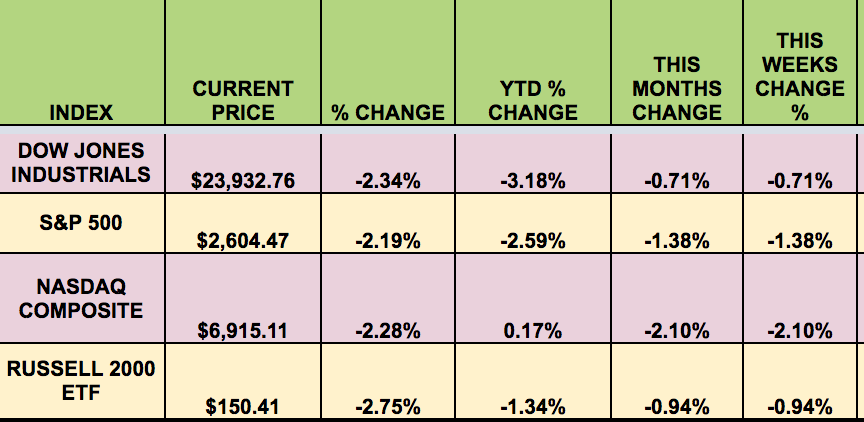

Markets: It was a down week for the market, with all 4 indexes falling, as investors reacted to tariffs from China, a disappointing March Non-Farm Payrolls report, and a rate-hawkish speech from new Fed chief Powell on Friday. The Dow Jones 30 Futures, S&P 500, and the RUSSELL small caps are in the red so far in 2018, with the Nasdaq being the only index still in positive territory year-to-date, (but barely).

“Big U.S. manufacturers, grain merchants and chipmakers were the early casualties on Wednesday after China and the United States announced tariffs on $50 billion of each others imports, cementing fears they were moving toward a trade war. The speed with which the trade spat between Washington and Beijing is ratcheting up the Chinese government took less than 11 hours to respond with its own measures led to a sharp sell-off in global stock markets and commodities.

China levied 25% additional tariffs on U.S. goods earlier in the day. But unlike Washington’s list that covers many obscure industrial items, Beijing’s covers 106 key U.S. imports, including soybeans, planes, cars, and chemicals. As a sector, technology has the most to lose from a world in which global trade is restricted and of course, some of the subjects of the tariffs, will also be hit, said Rick Meckler, president of investment firm LibertyView Capital Management in Jersey City, NJ”

“U.S. stocks extended losses and the S&P 500 hit a session low in Friday afternoon trading after Federal Reserve Chairman Jerome Powell said the U.S. central bank will likely need to keep raising interest rates to keep inflation under control. In a speech in Chicago on the U.S. economic outlook, Powell said the labor market appeared close to full employment. It was his first speech on the economic outlook since taking over as chairman on Feb. 5.”

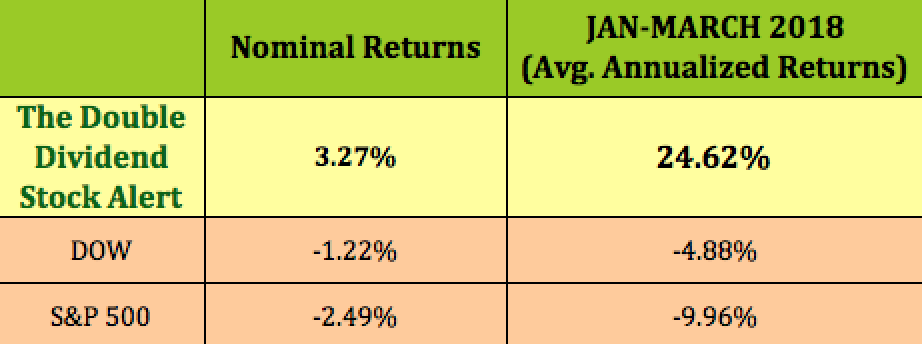

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Manhattan Bridge Capital Inc (NASDAQ:LOAN), City Office (NYSE:CIO), Liberty Tax Inc (NASDAQ:TAX), Manning & Napier Inc (NYSE:MN), PennyMac Mortgage Investment Trust (NYSE:PMT), Ares Management LP (NYSE:ARES), Five Oaks Invst (NYSE:OAKS), Telefonica (MC:TEF) Brasil SA ADR (NYSE:VIV).

Volatility: The VIX started out the week strong, hitting over 25 on Monday, then fell back to $18.73 on Thursday, before coming back on Friday, closing the week at $21.49, up 7.6% for the week.

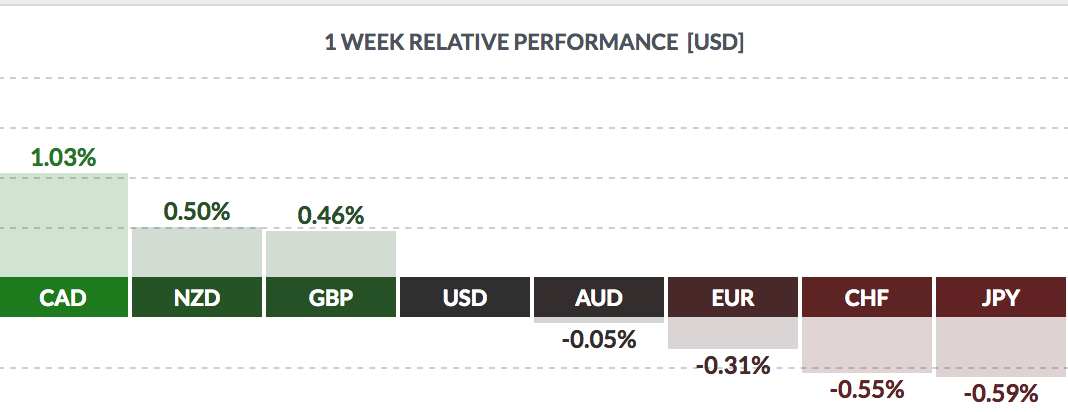

Currency: The USD rose vs. most major currencies this week, except the NZD, the Canadian Loonie, and the Pound Sterling.

Market Breadth: 27 of the DOW 30 stocks rose this week, and 86% of the S&P 500 rose.

Economic News: “The New York Federal Reserve launched a benchmark U.S. rate on Tuesday to potentially replace LIBOR, and market participants hope it will prove more reliable after a long and complex switchover.

The Secured Overnight Financing Rate (SOFR) set at 1.80 percent. SOFR is based on the overnight Treasury repurchase agreement market, which trades around $800 billion in volume daily.

Publishing the rate is the first step in a multi-year plan to transition more derivatives away from the London interbank offered rate (Libor), which regulators say poses systemic risks if it ceases publication.

Analysts have struggled to explain a recent jump in Libor, which has reached nine-year highs, even as bank credit quality is seen as solid.

Increased issuance of short-term Treasury securities and declining demand for credit due to tax reforms are deemed the most likely factors. A decline in interbank lending has reduced the robustness of the rate, which is sometimes estimated rather than based on actual transactions.” (Source: CNBC)

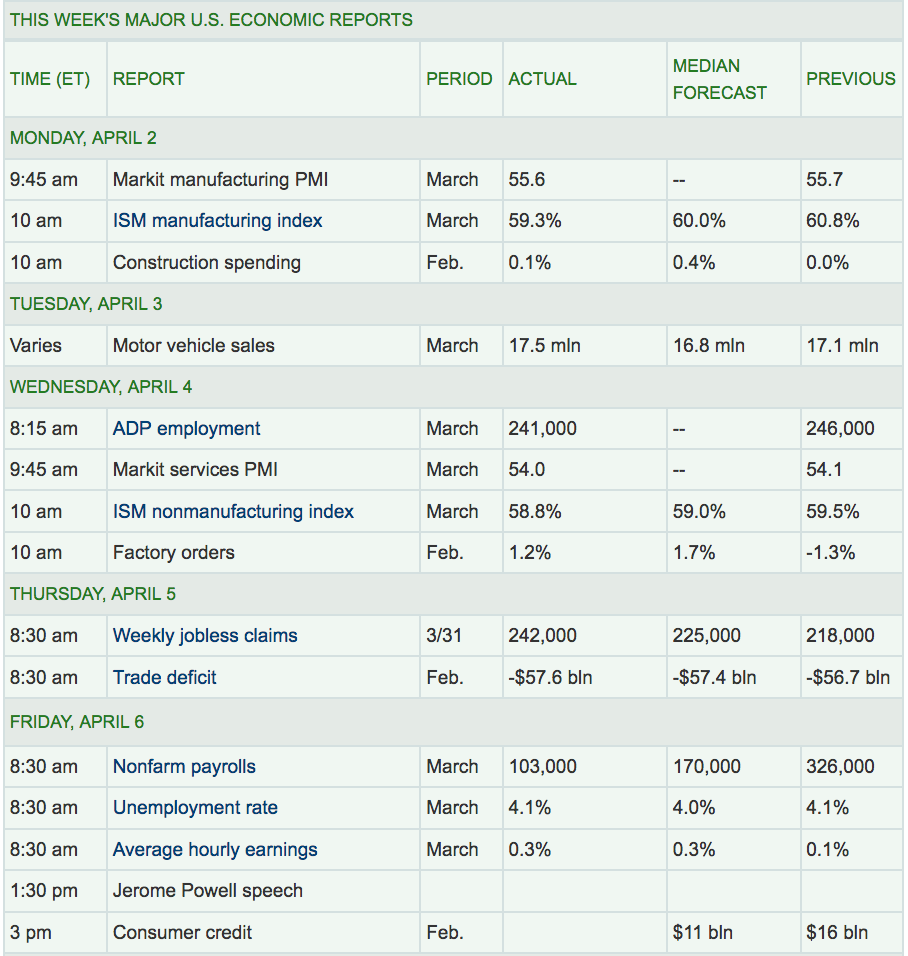

Friday’s Non-Farm Payrolls report disappointed, with the fewest jobs created in six months in March. Inclement weather is being blamed for the slowdown, which is seen as temporary. The unemployment rate held steady at 4.1% for a 6th straight month.

Week Ahead Highlights: It’ll be a slow week for data, but most eyes will be upon the escalating rhetoric between the US and China, trying to parse the threats from the likelihood of the next phase of this melee.

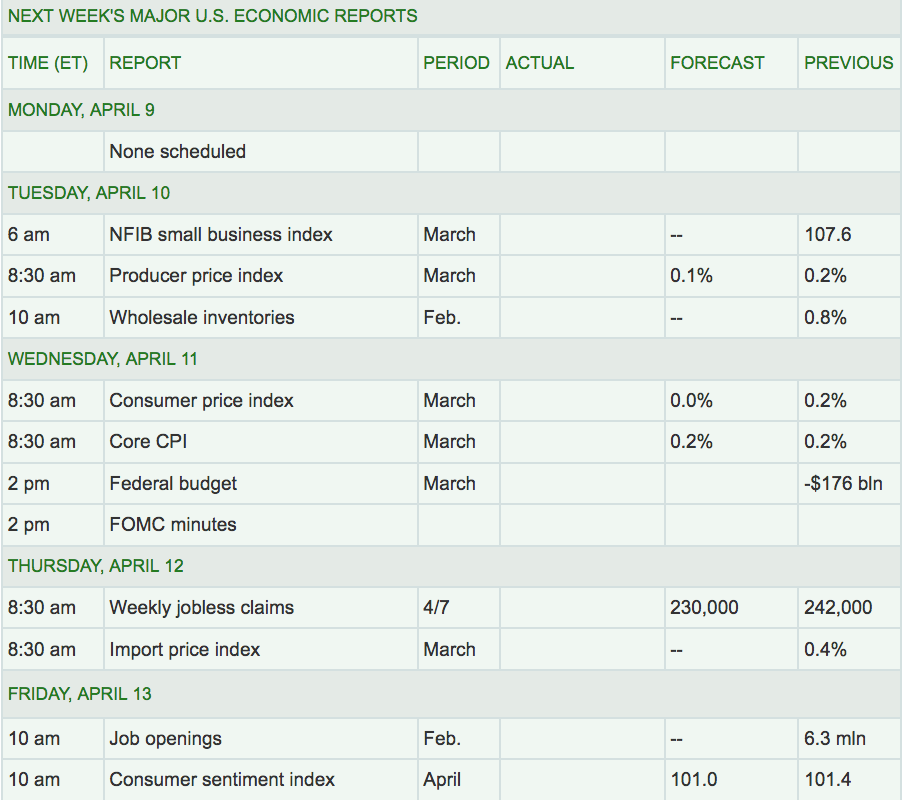

Next Week’s US Economic Reports: The Consumer Price Index and the Consumer Sentiment Index both come out next week. Investors will also get a look at the Fed’s minutes from its March meeting, and will be looking for clues as to the speed of future rate hikes.

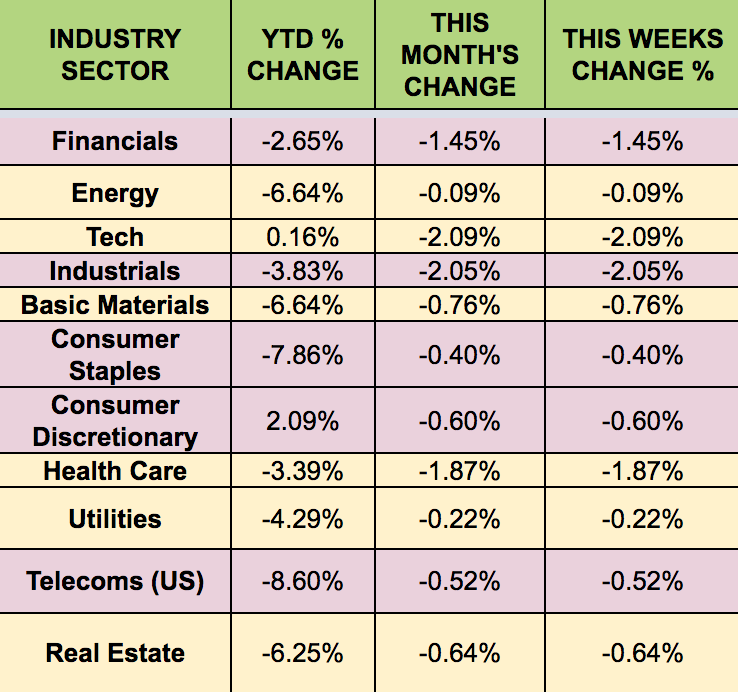

Sectors: The Energy sector and the defensive Utilities sector led this week, as Tech and Industrials trailed, stung by tariff fallout, and Facebook’s recent problems.

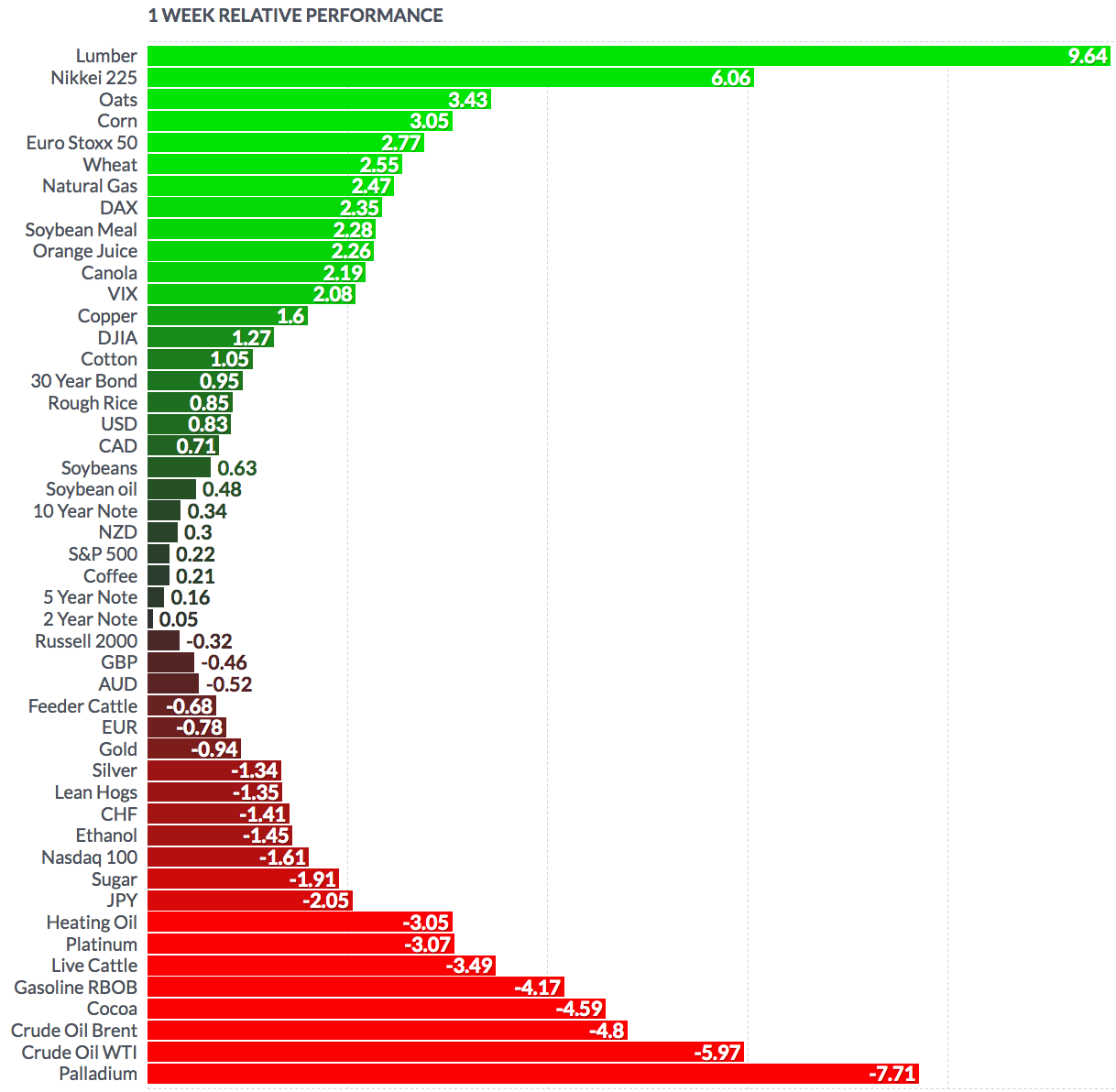

Futures:

Crude Oil WTI Futures dropped -6% this week, while Natural Gas futures rose 2.5%.