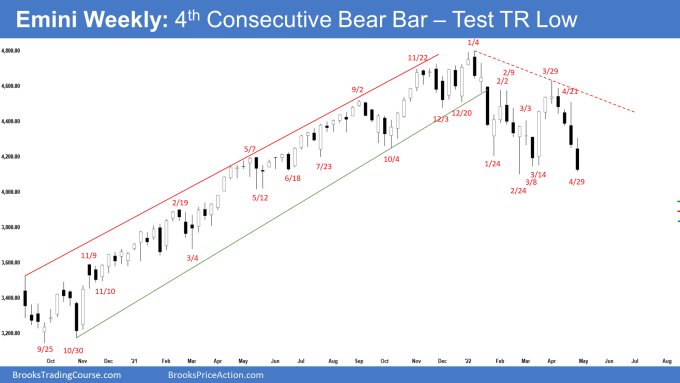

The S&P 500 E-mini futures has 4 consecutive bear bars closing near the low on the weekly chart, testing 20-month EMA and February low. The bears need a couple of closes below the February low on the weekly chart to convince traders that a deeper correction may be underway. Bulls hope that this is simply a sell vacuum test of the trading range low.

The monthly candlestick is forming the second leg down from the January top. The E-mini is in a 9-month trading range. While odds slightly favor a test below February low, breakouts from trading ranges fail 50% of the time.

S&P500 E-mini futures

- The April monthly E-mini candlestick was a big bear bar closing near the low. It closed below March low triggering the Low 2 short entry.

- In our last report, we said that the bulls need to close April as another follow-through bar to increase the odds of testing the January high, while the bears hope March was simply a pullback from the 2-months correction and want a reversal lower from a lower high or a double top with January high.

- Bears got the reversal lower from a lower high and closed near the low. April’s candlestick had the largest bear body since the Covid-19 crash.

- Since April closed near the low, it is a good sell signal bar for May. It may even gap down at the open. However, small gaps usually close early. Odds are, the E-mini will trade below February’s low in May.

- Bears will need a bear follow-through bar in May to convince traders that a deeper sell-off may be underway.

- Bears see this as the second leg down from the January top. They want a measured move down to 3600 based on the height of the 9-month trading range height.

- The bulls hope that this is simply a sell vacuum test of the trading range low and want any breakout below the trading range low to fail and reverse back up.

- However, April was a big bear bar closing near the low. It is a weak buy signal bar for a strong reversal up.

- The E-mini has been in a 9-month trading range. Traders will likely BLSH (Buy Low, Sell High) until there is a strong breakout from either direction.

- While the E-mini may test below the 9-month trading range, breakouts from a trading range have a 50% chance of failing.

- Odds slightly favor the E-mini to trade at least slightly lower in May. The bulls want May to reverse higher from a failed breakout below the trading range.

- Al has said that the February low did not quite reach the 20-month Exponential Moving Average (EMA). Many traders would conclude that the average was not yet tested which increased the chance of the E-mini going sideways to down until there is a low at least minimally below that average. That is one of the forces behind the current selloff.

- The E-mini tested the 20-month EMA on the last trading day of April.

- The last 3 to 4 bars are overlapping, alternating between bull and bear bars. That is a tight trading range.

- Al also said that the bull trend on the monthly chart has been very strong to make a bear trend on the monthly chart unlikely. This selloff should be a minor reversal on the monthly chart, which means the selloff will probably not go much below 3800, if it gets that far.

- The bears would have a better chance of a bear trend on the monthly chart after a test of the all-time high. Al has said many times that the E-mini should enter a trading range for about a decade within the next few years, but picking the exact high is impossible.

- It is always better to bet on at least one more new high. The trading range will probably have at least a couple of 30 – 50% corrections, like the trading ranges in the 2000s and the 1970s.

- For now, odds slightly favor May to trade at least slightly lower.

- Traders will be monitoring whether May closes as a bear follow-through bar or reverses up from a failed breakout below the trading range low, to close as a bull bar.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

- This week’s E-mini candlestick was a big bear bar closing near the low with a long tail above. It closed below March low and is testing the February low.

- Last week, we said that a failed failure increases the odds of at least slightly lower prices. If the bears get another bear bar, especially if it is big and closes near the low, the odds of testing the February low increase significantly.

- The bears got the 4th consecutive bear bar this week which represents follow-through selling. There have not been 4 consecutive bear bars since the Covid crash.

- The bears want a strong break below the February 24 low which is the neckline of the double top bear flag and a measured move down towards 3600 based on the height of the 9-month trading range.

- Since this week was a big bear bar closing near the low, odds favor at least slightly lower prices next week. It may even gap down at the open. If the gap is small, it should close early.

- The bulls hope that this is simply a sell vacuum to test the February low.

- However, 4 consecutive bear bars closing near the low means persistent selling. Since this week was a big bear bar closing near the low, it is a weak buy signal bar for a strong reversal up.

- The bulls will need a strong reversal bar or at least a micro double bottom with follow-through buying before they would be willing to buy aggressively from a double bottom major trend reversal pattern with February low.

- The bulls hope next week will be a bull reversal bar closing at the high, even if it trades lower first earlier in the week.

- Al said that the E-mini has been oscillating around 4,400 for 9 months. That price might well end up being the middle of the trading range. Since the top of the range is about 400 points higher, the bottom could be 400 points lower. That is below the February low and around the 4,000 Big Round Number.

- If it gets there, traders will then wonder if the E-mini might fall for a measured move down from the February/March double top. That would fill the gap above the March 2021 high on the monthly chart.

- The E-mini is currently trading at the bottom of the 9-month trading range. Trading ranges tend to disappoint both the bulls & bears and have poor follow-through. Traders will BLSH (Buy Low Sell High) and scalp.

- However, the bears are starting to get consecutive big bear bars closing near the low. It increases the chance of a downside breakout.

- If the bears get a couple of closes below the February low, odds of a breakout and a measured move would increase.

- Since this week was a big bear bar closing near the low, it is a good sell signal bar for next week.

- It may even gap down at the open. However, small gaps usually close early.

- Odds favor at least slightly lower prices next week and a breakout attempt below the 9-month trading range low.

- Traders will be monitoring whether the bears get another bear bar closing below the February low or next week trades lower, but reverses to close as a bull reversal bar.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.