- Michael Wilson predicts a 26% fall in the S&P 500 this year, causing concern in the market.

- Fed's preferred inflation indicator shows higher inflation, and the market expects further interest rate hikes from the Fed and ECB.

- Bullish sentiment is decreasing, and volatility is increasing in the markets.

- The S&P 500 was in the red for 4 consecutive sessions last week, but thanks to Thursday, it did not reach 5 consecutive sessions (and falls of 5 consecutive days can happen in bull markets). Looking back over the last 15 years, there were only two years without a 5-day losing streak: 2014 and 2017. So it is not that rare.

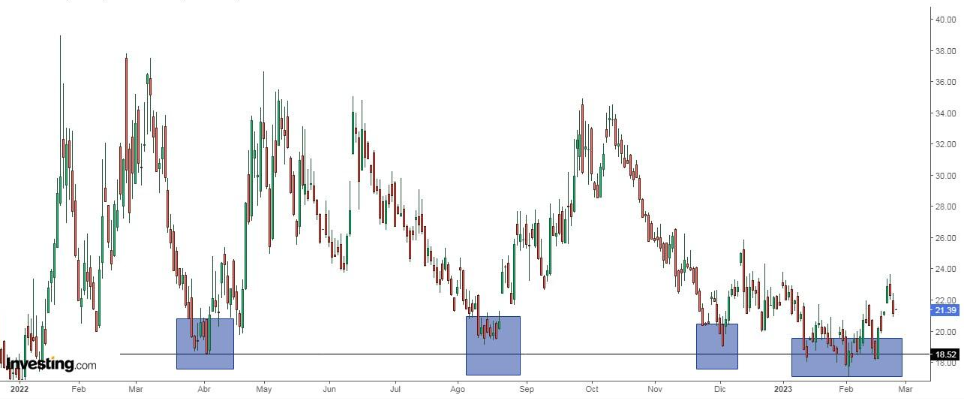

- This week marked the 35th stock market day, 17 of which saw the S&P 500 move 1% or more (up or down). Over the last 70 years, it ranks 5th among the years with the most such days. This brings us to volatility. The CBOE Volatility Index made a bottom in early February and has been rising ever since. This bottom, now a support, has prevented the index from crashing since April 2022.

- Italian FTSE MIB +15.76%

- Spanish IBEX 35 +13.18%

- French CAC 40 +12.72%

- Euro Stoxx 50 +12.06%

- German DAX +10.90%

- Nasdaq 100 +9.41%

- British FTSE 100 +6.66%

- Japanese Nikkei 225 +5.09

- Shanghai Shenzhen CSI 300 +4.45%

- S&P 500 +3.40%

- Dow Jones Industrial Average -1.00%

A few days ago, Michael Wilson, who took first place in last year's Institutional Investors survey when he correctly predicted a massive sell-off in equities, said the S&P 500 could fall by as much as 26% this year. No one has a crystal ball, but his comment has caused quite a stir.

Friday's Personal Consumption Expenditures data is important as it is the Fed's preferred inflation indicator. The market was expecting a monthly rise of 0.4%, but it came in at 0.6% in the end. This will encourage the Fed to continue raising interest rates.

The S&P 500 has shown some weakness in recent days. Firstly, it reached overbought levels on Feb. 2. The last time this happened was in August 2022, which meant a fall from 4325 to 3491 in less than two months. Second, because it is at a key point in relation to its 200-day moving average., it is very close to losing it.

The S&P 500 has recently lost its positive correlation with Bitcoin. For most of 2022, the markets had a good positive correlation. With the exception of the bankruptcy of FTX in November, the last time the correlation was negative was in December 2021.

Investors’ Patience Is Wearing Thin

The average holding period for a US stock is now just ten months, down from 5 years in the 1970s. The average holding period of a mutual fund, at two and a half years, is also too low. Impatience does not help investors' odds. Time generally works in their favor when it comes to investing in the markets.

Admittedly, we have just come out of a complicated 2022, and so far, in 2023, volatility has increased, and the range of daily movements is wide. But in reality, this is not unusual.

The VIX is the 1-month implied volatility, but we also have the VXV, which is the 3-month implied volatility. Normally the VIX is lower than the VXV because the longer the time horizon, the greater the uncertainty, partly because there is a bigger risk of events happening in 3 months than in 1 month, which is logical.

If you divide the VIX by the VXV, you get a number. History shows that when it is more or less around 0.82, the S&P 500 has been bullish most of the time and has ended the year in the green. Interestingly, this February, it went down to 0.82. Of course, this is not science and should not be taken as dogma, it is just another piece of data.

Fed, ECB, and BOJ Interest Rates

The market is adjusting its expectations for interest rate rises by the European Central Bank and the US Federal Reserve. In the case of the European Central Bank, interest rate futures are pointing to a rise to the highest level in its history at +3.75%, which last happened in 2000. It could raise rates by 50 basis points at its meeting in March.

For the Federal Reserve, futures point to a hike to 5.33% by September. Wall Street expects the Fed to raise rates by 25 basis points each at its next two meetings in March and May.

Turning to the Bank of Japan, new Governor Kazuo Ueda said on Friday that the bank must keep interest rates ultra-low to support the fragile economy. This comes as a bit of a shock, as much of the market saw this appointment as a prelude to a change in monetary policy. However, all indications are that this will not be the case.

Ueda will chair his first policy meeting on Apr. 27 and 28, when the BOJ will release its new inflation projections.

Investor Sentiment (AAII)

Bullish sentiment, or expectations that stock prices will rise in the next six months, fell 3.4 percentage points to 34.1%. Optimism is back below its historical average of 37.5%. Bearish sentiment, or expectations that stock prices will fall in the next six months, rose by 3.8 points to 28.8%.

The year-to-date performance-based rankings of the main European and US stock exchanges are as follows:

Disclosure: The author does not own any of the securities mentioned.