazooka’ initiated by the US Fed at the onset of the COVID pandemic in March 2020. The question remains whether this will be enough to stabilize markets.

Monday Brought Despair to the Banking Sector

To no surprise, Monday morning offered a wave of despair for the entire banking sector eradicating more than $200B worth of value for the US Banking sector alone.

USDC Depegged over the weekend!

USDC, the second-largest stablecoin in terms of market capitalization, was in the spotlight over the weekend as it fell to as low as 87 cents.

This unexpected de-pegging occurred after Circle, the issuer of USDC, disclosed that $3.3 billion worth of the cash reserves backing the stablecoin were still held at Silicon Valley Bank.

The news not only shook the confidence in USDC but also raised concerns about the sustainability of other stablecoins like DAI, USDD, and USDP.

Although USDC has now reclaimed its peg with the US Dollars, this certainly provided yet another wake-up call for the industry: stablecoins come with the risk of the underlying assets held and the concentration risk at counterparties.

Image source: CoinGecko

Notably News

- US Court approves Binance's acquisition of Voyager

Binance.US has successfully cleared a major hurdle in its bid to acquire the assets of bankrupt crypto lender Voyager Digital in a deal valued at over $1 billion. The move comes after Michael Wiles, a bankruptcy judge in the Southern District of New York, overruled the objections to the proposed acquisition. As part of the sale to Binance.US, Voyager's customers are expected to receive a 73% recovery. This decision is a significant win for Binance, which has been working on expanding its presence in the US market.

- BlockFi Woes Continue with SVB Collapse

BlockFi, a former crypto lender, has faced a series of unfortunate events related to affiliated companies collapsing. The first hit was the Luna crisis that pushed BlockFi to the brink of bankruptcy. However, they were saved by a $680 million transaction with FTX. Unfortunately, FTX also collapsed in November 2022, leading BlockFi to file for bankruptcy. Now, reports indicate that BlockFi had $227 in unprotected funds exposed to the recent SVB saga. Just how unlucky can one be?

- SEC rejects VanEck ETF proposal for the third time

VanEck's latest proposal for a bitcoin exchange-traded fund (ETF) has been rejected by the U.S. Securities and Exchange Commission for the third time. The decision has, however, been criticized by Commissioners Hester Peirce and Mark Uyeda, who released a joint statement accusing the regulator of using a different set of standards for bitcoin-based ETPs than for other commodity-based ETPs. This development raises questions about the SEC's approach to cryptocurrencies and their potential role in the advancement of financial markets.