A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators saw heading into another holiday shortened week, and one that should prove to be very light on everything the equity markets have, with equities rebounding but still looking vulnerable, especially the N:SPY. Elsewhere looked for gold (N:GLD) to consolidate in its downtrend while crude oil(N:USO) continued a bounce in its downtrend. The US dollar index (N:UUP) looked to be weaker short term in consolidation while US Treasuries (N:TLT) consolidated.

The Shanghai Composite (N:ASHR) looked to continue consolidation with an upward bias while Emerging Markets (N:EEM) bounced in their consolidation of the downward move. Volatility (N:VXX) looked to remain subdued keeping the bias higher for the equity index ETFs SPY, N:IWM and O:QQQ. Their charts agreed with that in the short term with the IWM looking the strongest. In the intermediate term the SPY looked weakest while the IWM and QQQ continued the sideways churn.

The week played out with gold probing lower in its consolidation range while the bounce in crude oil stalled and it reversed lower. The US dollar drifted lower while Treasuries met resistance and pulled back. The Shanghai Composite moved sideways in consolidation while Emerging Markets turned back lower in consolidation.

Volatility bounced but stayed in the normal range. The Equity Index ETFs started the week well making a short term higher high, but gave back most or all of the gains as the week and year closed out. What does this mean for the coming week? Lets look at some charts.

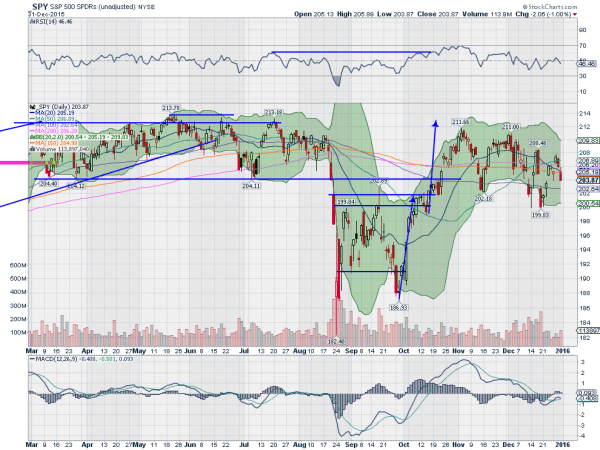

SPY Daily

The SPY started the week confirming a doji from Christmas Eve lower. That was reversed Tuesday though with a push higher, back over the 50 day SMA. Another reversal Wednesday took it back under the 50 day SMA and and put in place another lower high. Thursday saw continuation to the downside ending both the week and the year nearly unchanged. The daily chart shows the Bollinger Bands® have shifted the range lower, with the RSI stuck at the mid line and the MACD rising but also flattening. Out of steam if not rolling over short term.

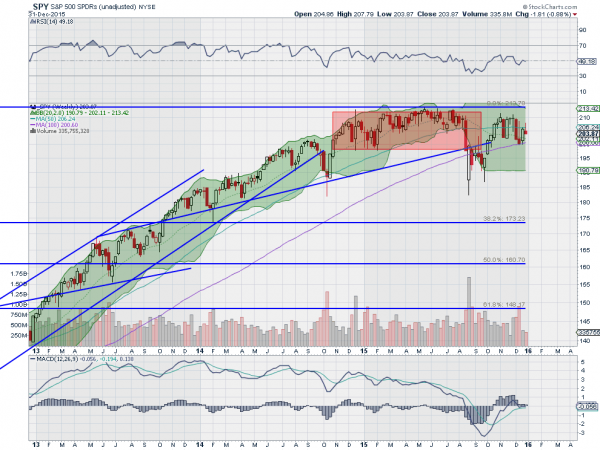

On the weekly chart the doji led to a lower high so far with the RSI also along the mid line and the MACD pulled back, but avoiding a cross down. Not as weak on this timeframe, but no strength either. There is resistance at 206.40 and 208.40 followed by 209 and 210.25. Support lower comes at 204.40 and 203 followed by 201.75 and 200. Short Term Downward Bias in the Long Term Consolidation.

SPY Weekly

As the books close on 2015 and we prep for 2016 the equity markets are showing a lack of strength at best and some weakness short term. Elsewhere look for consolidation to rule the short term. In gold look for consolidation in the downtrend with crude oil also consolidating its move lower. The US dollar index looks to consolidate in the uptrend, while US Treasuries just continue broad consolidation sideways marking time. The Shanghai Composite looks to continue its sideways motion while Emerging Markets are biased to the downside in consolidation.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts look to move into the new year showing further consolidation in the long run but with some weakness in the short run, especially in the SPY. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.