- Nvidia stock has skyrocketed and is highly overvalued now

- So, buying it now is very risky, and you should consider other chipmakers instead

- According to InvestingPro, for those looking to invest in chipmaker stocks, Qualcomm fits the bill perfectly

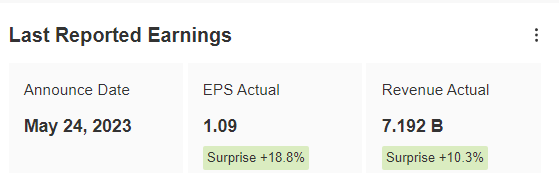

The semiconductor industry has garnered significant attention due to the surge in demand for artificial intelligence (AI) technologies. On Wednesday evening, NVIDIA (NASDAQ:NVDA) unveiled its first-quarter earnings, further fueling the already heightened excitement surrounding the sector.

Exceeding market expectations, the company's impressive profits and sales triggered a remarkable stock rally of nearly 25%.

Source: InvestingPro

EPS came in at $1.09, 18.8% higher than the 0.92 expected, while revenues reached $7.1 billion, a positive surprise of 10.3% versus consensus. In addition, the Santa Clara, California-based chipmaker reported optimistic forecasts, thanks in large part to the positive outlook for AI.

Artificial Intelligence relies on the use of super-powered computing components, a field in which Nvidia is currently the world leader. The problem, from an investor's point of view, is that it's perhaps a little too obvious that Nvidia will be one of the biggest beneficiaries of AI's widespread use.

Investors have been flocking to the stock since the start of the year. The stock has clocked a phenomenal 160% gain since the start of 2023, raising concerns that its potential has been exhausted, at least for now. And now, they may be wondering which chip stock to consider now that Nvidia's valuation has become too risky.

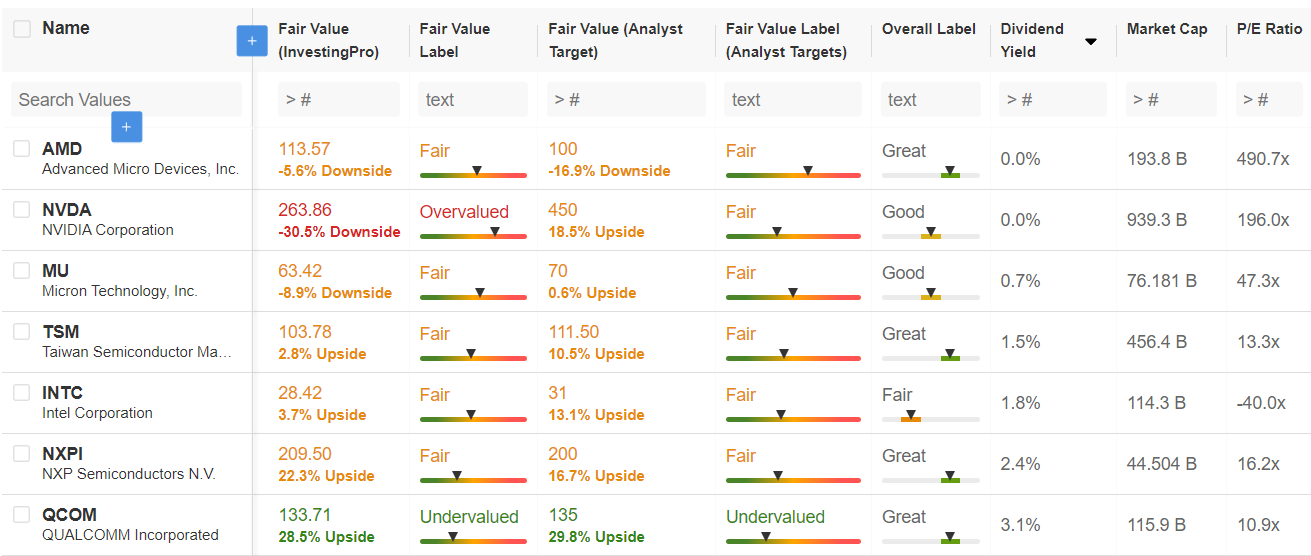

To answer these questions, we turned to the InvestingPro tool to compare the leading chip stocks listed in the US. Specifically, we gathered 7 of the most important US chip stocks into an advanced Watchlist.

In addition to Nvidia, we have included its main competitor Advanced Micro Devices (NASDAQ:AMD), Intel (NASDAQ:INTC), and Taiwan Semiconductor Manufacturing (NYSE:TSM), as well as smaller companies such as Micron (NASDAQ:MU), NXP Semiconductors NV (NASDAQ:NXPI) and Qualcomm (NASDAQ:QCOM).

Source: InvestingPro

Based on the data from InvestingPro, it appears that Nvidia's stock is currently valued very highly, with a P/E ratio of 196. While this is lower than AMD's P/E ratio, it is still much higher than the average for the sector.

What's more, we can see that Nvidia's InvestingPro Fair Value, which uses several recognized financial models to determine a fair value for any stock, stands at $263.86, which translates into a downside risk of 30.5% from the current price.

As for other stocks, AMD, Micron, Intel, NXP, and Taiwan Semiconductor are fairly valued according to InvestingPro, with limited upside potential or negative according to the InvestingPro Fair Value models and average analyst targets.

Only one stock on this list is therefore considered undervalued by the InvestingPro models: Qualcomm, which is the only stock on this list considered undervalued by analysts, and which shows the greatest bullish potential not only according to InvestingPro Fair Value but also according to analysts. Finally, Qualcomm is also the stock on this list with the lowest P/E ratio.

Qualcomm: Unfairly Criticized?

A quick glance at the daily chart of Qualcomm shares doesn't exactly give us much incentive to invest. Since its all-time high of over $193.58 in January 2022, the stock has been in a powerful downtrend.

Source: Investing.com

In particular, the stock bottomed out at $101.58 on Wednesday, a threshold not touched since July 2020.

It's also interesting to note that the latest results seem to have unfairly and heavily punished the company. On May 3, the company published EPS that was marginally below consensus and sales that exceeded expectations by 1.7%.

Yet the share plunged by over 8% the following day and then continued to fall, suggesting that the valuation may now be attractive for a buy.

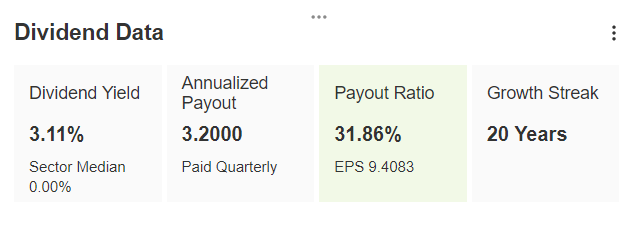

Dividends: Another Reason to Consider Qualcomm

One notable perk of owning this stock is its dividend payout.

Source: InvestingPro

With a yield of 3.11%, Qualcomm's dividend is one of the highest among chip stocks.

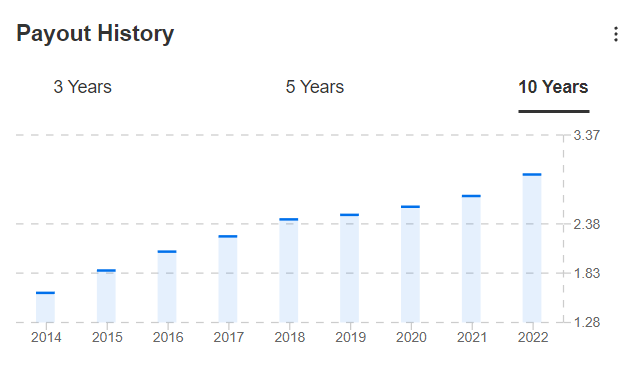

Source: InvestingPro

According to InvestingPro data, the dividend has been consistently increasing for the past 20 years and there are no indications of this trend slowing down.

Solid Financial Health

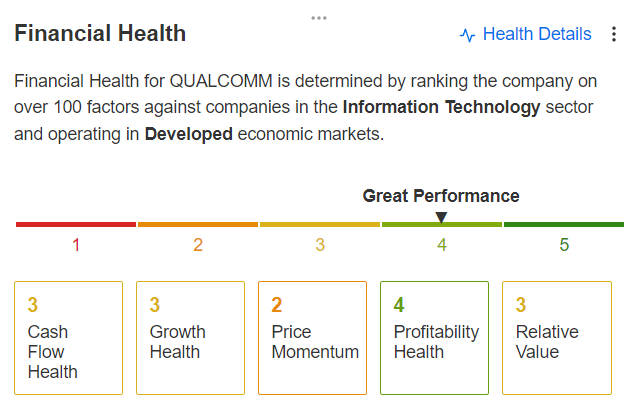

Finally, it's reassuring to note that Qualcomm's financial health ratings are solid.

Source: InvestingPro

According to InvestingPro's financial health ratings, Qualcomm's financial performance is rated 4 out of 5.

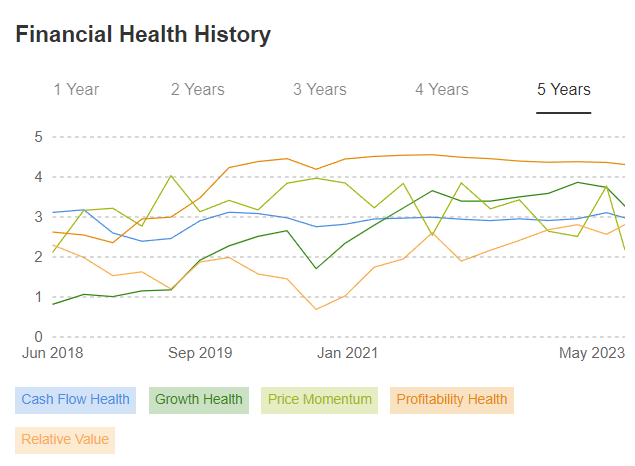

Source: InvestingPro

On top of that, the San Diego, California-based chipmaker's financial health ratings trend has been positive in recent years.

Conclusion

Although Nvidia is an attractive name amid the AI buzz, it is probably not an ideal time to buy the stock, as it is overvalued. However, this doesn't mean that all chip stocks should be shunned.

Our analysis has revealed that there are several companies to consider buying right now, such as Qualcomm, that have a lot of room to rally based on current valuations.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remain with the investor.