The Fed will have to harden its stance to break the labor market. But at what cost for investors?

The Bureau of Labor Statistics released the latest jobs report on Tuesday. Since inflation became a hot topic post-lockdown, Fed Chair Jerome Powell has repeatedly called for loosening the labor market. After all, having a steady income spurs excess demand, which prolongs inflation.

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,”

Jerome Powell, Federal Reserve Chair at Jackson Hole conference

Although the Fed’s official dual mandate is to keep unemployment low and prices stable, the latter takes priority. In this monetary regime, a resilient labor market is not a sign of a strong economy but a problem to be tackled.

With that in mind, the job report for August does not look suitable for the Fed’s goal to make labor market conditions softer.

Labor Market Hardens

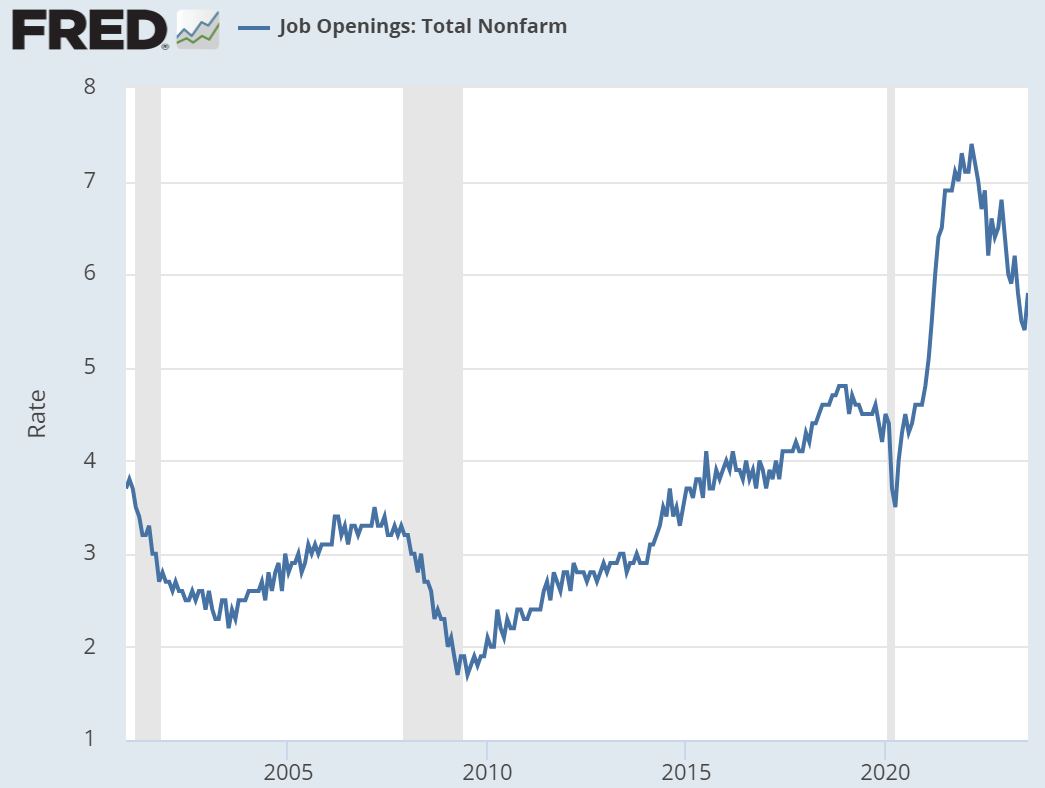

For August, the Job Openings and Labor Turnover Survey (JOLTS) revealed 9.6 million job openings. As 690,000 new jobs were added, this translates to a 5.8% job openings increase rate, beating the 8.8 million estimate significantly.

The bulk of new openings came from professional and business services, at +509,000, followed by jobs in finance and insurance at +96,000. Both the quit rate and hires rate remain unchanged, at 2.3% and 3.7% respectively.

The accommodation and food services sector had the most quits, at 88,000, followed by finance and insurance at 28,000. Interestingly, the number of layoffs, holding the rate at 1.1%, increased in state and local government education (+27,000) but decreased in state and local government (-39,000).

The latest JOLTS data marks the largest job openings increase since July 2021. The fresh labor market spike appears to be moving away from recession if compared to the Great Recession of 2007 – 2009 and the brief technical recession in March 2020.

With that in mind, JOLTS data holds a considerable 40-day lag and is vulnerable to sampling errors. For instance, the latest labor strike by the United Automobile Workers (UAW) is not captured.

Nonetheless, it does gauge sentiment for general business conditions. In turn, the market and the Fed take JOLTS data as indicative. In this case, the market reads JOLTS data as predictive of the Fed’s hardened response to the hardening labor market.

Stock Market Reacts Negatively

The Fed’s “higher for longer policy,” referring to elevated interest rates, seems to be in place now. In regular economies, companies would view a hardened labor market positively. After all, strong labor demand signals a healthy economy that benefits businesses’ bottom line.

But this is not the case when the priority is to crush inflation sustainably. Accordingly, the market reacted negatively to the JOLTS data drop. Dow Jones Industrial Average index (DJI) plunged 0.73%, and S&P 500 by 0.81%. Nasdaq 100 went down by 1.03%.

As the tech sector proxy, it is unsurprising that Nasdaq took the biggest hit following the JOLTS release. Tech companies predominantly rely on debt-based growth, and more expensive capital for longer doesn’t benefit that model.

November Hike Chance Doubles as Recession Gets Another Delay

In March 2023, the Federal Reserve projected a mild recession in the latter half of the year. This shifted in July 2023 when the recession forecast was removed entirely by the year’s end. As of September 6, 2023, the Fed’s Beige Book report noted only mild recession concerns, predicting a soft landing instead.

Yet, the present 5.25 – 5.50% interest rate has proved costly for the stock market. Accustomed to near-zero interest rates for a decade since 2000, companies need to realign their business models. The S&P 500 index has already lost around $3.2 trillion in market cap since the Fed’s recession outlook removal.

Moving forward, the interest rate hike probability has now doubled. Compared to last week’s 16% hike probability for the November FOMC meeting, investors are now pricing their futures bets on a 30.83% chance, per the CME FedWatch tool.

Disclaimer: Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.