Trump sends out tariff letters, extends levy deadline - what’s moving markets

- Nike's Q4 earnings showed a slight miss in EPS estimates but exceeded revenue estimates, driven by direct-to-consumer growth.

- The report signals significant headwinds for the US economy, including rising expenses and shrinking margins.

- These factors may impact upcoming earnings for retailers and manufacturers.

For those overly optimistic about the US economic prospects for H2, I suggest revisiting Nike's (NYSE:NKE) fiscal Q4 earnings from last Thursday.

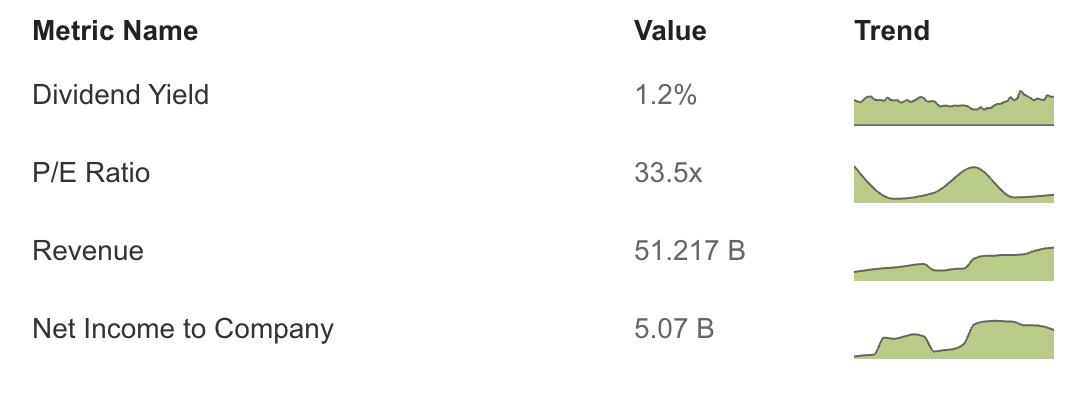

Not that the world’s largest athletic apparel company had a terrible quarter. In fact, it slightly missed EPS estimates by 0.20% but exceeded revenue estimates by 1.69% — driven by gains in its growing direct-to-consumer division. This led some analysts to have a bullish outlook on the sporting-apparel company, despite a 2.35% drop in share price after the earnings report.

However, Nike’s Q4 '23 earnings report makes it evident that the US economy is facing significant headwinds, which contrasts with the positive GDP figures released on that same Thursday morning.

With increasing inventories, rising expenses related to product inputs, freight, and logistics, augmented markdowns, and persistent adverse fluctuations in net foreign currency exchange rates, margins are shrinking both on the input and output sides.

Considering that most factors impacting Nike’s margins are external in nature, it would be surprising if similar issues did not affect upcoming earnings from retailers and manufacturers.

Given that consumer spending accounts for 68.4% of the US GDP, a broader margin compression in such industries could have a substantial snowball effect on the economy, potentially jumpstarting the long-awaited economic slowdown.

Nike’s CEO John Donahoe said on the company’s post-earnings call that the “right focus and attention for Nike is to focus on recovering a higher level of full price growth in the fiscal year 2024, profitable growth” — thus, implying further pain is expected in 2023.

Unsurprisingly, InvestingPro expects Nike’s earnings to take a nearly 40% dive in its next earnings report — expected for next September.

Source: InvestingPro

While I believe that a doomsday scenario remains unlikely for the broader US economy, the current market’s future pricing is increasingly worrisome, and traders are advised to manage risks accordingly.

This backdrop raises two questions, which I’ll aim to answer in the following sections:

- What does Nike’s earnings signal for the broader economy?

- Is Nike actually a buy for 2024?

Let’s use our InvestingPro tool to delve deeper into Nike’s earnings and address these questions. Readers can do the same research for virtually every company globally with InvestingPro. Sign up for a free week now!

Nike’s Results in a Nutshell

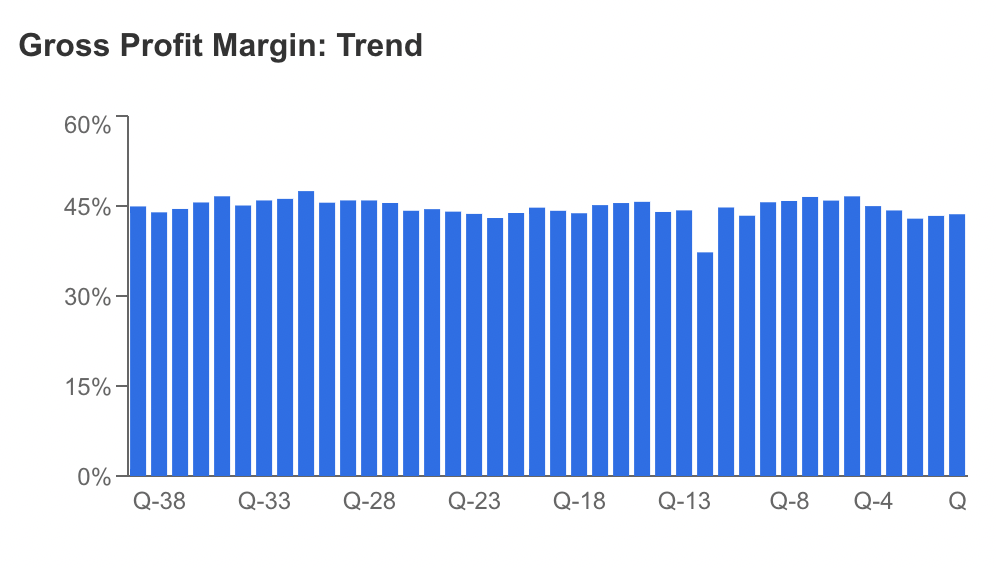

Nike’s gross profit margin decreased by 140 basis points, settling at 43.6%, which is marginally below the historical average. Source: InvestingPro

Source: InvestingPro

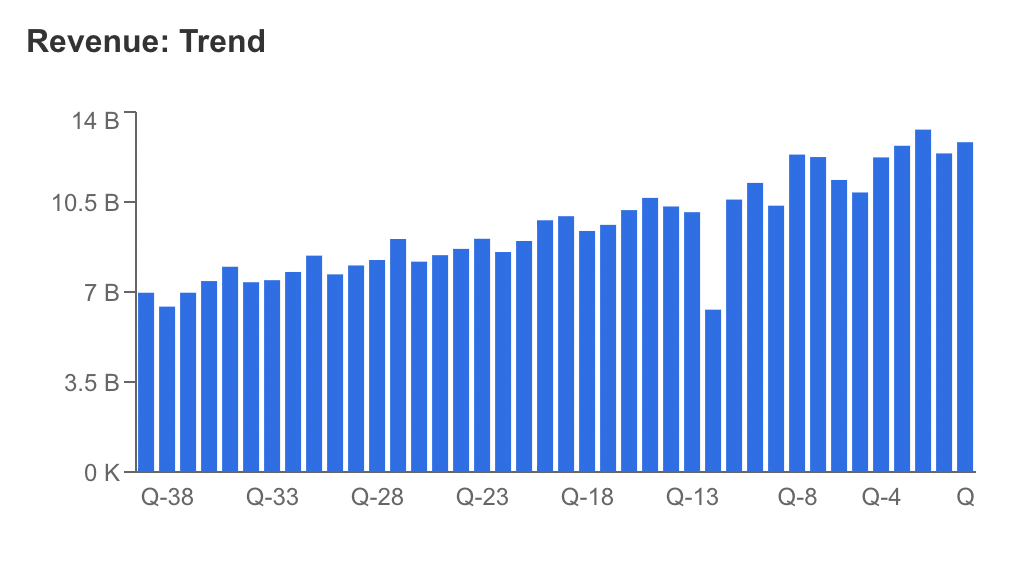

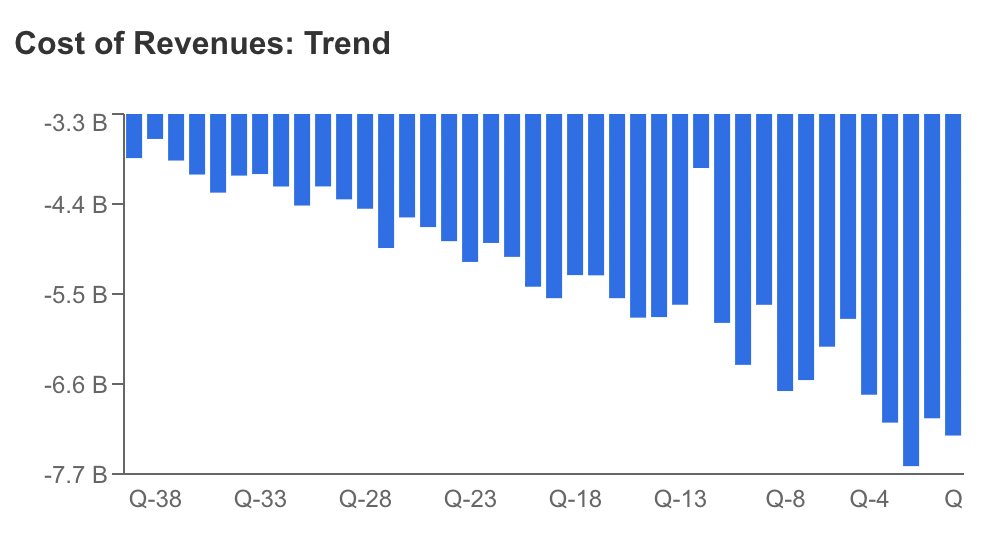

Given that revenues were positive—even topping estimates (see below), the margin compression comes mostly from higher cost of revenue.

Source: InvestingPro

Source: InvestingPro

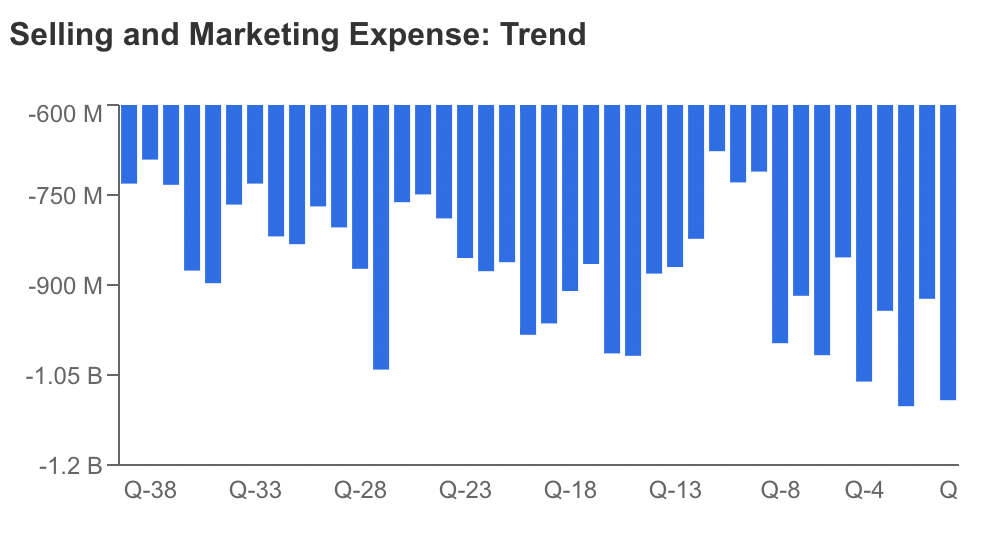

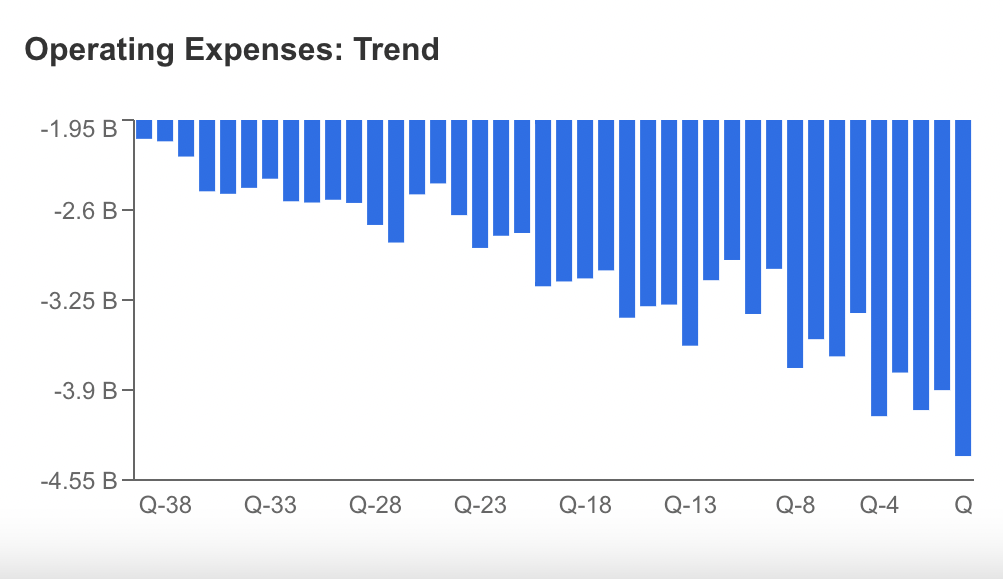

To break it down, selling and administrative expenses increased by 8%, totaling $4.4 billion, while demand creation expenses reached $1.1 billion, reflecting a 3%, primarily driven by investments in sports marketing, advertising, and marketing activities.

Source: InvestingPro

Source: InvestingPro

Operating overhead expenses have gone through the roof, rising by 10% to $3.3 billion, primarily due to wage-related expenses and NIKE Direct variable costs. Source: InvestingPro

Source: InvestingPro

The effective tax rate for the quarter was 17.3%, a significant increase compared to 4.7% during the same period the previous year. This change was primarily due to a non-cash, one-time benefit associated with the onshoring of non-US intangible property realized in the prior year.

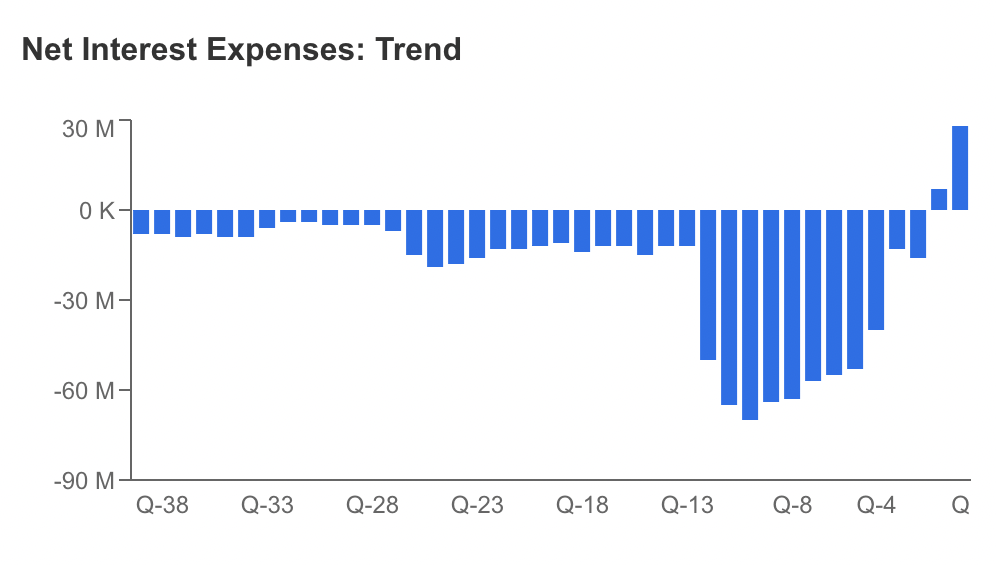

Finally, net interest expenses are also trending higher, showcasing the fact that Nike (and the broader US wholesale industry, by consequence) is starting to suffer from the prolonged rate hike cycle. Source: InvestingPro

Source: InvestingPro

Damage Control?

To address these trends, Nike recently made the surprising move of partnering with Designer Brands (NYSE:DBI) and Macy’s (NYSE:M) — which contradicts its strategy of focusing on its thriving direct-to-consumer division.

However, the rationale behind these initiatives becomes clear upon closer examination of Nike’s performance in the last quarter. Nike recognizes that it will need to sacrifice some profits by reducing its reliance on a declining wholesale industry. Given the detrimental impact of storage and freight costs on its margins, the company has no choice but to prioritize domestic sales.

But as the wholesale industry experiences decreasing sales, all participants in the cycle will be compelled to cut margins, potentially leading to a broader economic slowdown in the second half of the year.

The question now revolves around how effectively the industry can mitigate the damage.

This will centrally depend on the broader economy and — to a greater extent — on how much liquidity the Fed will squeeze out of the economy. While interest rates remain key, I suggest keeping an eye on the Fed’s balance sheet as well.

Still, Is Nike a Buy?

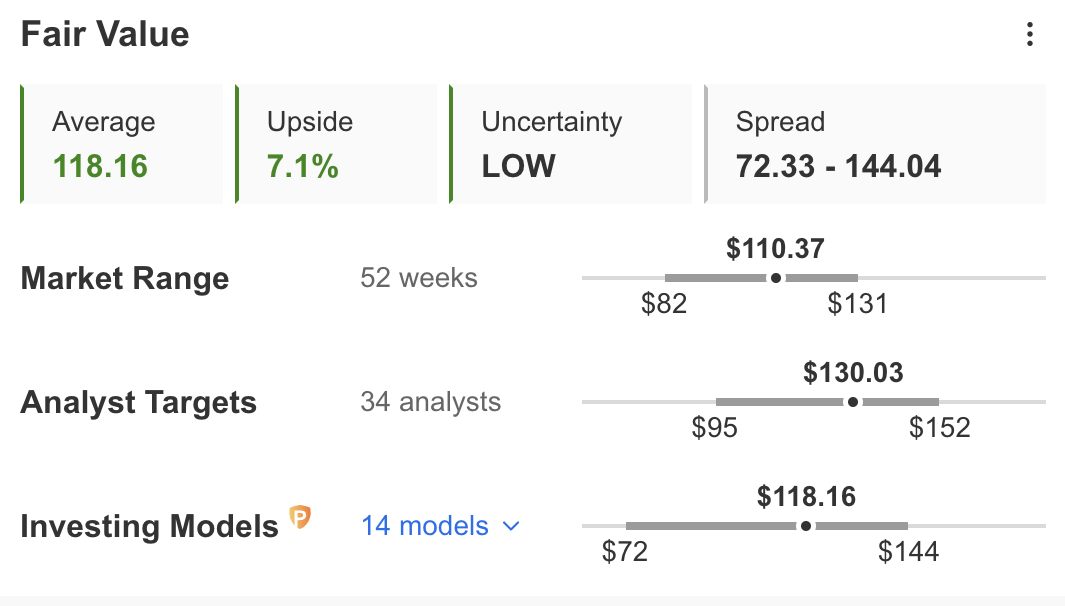

Despite the mixed report, some analysts are turning bullish on the Beaverton, Oregon-based behemoth. Likewise, InvestingPro is pricing a 7% upside for the company over the next 12 months.  Source: InvestingPro

Source: InvestingPro

That’s mostly because of Nike’s main positive point in fiscal Q4 2023: Its growing direct-to-consumer division, which surged to $5.5 billion, marking a 15% increase compared to the previous year. On a currency-neutral basis, the growth reached an impressive 18 percent, driven by a remarkable 24% expansion in NIKE-owned stores and a solid 14% growth in NIKE Brand Digital.

I, for one, also agree that Nike did particularly well in terms of finding solutions to the broad economic slowdown.

However, with multiples looking stretched in the face of declining earnings expectations (see below), I believe that we’re still likely to see further price weakness before a more substantial rebound into 2024. Moreover, considering the prevailing macroeconomic landscape, it appears highly likely that Nike’s challenges will persist throughout the year.  Source: InvestingPro

Source: InvestingPro

Nike's mixed outlook is clearly shown in its Financial Health Score.

Source: InvestingPro

Source: InvestingPro

Still, in a general overview, InvestingPro still prices more upside than downside for the athletic apparel giant. Source: InvestingPro

Source: InvestingPro

By the way, InvestingPro users can dig in even deeper on all of Nike's latest statements —such as 10-K, 10-Q, 8-K, and earnings. Try it out for a free week now!

Bottom Line

If we look at Nike’s earnings from an internal perspective, we will see that the company remains in solid financial shape. Furthermore, it has been doing a fantastic job in terms of finding solutions for the challenging macroeconomic environment of 2023.

However, it can only do so much amid declining consumer activity and higher costs. Given that these conditions will hardly change in the upcoming H2, I expect further mid-term weakness for the stock.

If conditions improve into 2024, though — which appears highly likely — Nike should be well-positioned to ride the uptrend in better fashion than most of its peers. Against this backdrop, I would consider Nike at sub-$100 prices an interesting buy for the long term.

Currently, however, I would stay away from it — as well as from anything dependent on consumer spending going into H2. As the signs of a broad economic slowdown keep mounting, traders are advised to avoid buying into the FOMO.

***

Disclosure: The author owns Nike stock for the long run.