Last week’s review of the macro market indicators suggested heading into the new week that the equity indexes looked strong and ready to challenge the all-time highs.

Elsewhere looked for gold (N:GLD) to continue lower while crude oil (N:USO) moved lower in its consolidation. The US dollar index (N:UUP) was breaking to the upside while US Treasuries (N:TLT) continued lower. The Shanghai Composite (N:ASHR) also looked to continue higher while Emerging Markets (N:EEM) consolidated under resistance.

Volatility (N:VXX) looked to remain subdued, keeping the bias higher for the equity index ETFs N:SPY, N:IWM and O:QQQ. Their individual charts showed some consolidation in the SPY and QQQ short term as the IWM took the lead, but all looked strong on the weekly timeframe.

The week played out with gold moving lower but at a sharply slower pace while crude oil continued lower and broke the consolidation range. The US dollar started slightly higher and then flagged, while Treasuries found a bottom Monday and then settled. The Shanghai Composite spent the week settling near 3600 while Emerging Markets broke the range to the downside.

Volatility moved slightly higher to start the week but then accelerated later. The Equity Index ETFs entered the week moving lower in consolidation and kept going. The SPY and QQQ filled the gaps below, while the IWM opened one probing below the 100 day SMA. What does this mean for the coming week? Lets look at some charts.

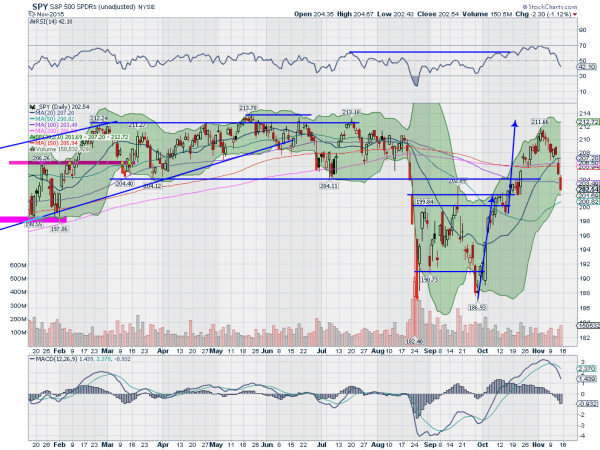

SPY Daily

The SPY came into the week having pulled back in a bull flag from the move higher off of the September low. It leaked lower again Monday and Tuesday saw a slight rebound. But that was a fake out as it continued lower the rest of the week closing the gap from October. The gapping candles suggest a possible Ad Block, an exhaustion pattern.

Its hard to assume that will happen though with the movement following the events of Friday night in Paris. The evidence is also lined up lower now. The RSI is falling and at the edge of the bullish zone while the MACD falls on the daily chart. The weekly chart shows an Evening Star pattern. The Marubozu candle lower this week also is a signal of more downside.

The RSI on this timeframe turned back at 60, right on the edge of a move back bullish, while the MACD is rising still. There is resistance higher at 204.40 and 206.40 followed by 208.40 and 209. Support lower comes at 201.75 and 200 followed by 199 and 197. More Downside Short Term.

SPY Weekly

Heading into November Options Expiration and the last week before the shortened Thanksgiving holiday, the Equity market have again shown an inability to make new highs, without giving up the positive longer term perspective.

Elsewhere look for gold to continue its downtrend, but with a possible short term reversal while crude oil works lower. The US dollar index looks to continue higher while US Treasuries are biased lower, but also may see a short term reversal. The Shanghai Composite is building energy for another leg higher while Emerging Markets are biased to the downside again.

Volatility looks to remain above the lower range, making things difficult for equities, but looking for a pullback after the spike in short order. The equity index ETFs SPY, IWM and QQQ, all look better to the downside this week. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.