Recession winds are blowing, and the next major gust could push silver over the edge.

While silver has benefited from the Middle East conflict, history shows the white metal can’t escape the ominous fundamentals of higher real yields, a stronger USD Index, and panic selling that occurs during recessions.

Furthermore, with economic pain hiding in plain sight, the crowds’ belief that higher long-term rates don’t matter should end in tears. For example, the National Association of Homebuilders (NAHB) released its Housing Market Index (HMI) on Oct. 17. The report stated:

“Stubbornly high mortgage rates that have climbed to a 23-year high and have remained above 7% for the past two months continue to take a heavy toll on builder confidence, as sentiment levels have dropped to the lowest point since January 2023.”

Please see below:

To explain, the black line above tracks the HMI, while the blue line above tracks the inverted (down means up) US 30-year mortgage rate. If you analyze the right side of the chart, you can see the latter implies more downside for the former.

Likewise, the U.S. 30-year Treasury yield closed at a new cycle high on Oct. 19, which means the mortgage rate is even higher now. Consequently, the pain confronting the U.S. housing market should spread to other areas of the economy, and gold could sell off when the crowd realizes the ramifications.

Labor Concerns

While U.S. unemployment claims sunk below 200,000 on Oct. 19, the labor market is weaker than it appears. LinkedIn has cut nearly 1,400 positions in 2023, and another round of layoffs was announced on Oct. 17.

Please see below:

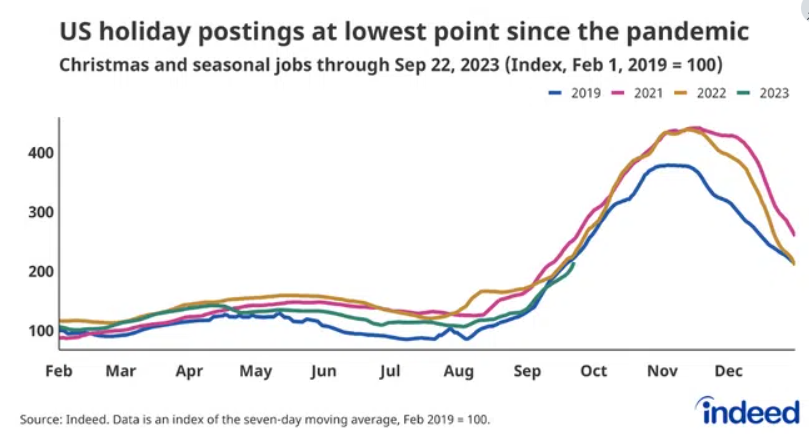

Similarly, Indeed noted on Oct. 2 that the Christmas rush is nothing like 2021 and 2022, as “there are fewer [seasonal] jobs available this year than in years past, and less urgency to fill those that are available.” The report added:

“For the first time in the post-pandemic era, the number of seasonal/holiday job postings on Indeed has fallen below pre-pandemic levels. As of late September, seasonal job postings were down 3% from the same time in 2019, and 6% below levels from the same period a year ago.”

Please see below:

To explain, the pink and brown lines above are higher than the blue line, which means that seasonal job postings outperformed in 2021 and 2022 relative to 2019. As a result, the data highlights why we faded the recession narratives back then, as employee demand was bullish for wage inflation and consumption.

In contrast, the green line above is below the blue line, which means that 2023’s postings are weaker than 2019, and this is bearish for wage inflation and consumption. Similarly, the rapid rate rise should lead to further weakness in the months ahead, and the USD Index should benefit from the volatility.

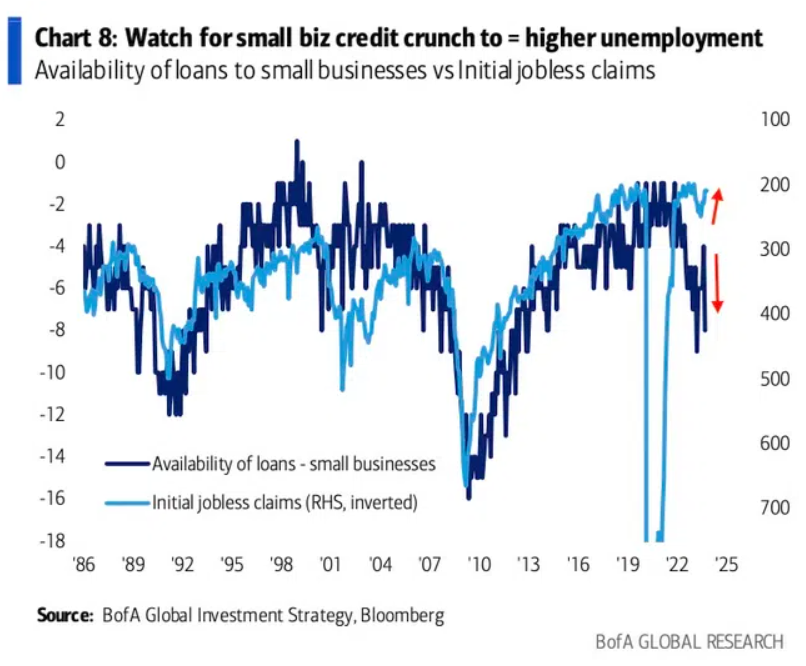

As another warning sign, Bank of America found that unemployment claims may look much worse in the months ahead.

Please see below:

To explain, the dark blue line above tracks the availability of loans to small businesses, while the light blue line above tracks the inverted (down means up) initial jobless claims. If you analyze the relationship, you can see that unemployment claims often rise when banks stop lending to smaller firms. And with the two lines diverging on the right side of the chart, it’s likely only a matter of time before jobless claims, and economically-sensitive assets like crude oil, bear the brunt of higher interest rates.

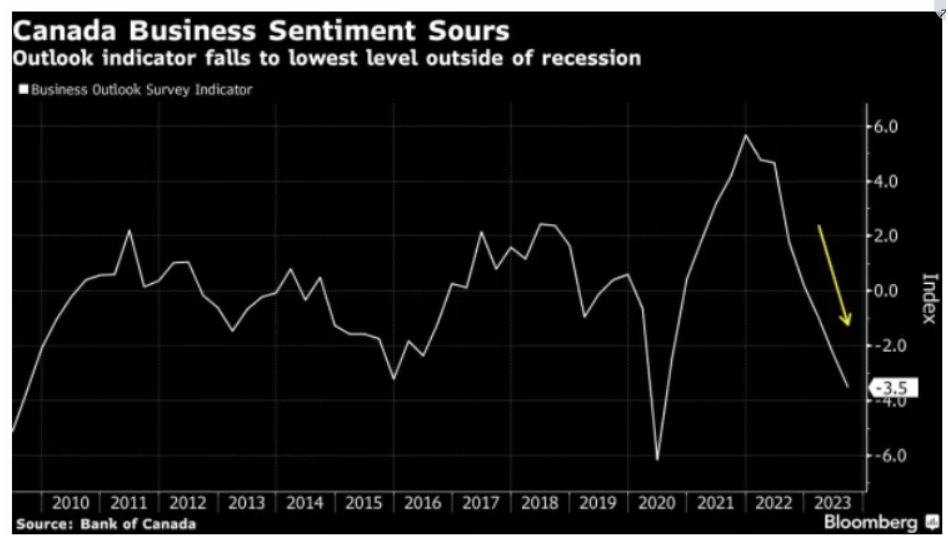

Finally, The Bank of Canada (BOC) revealed on Oct. 16 that Canadian business sentiment suffered its seventh consecutive quarterly decline and is gunning for its 2020 lows. And with Canada sending the bulk of its exports to the U.S., a slowdown is bad news for America.

Overall, the crowds’ 2023 belief that long-term rates can rise indefinitely without any carnage is like their 2021 belief that inflation is transitory. In reality, plenty of pain is present, and the current fundamental backdrop is nothing like 2021 or 2022, in our opinion. As a result, the S&P 500 should come under heavy pressure in the months ahead, and the PMs are unlikely to sidestep the volatility.