- Investors should brace for more volatility next week as the stock market faces a triple whammy of risk events.

- U.S. CPI inflation, the latest retail sales figures, and a read on wholesale prices will be in focus amid growing uncertainty over the Federal Reserve’s policy outlook.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

- I believe the data will emphasize the substantial risk of a renewed surge in inflation, which will force the Fed to raise interest rates at least one more time before the end of the year and then leave them at higher levels for longer than expected.

- Considering the recent spike in energy prices, I am of the opinion that inflationary pressures will reaccelerate in the months ahead, resulting in another wave of hot inflation, which will continue to exert pressure on the Fed to sustain its efforts in combating rising consumer prices.

- As oil and gasoline continue their upward trend, CPI could potentially rise back above 5.1%-5.5% by year-end. As such, inflation levels could remain elevated for a more extended duration than is presently anticipated by financial markets.

- Taking that into consideration, the Fed’s inflation battle is far from over.

- I anticipate the pair of reports will highlight the continued strength of the economy given a surprisingly resilient consumer, which in turn will keep pressure on the Fed to crack down on growth to curb prices.

- Powell, in a speech at an economic summit in Jackson Hole, Wyoming, last month, said policymakers would "proceed carefully as we decide whether to tighten further" but also made clear that the central bank has not yet concluded that its benchmark interest rate is high enough to be sure that inflation returns to the 2% target.

- All things considered, investors may want to exercise caution in the very near term as the current environment, in my opinion, is not ideal to be adding to your exposure to equities.

Next week will help determine what the Federal Reserve’s near-term outlook for interest rates will be as the U.S. central bank faces the difficult task of balancing between its ongoing battle to contain inflation and cool the economy without tipping it into a recession.

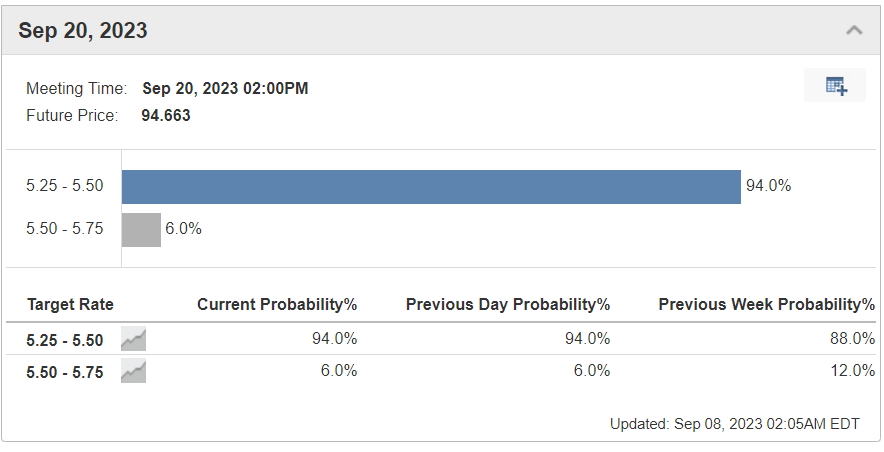

As of Friday morning, financial markets see a 94% chance of the Fed leaving rates unchanged at its meeting later this month, compared to just a 6% chance of a 25-basis point increase, according to Investing.com’s Fed Rate Monitor Tool.

Source: Investing.com

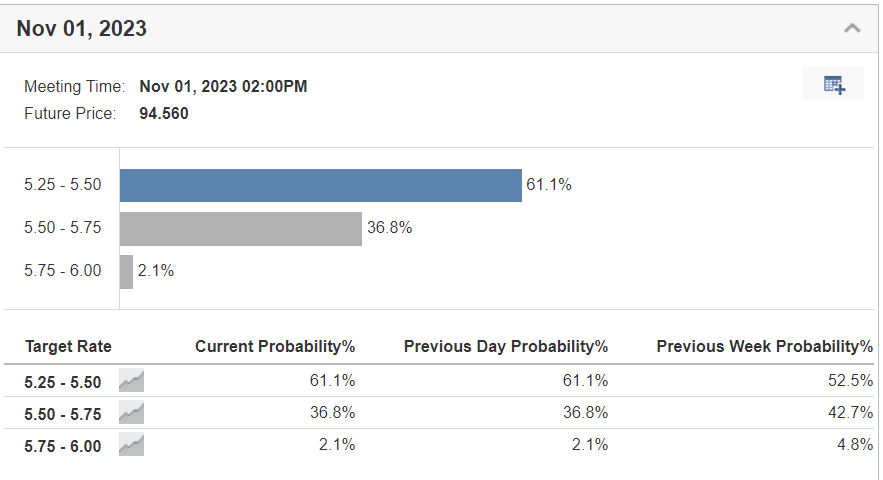

But what the Fed will do beyond September remains an open question, with future hikes not entirely off the table.

In fact, traders now see a roughly 40% chance of the Fed raising its benchmark interest rate by a quarter-percentage-point to a range between 5.50%-5.75% at its November meeting.

Source: Investing.com

At the same time, hopes of seeing rate cuts by early 2024 have almost completely faded.

With investors growing increasingly uncertain over the Fed’s monetary policy plans, a lot will be on the line next week as cracks begin to widen in the year-to-date rally on Wall Street amid rising bond yields, spiking oil prices and sending the dollar higher.

Wednesday, September 13: U.S. CPI Report

With Fed Chair Jerome Powell reiterating that his main objective is to bring inflation back under control, next week’s CPI inflation data will be key in determining the Fed’s policy moves through the end of 2023.

The U.S. government will release the August report on Wednesday, September 13, at 8:30 AM ET, and the numbers will likely show that prices continue to increase at a pace far more quickly than the 2% rate the Fed considers healthy.

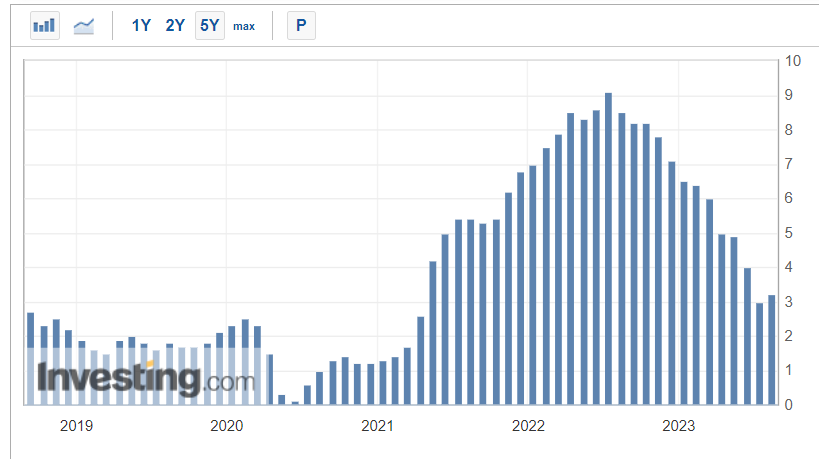

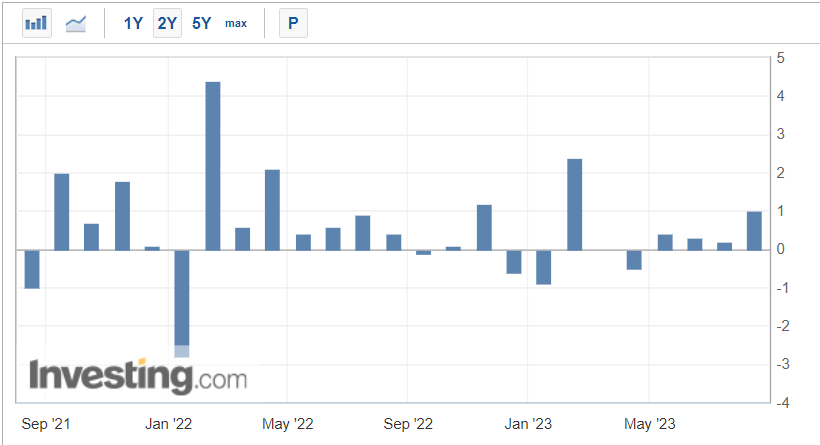

As per Investing.com, the consumer price index is forecast to rise 0.5% on the month after edging up 0.2% in July. The headline annual inflation rate is seen rising 3.4%, accelerating from a 3.2% annual pace in the previous month.

Source: Investing.com

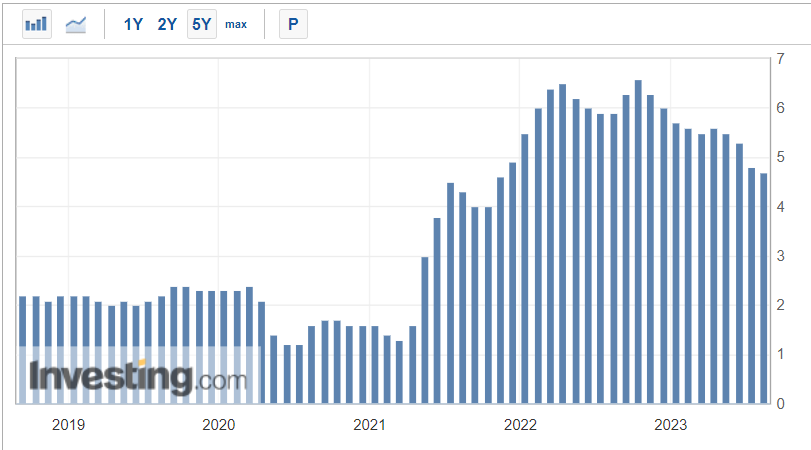

Meanwhile, the August core CPI index - which does not include food and energy prices - is expected to rise 0.2%, matching the same increase in July. Estimates for the year-on-year figure call for a 4.5% gain compared to July’s 4.7% reading.

Source: Investing.com

The core figure is closely watched by Fed officials who believe that it provides a more accurate assessment of the future direction of inflation.

Prediction

Thursday, September 14: U.S. Retail Sales, PPI

With the U.S. central bank being data-dependent, investors will pay close attention to the latest retail sales figures as well as the August producer price index report, which are both due at 8:30 AM ET on Thursday, September 14.

The data will take on extra importance this month, as it will be the final piece of information the Fed receives before making its monetary policy decision on Wednesday, September 20.

After retail sales scored their biggest monthly gain since February last month, the key question is whether consumer spending will remain strong enough for the Fed to maintain its efforts to cool the economy.

Economists forecast a 0.4% month-over-month increase in the headline number, with auto sales coming in stronger during the month. After stripping out the auto and gas categories, core retail sales are expected to show a 0.5% gain.

Source: Investing.com

Automobile sales account for roughly 20% of retail sales, but they tend to be very volatile and distort the underlying trend. The core data is therefore thought to be a better gauge of spending trends.

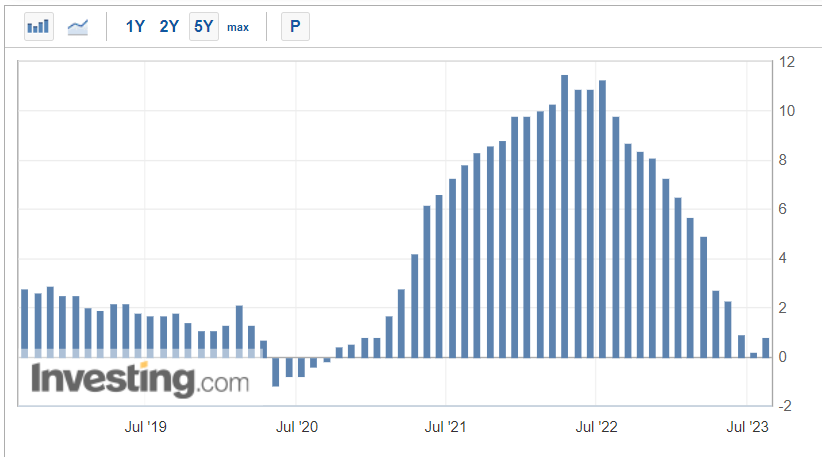

Meanwhile, the latest update on producer prices will give inflation watchers another talking point. The headline year-over-year August PPI reading is expected to increase 1.3%, after edging up 0.8% in July.

If that is confirmed, it would mark the second straight month in which wholesale prices have picked up from the previous month.

Source: Investing.com

Meanwhile, the annual core PPI rate should dip to 2.3% from 2.4%, which is still too high for the Fed.

Prediction

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading decisions.

***

Disclosure: At the time of writing, I am long on the Dow Jones Industrial Average via the SPDR Dow ETF (DIA). I also have a long position on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.