For last year’s gold and silver outlook, I wrote,

“Perhaps our biggest callout for a major rally in 2023 is in gold.”

Here we are over $2000 and although gold has not doubled in price, it did rise by 25%.

For 2024, we stay with our call for higher gold prices. I am looking for a move to $2400 provided gold continues to hold $1980.

That statement was from December 1.

Adding to that statement:

Trends for 2024: gold and silver start their last hurrah

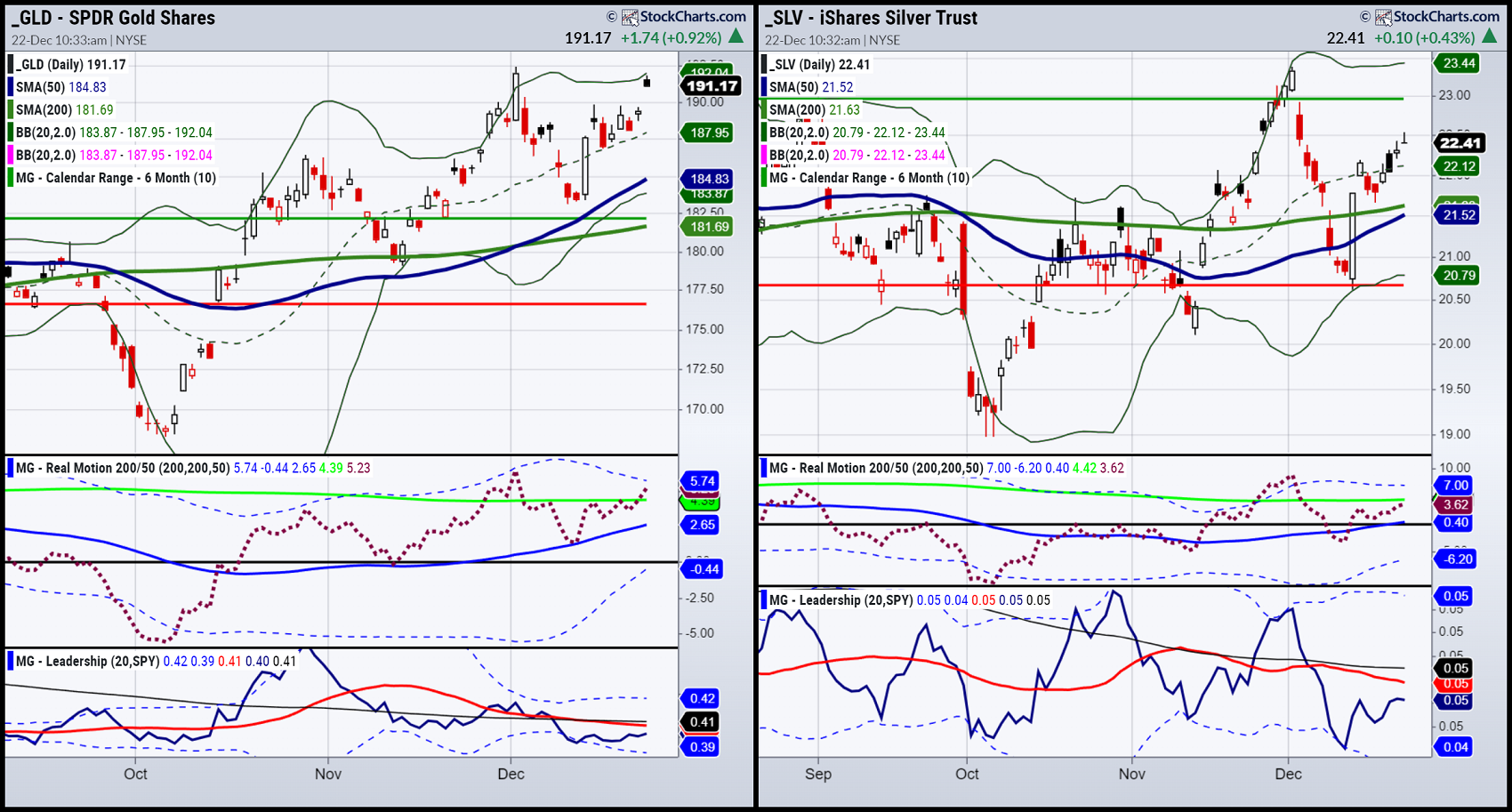

The look of the daily charts in both gold and silver show even more potential in silver for the coming year.

Gold has hit resistance and remains an underperformer to SPY.

Gold sits still at the highs like a quiet blanket of safety.

Silver has yet to hit resistance.

If it can take out 23.40, we see no reason why $27-30 is not attainable.

ETF Summary

- S&P 500 (SPY) 480 all-time highs 465 underlying support

- Russell 2000 (IWM) 200 pivotal and 194 support

- Dow (DIA) Needs to hold 370

- Nasdaq (QQQ) 410 resistance with support at 395

- Regional banks (KRE) 47 support 55 resistance

- Semiconductors (SMH) 174 pivotal support to hold this month

- Transportation (IYT) Needs to hold 250

- Biotechnology (IBB) 130 pivotal support

- Retail (XRT) The longer this stays over 70.00 the better!