Markets are quiet in anticipation of the Fed's comments later today. The most popular currencies and equity indices have stabilised near important levels near the limits of their trading ranges, from where they are equally likely to step back into established trends or break them.

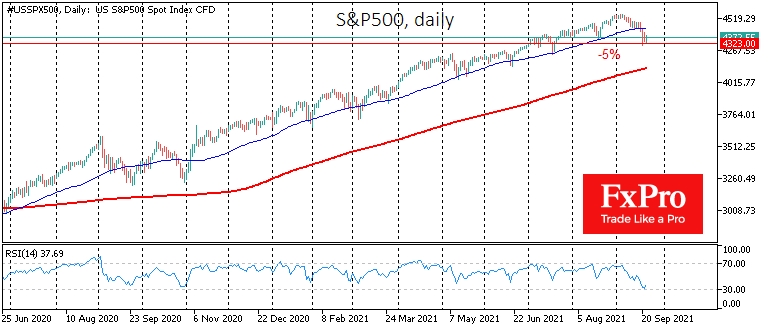

The S&P 500, the benchmark stock index, has found some support from buyers after it fell 5% from the early September peaks, but so far, it has not found enough support from buyers to develop growth ahead of the Fed statement and press conference. A renewal of the week's lows would pave the way for a deeper, 10% correction near 4100 on the S&P 500, near which the major 200-day moving average also runs. Soft comments from the Fed could bring back active buying in shares and push indices to new all-time highs as early as next month.

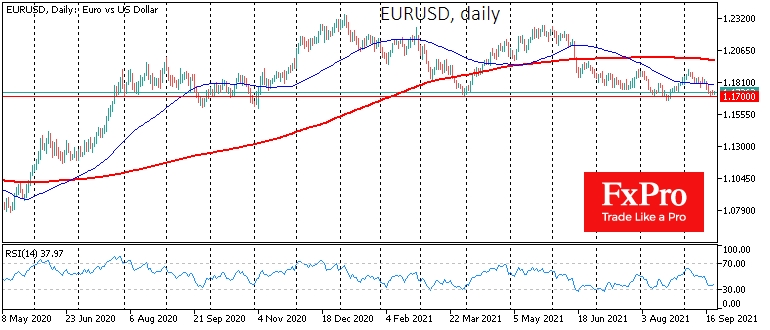

EUR/USD, the FX flagship pair, has settled near 1.1700, a support area from last July. It has traded lower for only a few days and was quick to find buyers. With hawkish FOMC comments, a dip below this level would occur, highlighting the contrast in policy between the Fed and the ECB. In that case, the EUR/USD may correct towards 1.1200 before the end of the year. The Fed's dovishness may push the pair towards the upper end of the range above 1.21 by the end of 2021.

The precious metals have been resisting the general consolidation trend in recent days. After last week's tumultuous dip, cautious buying remains in place. Gold is again near $1780, staying away from significant technical levels to highlight and reinforce the bullish sentiment. Silver is hitting the downside to the former lower band trading channel of the last year, and it cannot move back above $23 just yet. Fed softer comments will spur demand for metals, as overall demand risk.

By the Fed's soft stance, we mean the desire to get more data before announcing a reduction in the asset purchase programme on the balance sheet. This is the most likely scenario due to Chinese uncertainty (has Evergrande (OTC:EGRNY) triggered a domino effect?) and the latest weak labour market report.

However, if the Fed emphasises that the current stimulus has outlived its usefulness and is introducing adverse secondary effects, a deeper correction and reassessment of risks could begin in the markets.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Markets Wait For Fed Decision, Ready For New Big Trends

Published 09/22/2021, 05:21 AM

Updated 03/21/2024, 07:45 AM

Markets Wait For Fed Decision, Ready For New Big Trends

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.