- A significant rally on the daily and weekly charts

- The longer-term charts show room to rally

- Buffett’s purchase lit a bullish fuse: Coincidence or blessing?

- Levels to watch over the coming weeks

Natural gas moved from an oversold to an overbought condition over the past few weeks. The energy commodity traded to a new 25-year low of $1.432 in late June. Last week, the nearby September futures contract hit a high that was more than 72% higher when it traded to $2.468 per MMBtu on Aug. 21. As the hot and humid days of summer are numbered, the natural gas futures market is looking forward to the fall and winter seasons where the demand tends to peak.

Meanwhile, natural gas inventories in storage across the United States remain appreciably above last year’s level and the five-year average for mid-August. Bullish and bearish factors could pull natural gas in opposite directions over the coming weeks.

The injection season where stockpiles of natural gas rise begins in March and runs through November each year. Futures prices often reach lows in the spring and rally to highs in late fall and early winter. The rally in the natural gas market may have come a bit early in 2020. The price of the energy commodity at over the $2.40 per MMBtu level at the end of last week was higher than last year at this time when it traded in a range from $2.12 to $2.238 per MMBtu. The United States Natural Gas Fund (NYSE:UNG) moves higher and lower with the price of NYMEX natural gas futures.

Significant Rally On Daily, Weekly Charts

After hitting a low of $1.583 on the September futures contract in late June and a 25-year low of $1.432 per MMBtu, the natural gas futures market recovered.

Source: CQG

The daily chart of September natural gas shows that the price reached a high of $2.468 on Aug. 18, just 3.1 cents shy of the early May high. Price momentum and relative strength indicators moved to overbought conditions. The open interest metric fell from over 1.30 to the 1.243 million contract level as the price moved higher. In a futures market, declining open interest and rising price is not a technical validation of an emerging bullish trend. Daily historical volatility fell from over 90% earlier this month to the 51% level at the end of last week. The daily trading ranges narrowed, pushing the measure of price variance lower. Natural gas put in a bullish reversal on the daily chart on Aug. 21.

Source: CQG

The weekly chart shows that while the slow stochastic and relative strength metric continues to point higher, they are both in overbought territory. The upside target for the price of the energy commodity is the November 2019 high at $2.905. However, the trend since the 2018 peak at $4.929 per MMBtu illustrates that selling natural gas on rallies had been the optimal approach. Short sellers are likely to become more aggressive if the price action stalls after the recent rally.

Longer-Term Charts Show Room To Rally

The latest move in the natural gas futures market has put a constructive spin on the monthly and quarterly charts for the energy commodity.

Source: CQG

The monthly chart highlights that the move in August that took the price 61.6 cents per MMBtu high from the low to the peak was the most significant rise since November 2018 when the price hit a peak of $4.929 and traded in a $1.763 range. Price momentum and relative strength indicators were on either side of neutral readings, and both were pointing higher at the end of last week.

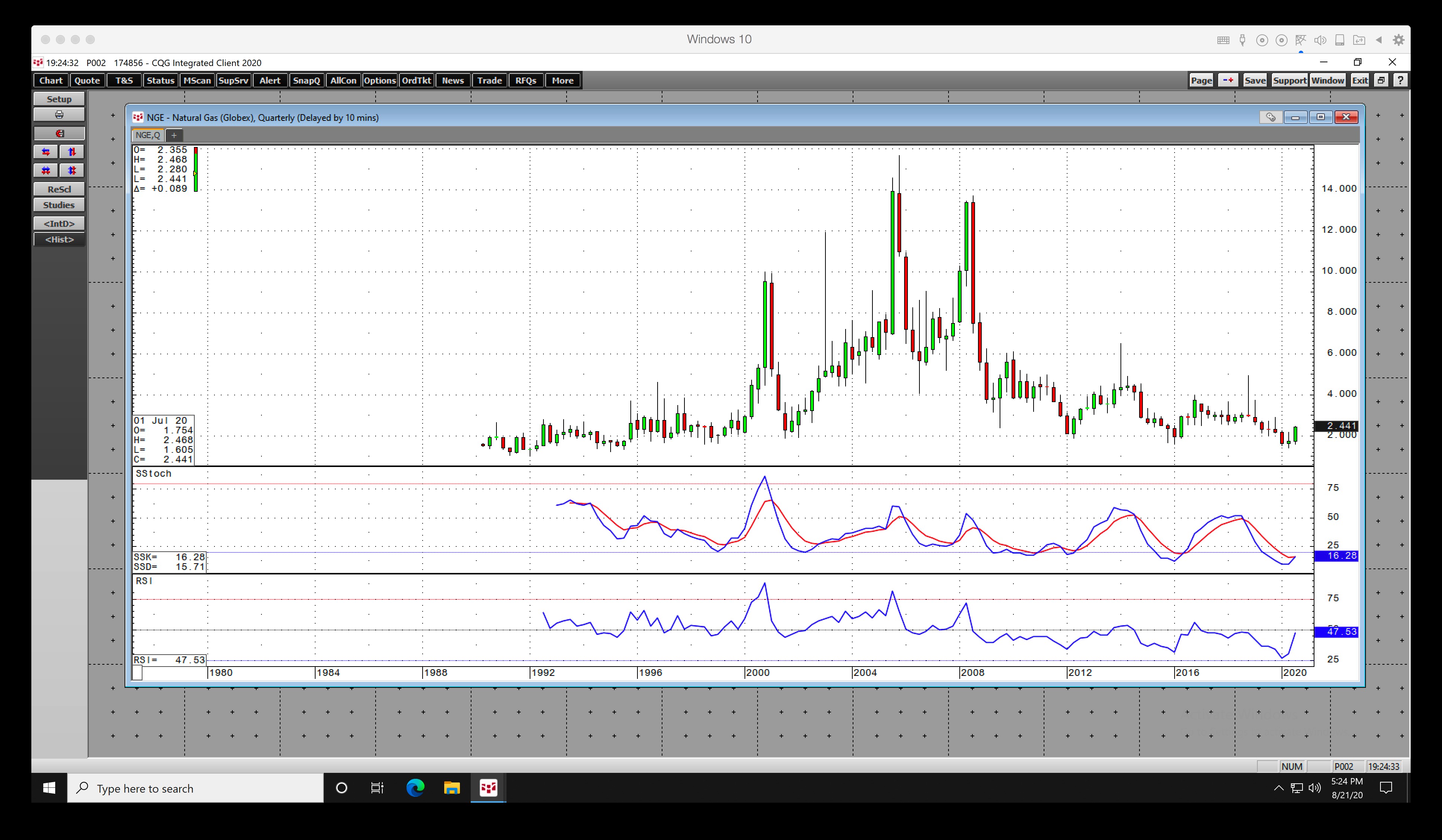

Source: CQG

The long-term quarterly chart shows that relative strength has risen from an oversold reading in earlier in 2020 and was approaching neutral territory on Aug. 21. However, price momentum remained in an oversold condition but was attempting to cross higher after the recent rally.

The monthly and quarterly charts leave plenty of room for a challenge of the late 2019 high at $2.905 and the $3 per MMBtu levels as the peak season of demand that starts in November approaches.

Buffett’s Purchase Lit Bullish Fuse: Coincidence Or Blessing?

Time will tell if Warren Buffett’s timing in natural gas was impeccable in the natural gas market. As the price was hitting a quarter-of-a-century low in late June, the Oracle (NYSE:ORCL) of Omaha was likely negotiating the purchase of the transmission and pipeline assets of Dominion Energy (NYSE:D), which Berkshire Hathaway (NYSE:BRKb) bought for $10 billion.

Buffett is a value investor. Buying natural gas assets when the price of the energy commodity was at its lowest level since 1995 and shares of all energy-related companies continued to lag the stock market could turn out to be a shrewd move. In the world of commodities, the cure for low prices is the low price, as production tends to decline, leading to falling inventories and rising prices. Stockpiles of natural gas remained at an elevated level with 21.4% more in storage in mid-August 2020 than at the same time in 2019 and 15.1% more than the five-year average, production dropping. According to Baker Hughes, only 69 natural gas rigs were operating in the U.S. as of Aug. 21 compared to 162 last year at the same time.

After reaching the lowest price of this century, Buffett stepped up to the plate and made a significant investment in natural gas assets. Since the start of the global pandemic, he sold his interest in airline stocks and recently sold shares in some of the leading banks and financial institutions. He purchased the natural gas transmission and pipeline assets and shares of Barrick (NYSE:GOLD), a gold mining producer. The falling dollar, rising deficits because of the stimulus, and uncertainty in markets across all asset classes have pushed Buffett to make his last two sizeable investments in commodity production or related businesses. Buffet’s actions could be a blessing for the raw materials asset class.

Levels to Watch Over Coming Weeks

When it comes to the natural gas market, the first level to watch on the downside is the Aug. 12 low at $2.085 on the September futures contract. Below there, $1.781, $1.641, and $1.583 stand as technical support levels. On the continuous futures contract, $2 is a critical psychological level, with support at $1.605 and $1.432, the late June low.

On the upside, the early May high of $2.499 on the September contract is the first target for the energy commodity. Above there, the November 2019 peak at $2.905 is critical technical resistance. As we move closer to the 2020/2021 peak season of demand that begins in November, the chances of a rally increase. The uncertainty of the weather during the winter months tends to support the price of natural gas in November and December, which is the time of the year where the price displays seasonal strength.

Meanwhile, inventories are at a level that could cap rallies over the coming weeks and months as there is plenty of natural gas in storage across the United States to meet all requirements for the coming winter season. I would not be surprised to see another downside correction before the seasonal strength in October and November. The short-term overbought position of the market is a warning sign that it may be too early to be bullish for the price of natural gas. However, the bullish reversal on Friday makes the picture cloudy. Natural gas is always a market that is full of surprises for market participants.