- Bond yields continue to rise as surging oil prices add to higher for longer case

- Stocks pressured as higher yields start to bite, earnings disappoint

- Oil and gold ease from highs but eye more gains amid ongoing tensions in Mideast

Markets unsettled by geopolitics as oil rallies

Stock markets fell deeper into the red on Thursday after widespread losses yesterday on the back of the tense mood in the Middle East that has fanned the rally in crude oil, which in turn is pushing up soaring bond yields even higher.

President Biden’s unscheduled visit to Israel on Wednesday was marred by the bombing of a hospital in Gaza that prompted Arab leaders to cancel a planned summit with the US President. But although a ceasefire looks even further off than it did prior to this week’s developments, there was some relief that Biden is stepping up efforts to get aid into the Gaza strip as well as urging Israel to proceed cautiously amid preparations for a possible ground offensive.

The ongoing risk of an escalation of the conflict that could draw in other regional powers such as oil-rich Iran drove oil futures up more than 3% at one point. A much bigger-than-expected drop in weekly US crude inventories added to the upside pressure.

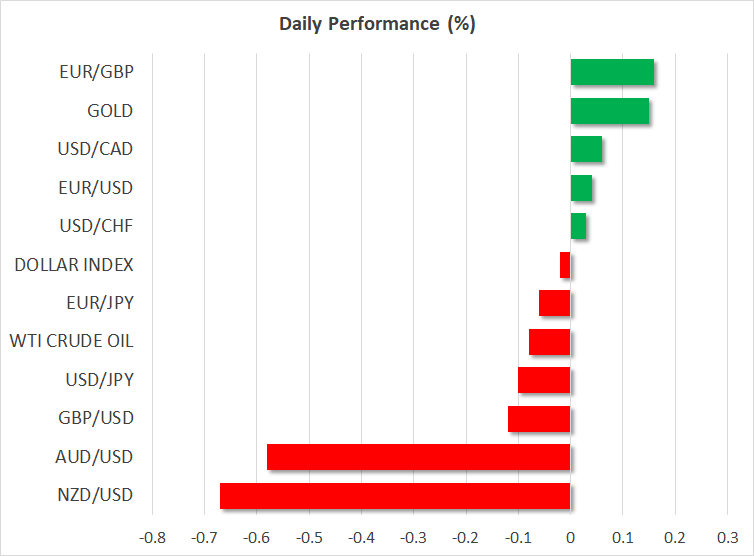

Both WTI and Brent crude futures later erased some of those gains to close around 1.8% higher but gold maintained a sturdier uptrend. The precious metal has jumped more than 6% since the outbreak of violence in Israel on October 7 and it is trading higher today to test the $1,950/oz level.

Powell speech awaited as 10-year yield approaches 5.0%

Demand for safe havens failed to put a cap on bond yields although yesterday’s auction for 20-year Treasuries did attract plenty of buyers. Nevertheless, concerns not just about the rise in oil prices but also about the recent run of solid economic indicators out of the United States has added fuel to the rally in Treasury yields.

The yield on 10-year Treasury notes reached a fresh 16-year high of 4.98% today, while the 30-year yield breached the 5.0% threshold for the second time in two weeks.

Fed officials have been questioning the need for additional rate hikes lately, arguing that the tighter financial conditions stemming from higher yields have done some of the work for them. But after the hattrick of data beats from the nonfarm payrolls, CPI and retail sales reports, investors have begun to price in a higher probability of one final 25-bps rate hike.

Speaking in London yesterday, Fed Governor Christopher Waller signalled a pause in November, saying he wants to “wait, watch and see”, but he did not rule out “more action” at a later point if needed. All eyes today, though, will be on the Fed Chair as Powell will be speaking at the Economic Club of New York (16:00 GMT) before the blackout period begins at the weekend.

Equities face growing headwinds

Stocks took fright from the relentless upward march in bond yields, with all three of Wall Street’s leading indices closing lower on Wednesday. Even if the Fed decides against raising rates further, the ‘higher for longer’ reality is slowly sinking in for investors, with 2024 rate cut expectations pared back sharply this week.

After starting the week on a positive note following a strong set of bank earnings on Friday, stocks took a dive yesterday as rising borrowing costs took the steam out of the latest bounce, while the Israel-Gaza conflict further muddied the outlook.

Morgan Stanley was a major drag as the stock plunged 6.8% after the bank reported a 9% fall in its Q3 earnings. Tesla’s results also disappointed and its stock looks set to extend yesterday’s 4.8% drop, which came even before the earnings were announced.

However, Netflix (NASDAQ:NFLX) could spread some joy today as its stock surged by more than 10% in after-hours trading when it reported impressive revenue and subscriber numbers.

Dollar’s uninspiring performance

The US dollar was marginally firmer on Thursday, failing to significantly capitalize on the spike in Treasury yields as well as the flight to safety. The dollar index remains below its October 3 peak, suggesting that FX markets are adhering to the shift in Fed rhetoric differently than bond markets.

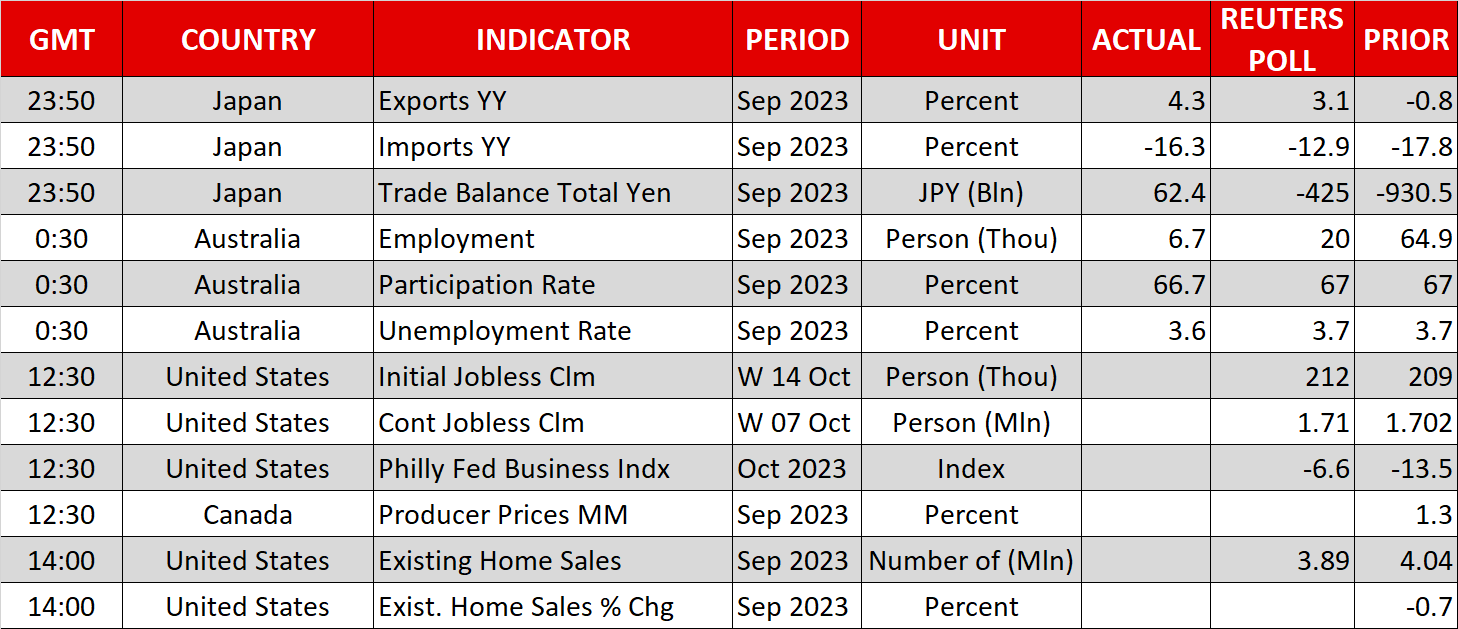

The pound is trading at a two-week low as yesterday’s hotter-than-expected UK CPI data didn't alter rate hike bets much for the Bank of England. The Australian dollar, meanwhile, is one of the worst performers today, weighed by a smaller-than-forecast increase in Australian employment in September, which slightly dented expectations of the RBA raising rates again.