Last week’s Stock Exchange focused on making hay while the sun is shining. The week before we discussed risk, where every trader and investor should start. Now the models must deal with news and symbolism. Dow 20K is grabbing the headlines as I expected. It is very nice to get some recognition for my early call on the most important investor perspective – concern about “upside risk.”

How does this affect the decisions of our technical experts? The models are not caught up in the symbolism of Dow 20K or the promise of Trumponomics. It is all about the charts.

Getting Updates

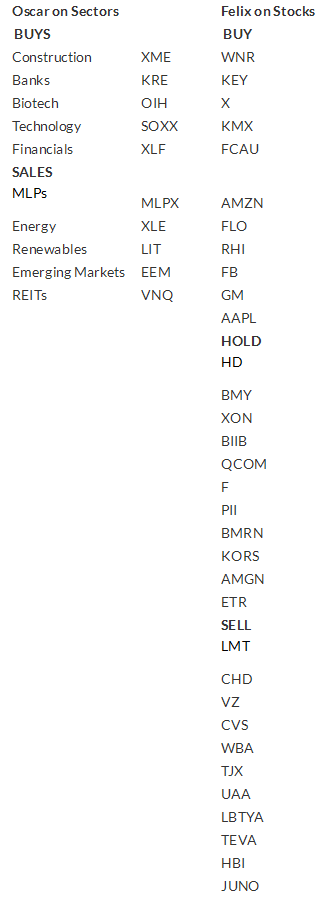

I have offered a new service to subscribers (free) on our Felix/Oscar update list. Each can suggest three favorite stocks and sectors. I plan to report the “favorite fifteen” in each category– stocks and sectors. Sign up at etf at newarc dot com. Ideas and comments are welcome, as always. Green represents a “buy,” yellow a “hold,” and red a “sell.” Each category represents about 1/3 of the universe. Please remember that these are responses to reader requests, not necessarily stocks and sectors that we own. For now we are not holding the list to the top fifteen, but we soon will. Sign up now to vote your favorite stock or sector onto the list!

Oscar and Felix Responses to Questions

This Week— Coping with the symbolism of Dow 20K

Holmes

Holmes: Amgen (NASDAQ:AMGN) is an interesting opportunity. The early November drop and recovery attracted my attention. The market message seems to reflect a concern that has been re-evaluated. We could easily see some price recovery here, perhaps to the level of the 200-day moving average.

J: Do you understand that the Presidential campaign involved everyone attacking drug prices?

H: What campaign?

J: Do you know that the President-elect is tweeting about drug prices?

H: I do not know what a President-elect is. And by the way, what is a tweet?

J: Do you know that everyone is focused on Dow 20K?

H: What is this “Dow.” I am talking about Amgen. Whatever you humans might think to be important, the message of this chart is clear – a possibly dubious selloff and a great rebound opportunity. It is my kind of trade!

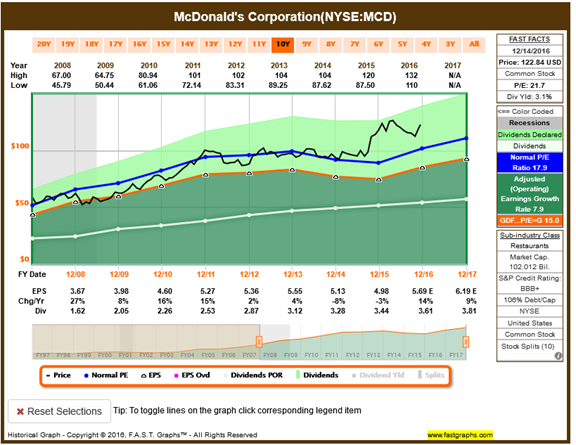

Athena: Some might think I have been a little late to the party on some recent picks. In the long run, you all will see. This week I especially like McDonalds (NYSE:MCD). There’s been a bit of a recovery in place since early August. More importantly, though, the SMA 500 and 200 are both itching to shoot up a little higher. I’d be very surprised to see the price decline, or even start to flatten out, within the next couple weeks.

J: This is yet another of your over-valued picks. Take a look at the excellent analysis from F.A.S.T Graphs:

A: As I keep explaining to you, valuation is not relevant for my trading time frame.

J: Do you realize that this stock is caught up in the “Trump Rally” and the quest for Dow 20K?

A: Unlike the other models, I am aware of news. It is a reflection of my superior wisdom and knowledge. Whatever the causes that motivate you humans, I will enjoy this rally. When it ends, I will sell.

J: That sounds like what some call the “greater fool theory.”

A: There is a limitless supply of fools!

J: I like biotech stocks that have real earnings, like AMGN, but there are better choices. The bottom might well be a few months away.

Felix

Some might be apprehensive about buying a stock at a 12 month high. I like to see a sustained recovery in price and volume, since I plan to buy for a holding period of more than a year. US Steel (NYSE:X)) pushes all my buttons. With improving strength in the overall economy, I predict consistent growth over the next 12 to 18 months.

J: Your choice might also be helped by Trump trade policies against China.

F: Who is Trump and where is China?

J: Those are important fundamental considerations.

F: If it is important, it is all reflected in the price.

Oscar

They may call it the Lombardi Trophy, but there will never be a Super Bowl in Green Bay. And that’s not just because it’s inhospitable there come February (though it is). There simply aren’t enough hotels around to hold the massive crowds. After all, they can barely find a place to host the Vikings fans in Appleton!

J: Very interesting. Moving beyond your favorite part of the newspaper – the sports section — do you have a sector pick for us this week?

O: Right – I got distracted thinking about REIT Hotels. Vanguard REIT (NYSE:VNQ) is the most popular REIT, but I have it rated as a “sell.” The group has been on a downswing the past six months.

J: I expect REITs to be hit hard by rising interest rates. That is what your chart shows. I especially do not like VNQ.

O: Well, there are some better charts.

J: Don’t hold out on us.

O: I really like Apple (NASDAQ:AAPL) Hospitality REIT Inc (NYSE:APLE); it is better oriented to a growth sector.

J: I agree. This is a REIT that we hold for clients who really need fixed income. I expect it to handle higher interest rates via economic growth.

Background on the Stock Exchange

Each week Felix and Oscar host a poker game for some of their friends. Since they are all traders they love to discuss their best current ideas before the game starts. They like to call this their “Stock Exchange.” (Check it out for more background). Their methods are excellent, as you know if you have been following the series. Since the time frames and risk profiles differ, so do the stock ideas. You get to be a fly on the wall from my report. I am the only human present, and the only one using any fundamental analysis.

The result? Several expert ideas each week from traders, and a brief comment on the fundamentals from the human investor. The models are named to make it easy to remember their trading personalities. Each week features a different expert or stock.

Questions

If you want an opinion about a specific stock or sector, even those we did not mention, just ask! Put questions in the comments. Address them to a specific expert if you wish. Each has a specialty. Who is your favorite? (You can choose me, although my feelings will not be hurt very much if you prefer one of the models).

Conclusion

Are the models ignoring the Dow 20K story? None of them watched my CNBC appearance reprising my 2010 call, even though they all work for me! As true technical analysts, they focus on their own setups and expect anything really important to be reflected in price, momentum, and volume.