Last week’s review of the macro market indicators which heading into the first full week of April saw the equity indexes looked strong and ready to make another leg higher. Elsewhere looked for gold (NYSE:GLD) to continue its pullback along with crude oil (NYSE:USO). The US dollar (NYSE:UUP) also looked to continue lower, possibly testing key 12 month support while US Treasuries (NYSE:TLT) were breaking to the upside and looked to continue.

The Shanghai Composite (NYSE:ASHR) looked poised to move higher in its downtrend as Emerging Markets (NYSE:EEM) continued to trend higher. Volatility (NYSE:VXX) looked to remain low and biased lower keeping the bias higher for the equity index ETFs NYSE:SPY, NYSE:IWM and NASDAQ:QQQ, despite the moves the past week. Their charts also looked strong on both the daily and weekly timeframe with the only slight warnings coming from slowing momentum indications.

The week played out with gold probing lower and finding support for a bounce while crude oil also started lower and rebounded late in the week. The US dollar moved in a narrow range while Treasuries pushed higher. The Shanghai Composite gained some separation from 3000 and then gave it back while Emerging Markets moved lower testing their trend.

Volatility drifted higher, but not materially. The Equity Index ETFs all started the week flat, but fell Tuesday and held there for the remainder of the week. No real damage to equities but a stall or stop of the trend higher. What does this mean for the coming week? Lets look at some charts.

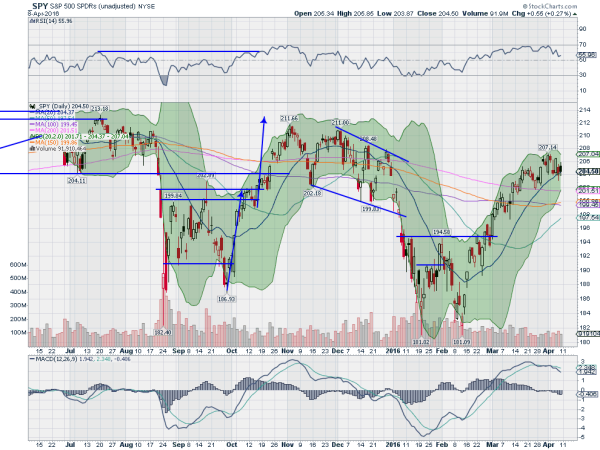

SPY Daily

The SPY started the week digesting the move higher from the prior Friday. Tuesday saw a gap lower that filled but then fell back followed by a string move higher Wednesday, but to a lower high. Thursday dropped back again, moving under the 20 day SMA for the first time since late February before a push back above it Friday. A wild up and down for day traders and a a very tight range of 3 points that longer term traders may not have even noticed.

It ended the week down 1% but over the 20 day SMA. The daily chart shows the momentum indicators weakening with the RSI falling back toward the mid line and the MACD crossed down and falling. Perhaps a topping short term, and if so another lower high after a lower low. On the weekly chart the week looks consolidative. The RSI is leveling under the 60 level, where it would turn bullish, while the MACD rises. There is resistance higher at 206 and 207.6 followed by 208.50 and 210.75. Support lower comes at 203.75 and 201.50 followed by 200 and 199. Consolidation Watching for a Downside Break.

SPY Weekly

Heading into April Options Expiration week the equity markets have stalled in some respects and may be starting to turn back lower. Elsewhere look for gold to continue its reversal higher as crude oil rises. The US Dollar Index looks weak and headed lower while US Treasuries are strong and rising. The Shanghai Composite looks to continue its drift higher as Emerging Markets are starting to turn lower.

Volatility looks to remain subdued keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts show some weakness, especially in the SPY, with the IWM and QQQ a bit strong and consolidating, but no longer rising short term. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.