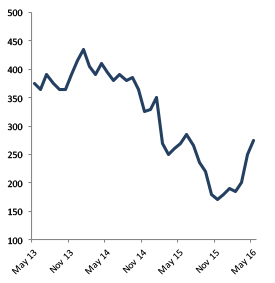

U.S. shredded scrap prices for steel started 2015 at $350 per long ton delivered to Midwest steel mills.

Barring a very brief rally in June, the price fell every month over the year and dropped to $170/long ton in December. Indeed, if we look at the chart, U.S. ferrous scrap prices have been in a downtrend since late 2013.

U.S. Shredded Scrap Prices ($/long ton delivered US Midwest mills)

When prices fall every month, scrap yards and steel mills reduce their purchases to the bare minimum, as they expect to be able to procure material at a lower price the very next month.

As a result of the long downturn in prices, scrap inventories were run down. Thus, when steel mills started buying again this year — particularly as steel prices rose in March — there was very little scrap available. Prices jumped $80 per ton over March and April and now stand at $275 a ton. Moreover, we expect that prices could touch $300 per ton this month or in June.

Is Scrap Back?

Supply has returned. March inflows to scrapyards were 30-50% higher, but steel mills have been unable to fully replenish. Part of the reason is that international prices have moved even higher and material is flowing to the export market. In order to secure their needs, mills have to raise prices.

Meanwhile, the steel market is even tighter thanks to import curbs. Flat-rolled steel prices have gone up by $160/short ton since December. This is substantially more than the scrap market, meaning that mills will be willing to pay more to secure more metal.

Integrated mills cannot rapidly secure more iron ore supply. It has to be mined, railed and then shipped across the Great Lakes. In order to make more highly profitable steel now, they can supplement their raw material purchases with scrap much more quickly. Meanwhile, mini mills are also looking to ramp up utiliation rates to take advantage of higher prices and secure more profit.

So does that mean that prices are going back up to $400 a ton?

In our opinion, no.

Its fundamental competitor is pig iron. Even with the increase in iron ore and coal prices, it is still cheaper to make pig iron now than to buy scrap. Over time, therefore, scrap buying will slow.

The International Scrap Market

International prices are soaring right now, as the Chinese steel industry ran down its inventories so that they are now too low. Steel prices there spiked (exacerbated by derivatives trading), but, fundamentally, the issue of too much steel supply and too little steel demand remains. That means steel prices in China will tumble again in the second half of the year and international scrap prices will plummet again.

In the U.S., export orders will drop in the second half and scrap will be dependent on the local market again. Meanwhile, steel mills will have restocked in Q2 and integrated mills will be receiving more iron ore. Prices will peak at some point between May and July at just over $300/ton and then dive back down again. If you have scrap, sell it soon!