Last week’s review of the macro market indicators suggested heading into Options Expiration Week, the last full week before Christmas and the FOMC meeting that the equity markets looked weak in the short run and all but the O:QQQ tired or weak on the intermediate term.

Elsewhere looked for gold (N:GLD) to consolidate in it downtrend while crude oil (N:USO) ran lower. The US dollar index (N:UUP) was back into consolidation with a short term downward bias while US Treasuries (N:TLT) were biased higher in consolidation. The Shanghai Composite (N:ASHR) looked better to the downside short term in its bounce and Emerging Markets (N:EEM) flat out broken and falling, but oversold.

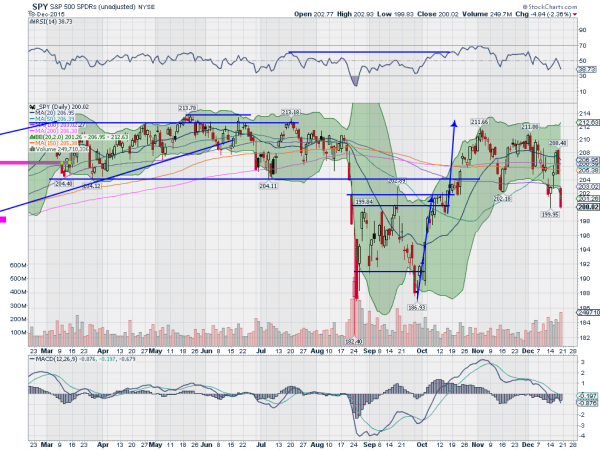

Volatility (N:VXX) looked to remain elevated keeping the bias lower for the equity index ETFs N:SPY, N:IWM and O:QQQ. Their charts looked weak in the short term as well. In the intermediate term the IWM was nearing key support, and the SPY testing a shift to a downside bias while the QQQ was still the strongest.

The week played out with gold moving in a channel before probing lower and rebounding to end the week while crude oil continued lower. The US dollar moved slightly higher while Treasuries pulled back but then bounced to end the week near unchanged. The Shanghai Composite found support and bounced while Emerging Markets acted likewise.

Volatility started the week at the highs but settled back, still elevated. The Equity Index ETFs started the week well but made outside reversals Thursday and followed lower Friday. The SPY, the IWM and the QQQ all ended the week lower. What does this mean for the coming week? Lets look at some charts.

SPY Daily

The SPY started the week printing a Hammer reversal candle Monday drawing back to the lower Bollinger Band®. That was confirmed higher Tuesday, but with a Spinning Top, signaling indecision. All seemed well Wednesday then as it moved strongly higher. Thursday’s bearish Marubozu candle ended that though, and set in another lower high.

Friday gapped down and ran, with another Marubozu, finishing well out of the Bollinger Bands, near the low of the week and right at the round number 200. This could lead to a bounce to start the week but the dirth of evidence looks lower. The RSI is falling and moving into the bearish zone while the MACD continues lower on the daily chart. These bode for more downside.

On the weekly chart the price is back at the 100 week SMA. Volume has picked up and the RSI is falling with the MACD rolling down. There is support at 200 and 199 followed by 197 and 195. Resistance higher comes at 202 and 204.60 followed by 206.60. Continued Move Lower.

SPY Weekly

Heading into the shortened Christmas week the equity markets look weak in the short with the SPY weak in the intermediate term as well. Elsewhere watch gold for a bounce in its downtrend while crude oil continues lower. The US dollar index looks strong and ready for more upside while US Treasuries are mired in broad consolidation. The Shanghai Composite is biased higher in consolidation and Emerging Markets are biased to the downside.

Volatility looks to remain elevated keeping the bias lower for the equity index ETFs SPY, IWM and QQQ. Their charts concur on the daily feed after back to back strong down days, while the IWM and QQ are nearing support in prior consolidation channels on the intermediate view. The SPY looks to be weaker rolling lower on the longer view. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.