The most recent report reiterated the warning that investors would be wise to exit equities, hedge or short at some level BELOW Dow 30,000.

As with the other recent reports, it was explained how the Wall Street pros cover shorts to attract buyers ahead of a hyped-up number that they are themselves using to go short or liquidate long books.

The remainder of the recent articles also harped on the need to use the move to UNDER 30,000 to get out, while underscoring the best strategies to employ, which are updated below.

The articles above were also instructive regarding the importance of ignoring the virus scare as if it were the cause for the market decline, including the historical nature of such market phenomena vis-à-vis headline stories. If one did not engage in the most recent report’s advised mini-study, I certainly reiterate this recommendation as well, so that investors know how to avoid getting trapped by orchestrated volatile bear market rallies.

Dow (U.S. equity market proxy) analysis and strategy:

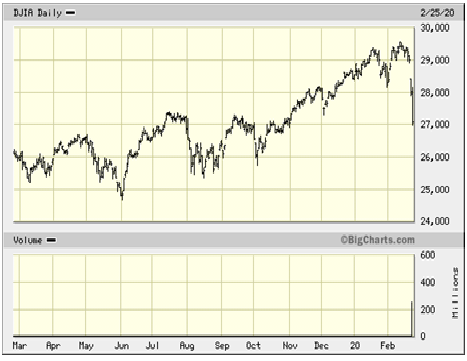

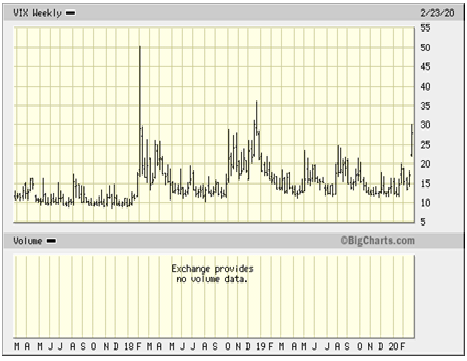

The 1-year Dow chart below illustrates the index’s sub-30,000 all-time-high, along with its ~8% smash. The 3-year VIX chart shows that option time premiums have come unto a critical resistance level. That level suggests that it is no time to be greedy, and this conclusion is consistent with how I view the market’s own pattern.

I believe that it is wise to exit Dow put strategies on any new low. This includes the opening 15 minutes of market trading, if the Dow does not gap higher based on an intra-day short-covering rally that would actually begin at the open.

In combination, these 2 charts tell us that PEAK put time premiums have been seen, even though new market lows should occur by ~March 1.

Recent reports have advised the development and use of put combinations (long and short contracts coupled with a rules-based approach) that could provide 65-95% profits while offering positive results following a bullish quarter. Such strategies should avoid reinvestment at VIX levels that are deemed to be too high, so as to not reenter such a strategy at prices that are prohibitive.

For these reasons, correlated study of the Dow and VIX suggest that one may exit on a new market low Wednesday, given that the index has already declined ~ 8%.

Summarizing the above further, the ideal reentry into the hedge strategy should occur ~March 1st, based on the anticipated lower level of the VIX, despite any new lows in the market.

Remember that the recommended put combination program is a hedging and income strategy, and not one that aims to act at, or be dependent upon, index highs or lows for the strategy’s implementation.

CONCLUSION

Given the dramatic spike in the VIX, a properly constructed put combination income-generating market hedge should be enjoying dramatic double-digit profits from the quarter’s beginning at January 1st, so exiting the strategy at these market and VIX (time premium) levels makes sense.

Silver (SLV) analysis and strategy:

Particularly given their momentum indicators, yesterday’s action in gold and silver struck me as short term blow-offs, which would likely portend an impending stock market bottom.

My views on the stock market appear above, and the 1-year SLV chart below illustrates yesterday’s high and the sharp reversal that followed Tuesday.

Yesterday’s “tree-shaking” will get rid of the weak hands who bought into silver as a cheap gold play (the retailer’s attitude), though silver’s bottom should be achieved by Monday at levels that will likely not be much, or at all, lower than whatever low silver’s price registers Wednesday.

CONCLUSION

Based on past experience, I believe that the majority of silver’s price correction is already over, with the coming four trading sessions mostly serving to batter call premiums (VXSLV). Once the weak hands have fallen out of the tree, silver should be ready to advance again.

There is no change to the strategies that have appeared in the recent reports.