For readers, new and returning, allow me to refresh your memory. Since Mid-October last year, see here; we were starting to look for the possibility of a multi-month rally. Here’s what we found back then:

“If the S&P 500 manages to rally above that level [SPX3886.75], without dropping below last week’s low first, then the index completed five waves lower from the mid-August high. … We will then look for a multi-month rally to the SPX 4350-4650 target zone.”

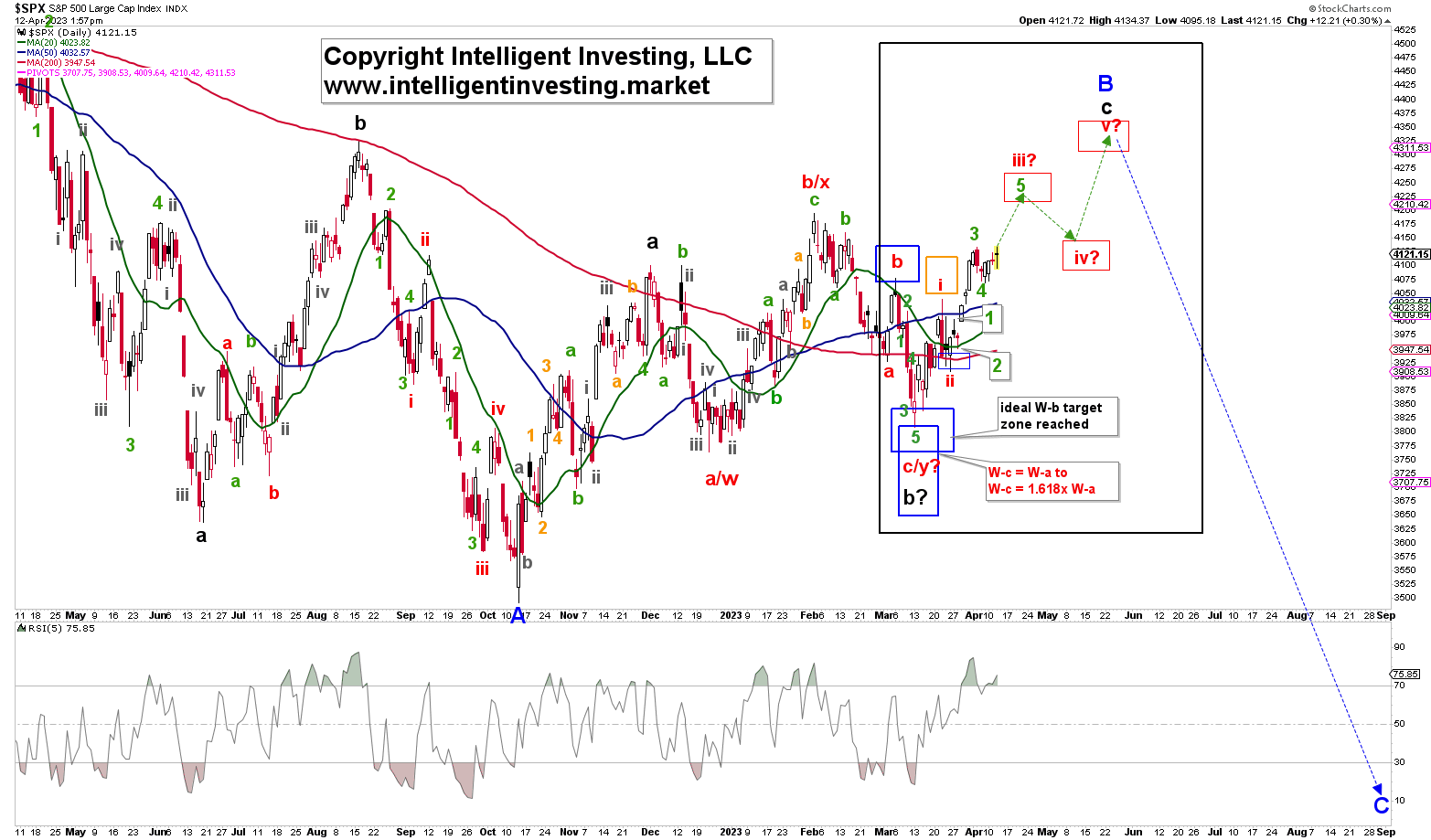

Please note this “multi-month rally” is a countertrend rally. In Elliott Wave Principle (EWP) terms a B-wave. In this case, the blue W-B is shown in Figure 1 below. B-waves always comprise three overlapping waves. In this case black W-a, -b, and -c. Because of the overlapping nature of B-waves, the hallmark of a countertrend, i.e., many more unexpected twists and turns than during an impulse pattern, the advance from the October 13 low has not been the easiest to anticipate. But when we know, understand, and accept the market environment we are dealing with, we can trade accordingly and still profit appropriately. Hence, our (members) portfolio is up >20% YTD.

Figure 1.

Closer to home, we focus on the price action since the March 13 low (larger black box). Note the blue boxes were the well-in-advance forecasted target zones, which have all been reached. The index should now be in green W-5 of red W-iii? of black W-c of blue W-B. That is quite the sequence, but it is essential to understand where we are in this countertrend rally. Because once it is complete, blue W-C will take hold and wreak havoc among most market participants as it gathers steams toward the SPX2500 region.

Thus, our primary expectation remains for higher prices in the $4300+ region, as anticipated in October last year. Shorter-term, and as I recently Tweeted:

“Thus, as long as today’s low [SPX4095] holds, and especially SPX 4070, we must allow for higher prices per the green path.”

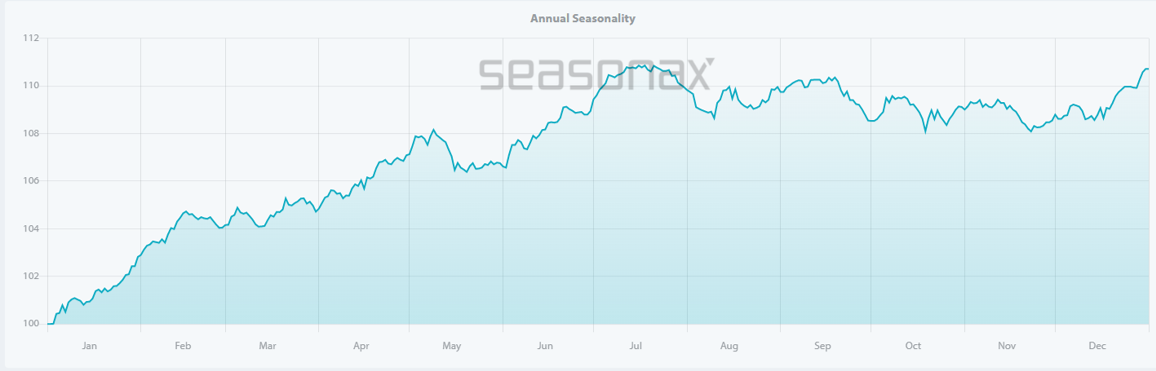

Our bullish outlook for the next several weeks to months is also based on two additional layers of information. The first is the index’s average price action during US Presidential pre-election years. See Figure 2 below. It is still only an average and should not be used as the can-all-do-all magic tool, but it is based on 95 years-long data records, of which 23 were pre-election years. And thus, it should be respected.

Figure 2.

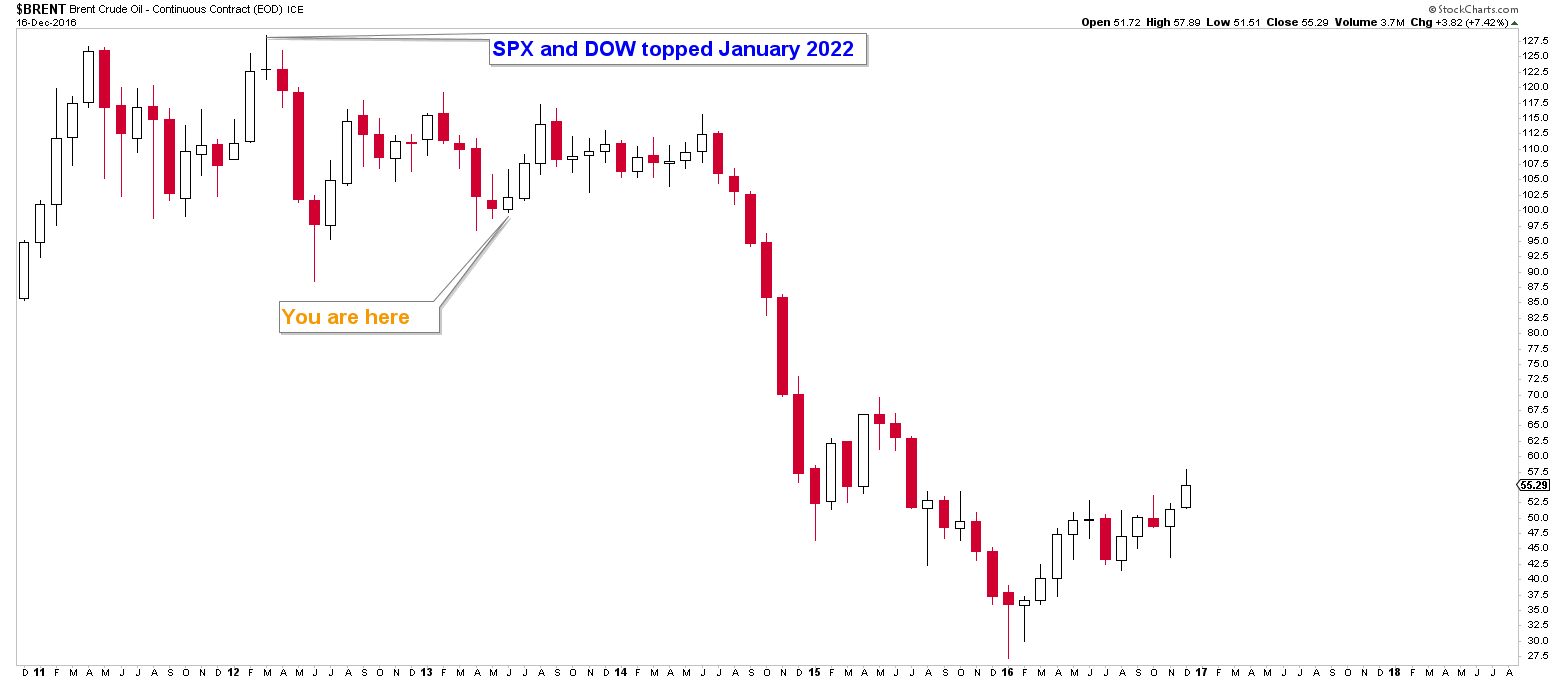

The second is the 10-year-delay relationship between Crude Oil and Dow Jones Industrial Average, discovered by Tom McClellan. See here and Figure 3 below. This relationship has worked very well over the past 120 years, and although it is not an exact timing tool, it tells us the most likely path ahead. In this case, it will be a rough path as Crude Oil’s echo from 2013 tells us to expect a market top around June-August this year, plus/minus a few months. After that, well Figure 3 tells the story. Please note, for both seasonality and the Crude Oil-Dow Jones relationship; it is not about the magnitudes of the moves but about the direction of them.

Figure 3.

Thus, combining our preferred EWP count with average pre-election year seasonality and the Crude Oil-Dow Jones 10 year-lag relationship provides us with a well-balanced weight of the evidence approach telling us to expect higher prices over the next several weeks to months before much worse is to be expected. Forewarned is forearmed.