Two weeks ago, see here, we warned it was time to be a bit more cautious for the Bulls based on the interpretation of the price action for the Nasdaq 100 using the Elliott Wave Principle (EWP):

"The index should top out at ideally ~$15750+/-100, then drop back to the low $14Ks again before staging the red W-v rally. It will require a break below the green W-1 high at $15277 to suggest that path, which is our alternate EWP count."

Fast forward, and the index could not even reach $15750+/-100. Instead, it stalled at $15557 and dropped below the critical $15277 level a day later. Thus, as we already stated a month ago:

"based on the EWP, we know that after three waves down, expect at least three waves back up," as the market can present us with a flat correction consisting of three waves down, three back up, and five waves down (3-3-5).

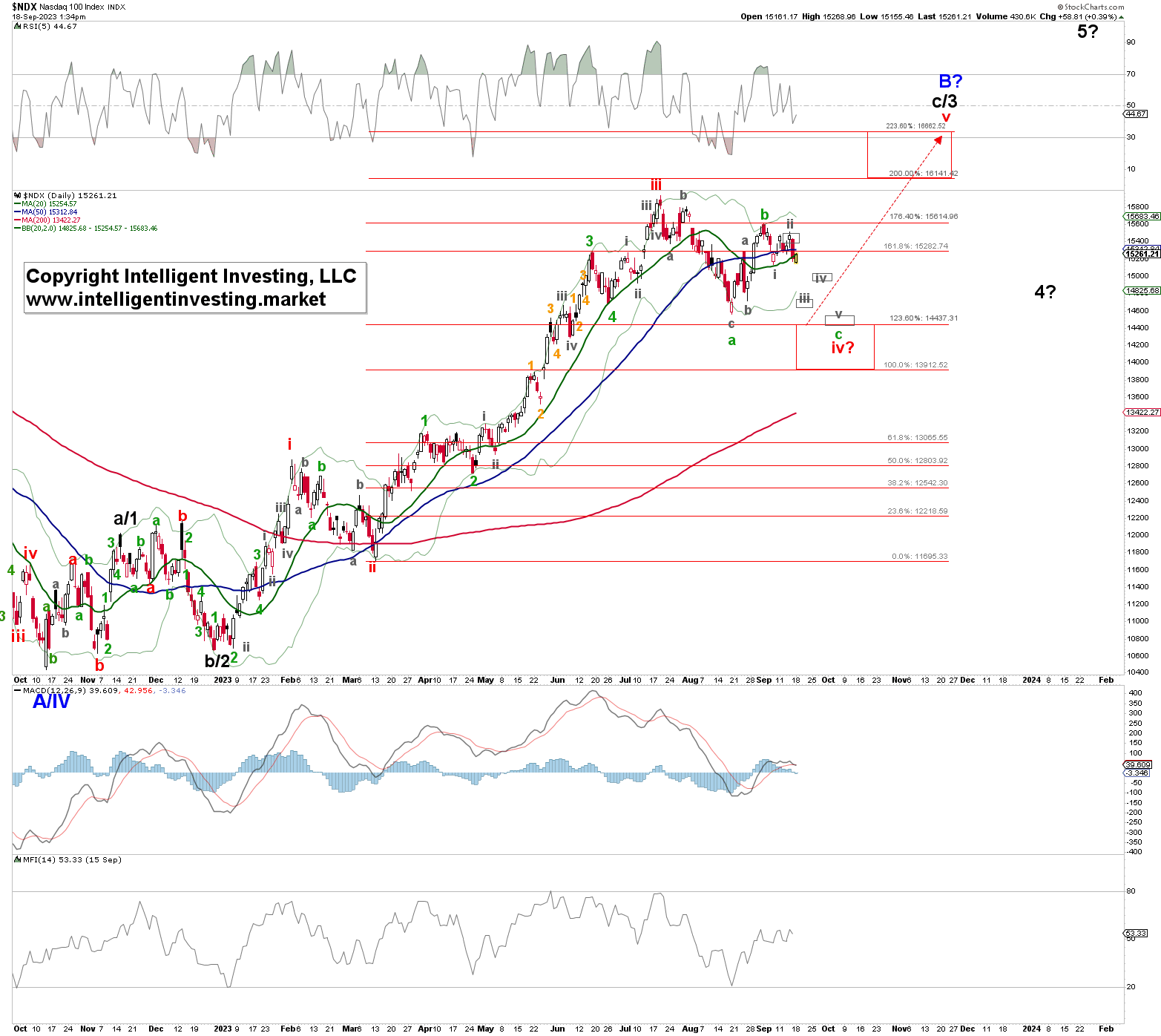

That pattern is the green W-a, -b, -c in Figure 1.

Figure 1. NASDAQ100 daily resolution chart with technical indicators and detailed EWP count. Although it was our alternate option, over the last two weeks it has become our preferred because the index dropped below $15277 and, moreover, the decline from the September 1 high to the September 7 low counts best as five (orange) waves lower (grey W-i), while the subsequent rally into last week's high was, again, only three (orange) waves (grey W-ii). See Figure 2 below. As you can see, a lot can happen in two weeks, and it pays to stay informed frequently.

Although it was our alternate option, over the last two weeks it has become our preferred because the index dropped below $15277 and, moreover, the decline from the September 1 high to the September 7 low counts best as five (orange) waves lower (grey W-i), while the subsequent rally into last week's high was, again, only three (orange) waves (grey W-ii). See Figure 2 below. As you can see, a lot can happen in two weeks, and it pays to stay informed frequently.

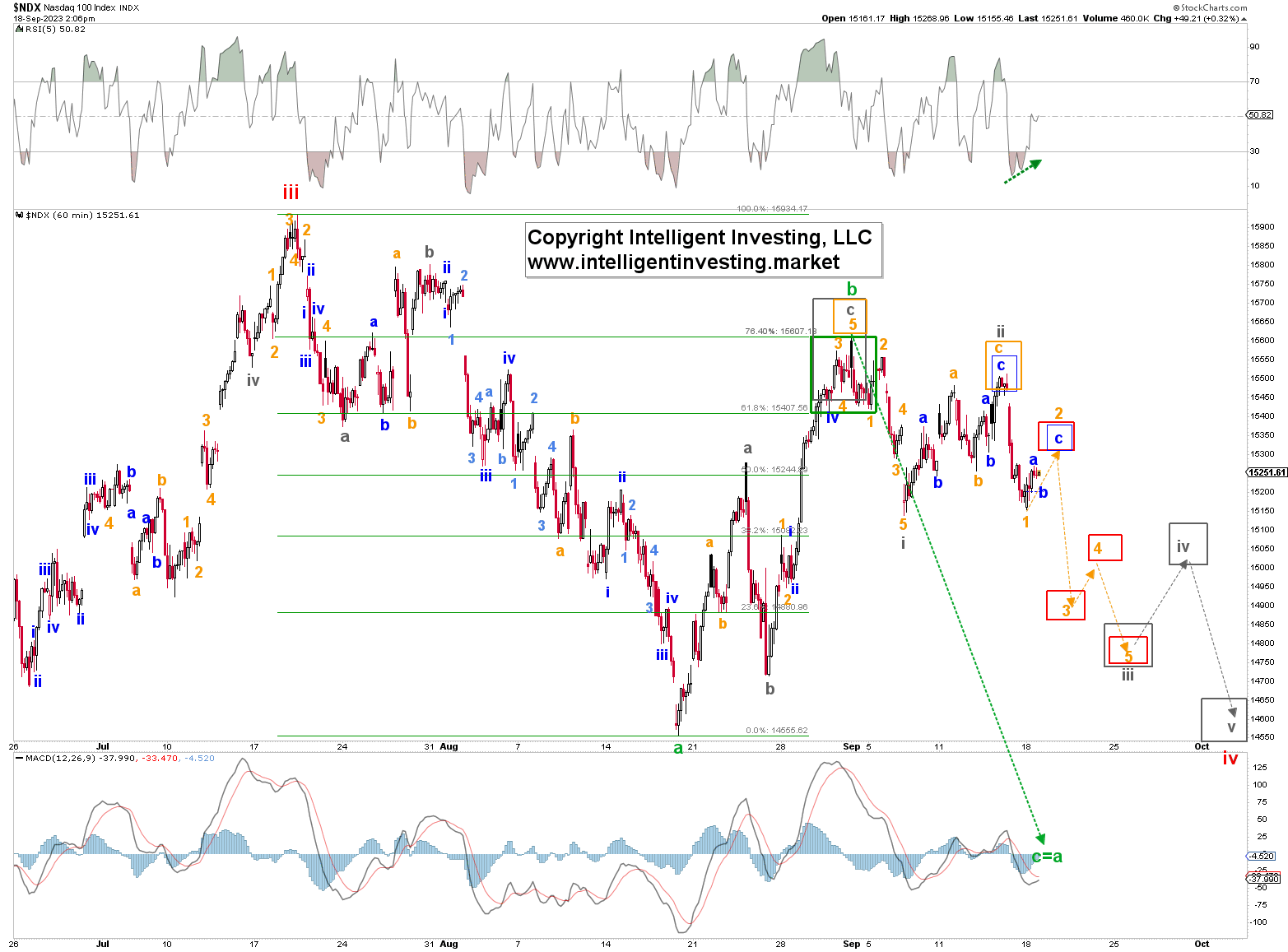

Figure 2. NASDAQ100 hourly resolution chart with technical indicators and detailed EWP count. Our preferred path is now for the completion of the red W-iv as an expanded flat, with green W-c underway. As stated, C-waves in a flat comprise five waves. Thus, grey W-iii, iv, and v of W-c of W-iv should commence soon. See Figure 2 above.

Our preferred path is now for the completion of the red W-iv as an expanded flat, with green W-c underway. As stated, C-waves in a flat comprise five waves. Thus, grey W-iii, iv, and v of W-c of W-iv should commence soon. See Figure 2 above.

Please note that we are all always students of the market, and our preferred assessment will be wrong on a break above $15600, with a first warning for the Bears above last week's high of $15512. We will then have to switch to a Bullish Ending Diagonal (ED) targeting $16750s. EDs comprise five sets of three waves (3-3-3-3-3), and thus, while the initial part still looks corrective due to three waves up and down, it is a tricky way to get wrong-footed ultimately. But it is simply our insurance policy if things go wrong. Lastly, we are tracking two other (Bearish) possibilities, but given the length limitations of these articles, we cannot share them at this stage.