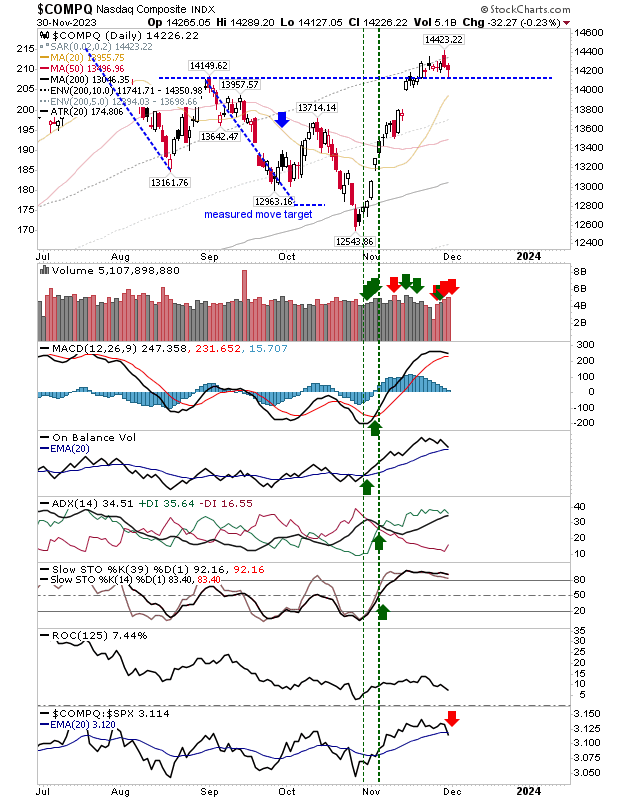

Bulls have managed to retain control of their powerful rally off October lows. Shorts looked ready to attack with the day before yesterday's bearish 'cloud cover' candlestick in the Nasdaq and S&P 500, but yesterday's action has managed to counter that without really changing the larger picture.

If you held index ETFs then the current action would be a decent opportunity to sell covered calls against your position. There may be some pullback, but it's hard to see any selling going all the way back to those October lows.

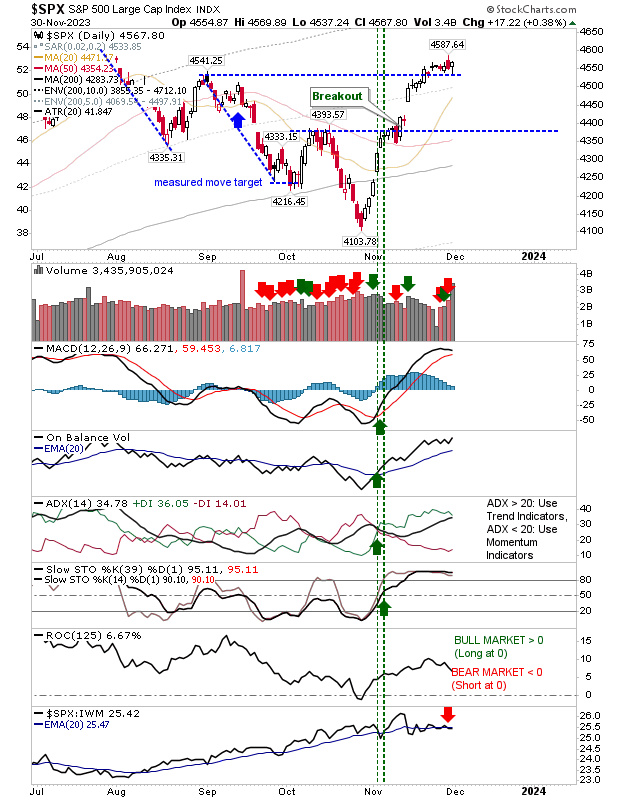

The S&P 500 managed a bullish hammer, although when it occurs in an overbought state it carries little bullish significance, but it does negate the previous day's more bearish candlestick.

The index is in a bit of a struggle in relative performance against the Russell 2000, and given current action I would be looking for an extension in the relative underperformance of this index against Small Caps.

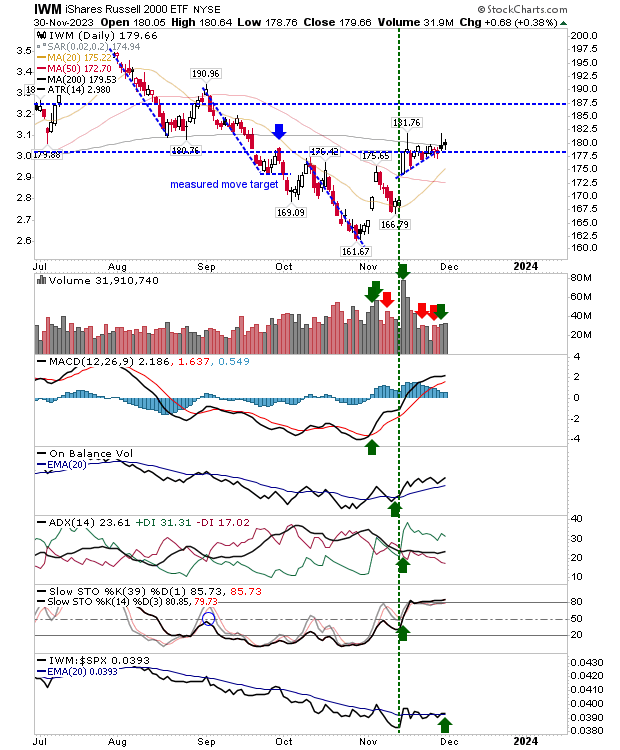

The Russell 2000 (IWM) is in a dice with its 200-day MA. As the price squeeze was only good enough for a failed breakout, I would be looking for some easing in the price action before judging action at 20-day and/or 50-day MAs.

Markets are working through an overbought state that is to be expected after the extended short-term rally we have seen. The longer markets stay at current levels, the smaller any subsequent sell-off is likely to be.