U.S. economy grew 4.3% in the third quarter, crushing estimates

Seagate Technology plc (NASDAQ:STX) recently entered into a partnership with Tape Ark in a bid to migrate legacy tape-archived data to strong and secure cloud platform.

In this regard, robust data management capabilities of Lyve Data Services of Seagate will complement data restoration technology of Tape Ark.

The evolution of data storage mediums have been shaped by its drive to increase the longevity of data and making it seamlessly accessible to future generations.

Data is touted to be the new oil driving digital transformation. However, data trapped in traditional storage devices, including tapes, is not easily accessible, making the immense business value it holds, redundant.

Notably, per Tape Ark estimates, legacy data in tapes, exceeding 1 billion units, stored in offsite physical backup are at risk of permanent loss. In an attempt to solve inaccessibility and data loss, both Seagate and Tape Ark have teamed up to “liberate” the tape-restricted data by transferring it to the cloud.

The new edge solutions of Seagate leveraging Tape Ark’s tech are anticipated to provide customers with a cost effective and environment friendly solution paving the way for higher productivity.

The decades-old data, once mobilized to secure, robust and market leading public cloud platforms including the likes of Amazon’s (NASDAQ:AMZN) Amazon Web Services, Microsoft’s (NASDAQ:MSFT) Azure, Alphabet’s (NASDAQ:GOOGL) Google, will enable the enterprises to seamlessly access it and unlock valuable business insights.

The aim to provide industries with seamless access to larger data set is expected to lead to robust intelligent systems. In the words of chief executive officerand founder of Tape Ark, Guy Holmes, “Ingesting these data sets into the cloud puts them back in control of their data assets and potentially turns an inaccessible, decaying cost center into a valuable revenue stream.”

With advanced artificial intelligence (“AI”), machine learning (“ML”) and analytics tools, the industries can benefit from meaningful research insights and financial planning mechanisms. As a result, majority of industries, comprising healthcare, space and environmental sciences education and research, utility, mining, agriculture, media, finance, technology, among others stand to benefit from the new deal.

Notably, per recent IDC estimates, the global datasphere will grow to 175 zettabytes (that is a trillion gigabytes) by 2025, from 33 zettabytes in 2018. This exponential growth is expected to favor the adoption of Seagate’s new hardware solutions.

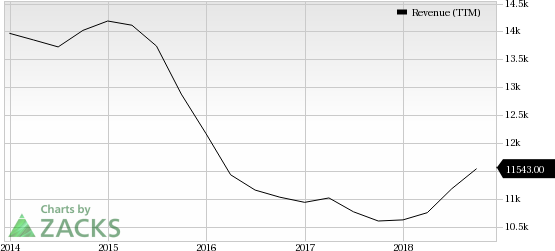

New Alliance to Aid Top Line

Anticipating a potential acceleration in cloud deployments (due to exponential growth in data storage in the cloud), Seagate is investing heavily in order to deliver high-capacity storage devices that would support expansion of cloud infrastructure and cloud applications.

Moreover, increasing traction for mass storage solutions across the company’s edge and enterprise markets is a tailwind. Notably, total hard disk drive ("HDD") revenues went up 17% year over year to $2.801 billion during the first quarter of fiscal 2019 primarily due to advancement and accelerated growth of cloud storage technologies.

Seagate anticipates cloud-based solutions to drive revenue growth in the near term. For fiscal 2019, the company anticipates solid capacity demand, robust exabyte growth in its edge markets and seasonal strength in other markets to boost the top line. The company’s expectations stems from the fact that IDC expects 49% of the 175 ZB data produced to be stored in public cloud environments in 2025.

Furthermore, the shift of focus toward higher-margin enterprise business is anticipated to reduce the company’s dependence on the PC market.

Risks Remain

Sluggish macroeconomic conditions, flattish price environment, and stiff competition, primarily from Western Digital (NASDAQ:WDC) remain near-term headwinds.

Zacks Rank

Seagate carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Seagate Technology PLC (STX): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research