The equity markets are surging higher this morning, I have almost nothing but short positions, and I think it’s great.

Why? Well, because the markets are behaving in a completely chart-friendly manner, and the 23.6% retracement level I warned premium members about yesterday did a picture-perfect job calling for a bounce, which is why I covered my largest position, my IEFA short.

There’s no doubt I’m going to see my positions weaken substantially in the open. It doesn’t matter, because the charts are behaving beautifully, and that’s really what I’m after. Plus, I have a ton of free cash available.

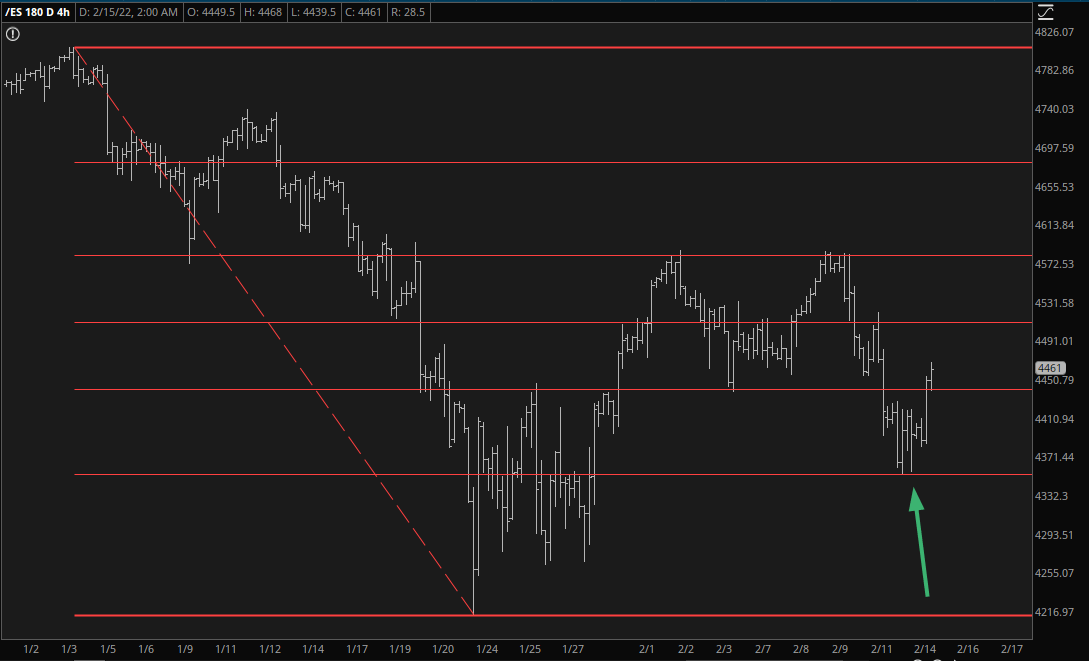

Below is the 4-hour bar chart of the S&P 500 Futures. You can see the amazing job the Fib retracement did by calling for a bottom. Look at the congestion area it has entered, however.

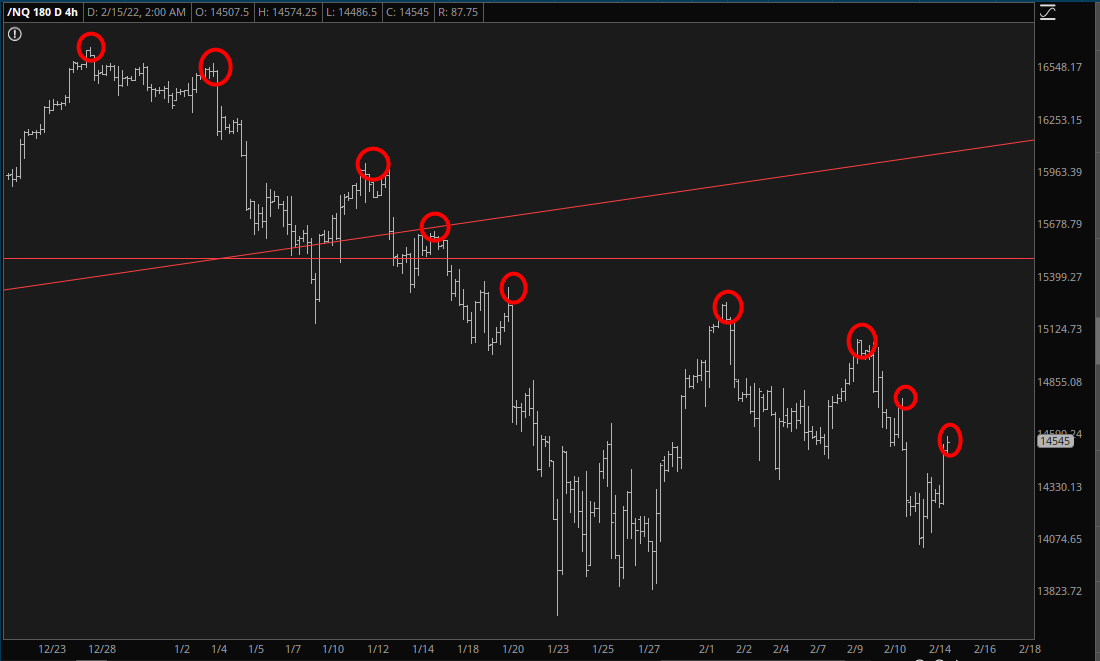

The market’s situation is made plainer by the NASDAQ 100 Futures chart, which shows the steady stair-step progression. Time and time again, “the bottom” is achieved, and a bounce ensues, and Jim Cramer and Marko Kolanovic tells the world to go long, only to see equities roll over again. I doubt it’s different this instance.

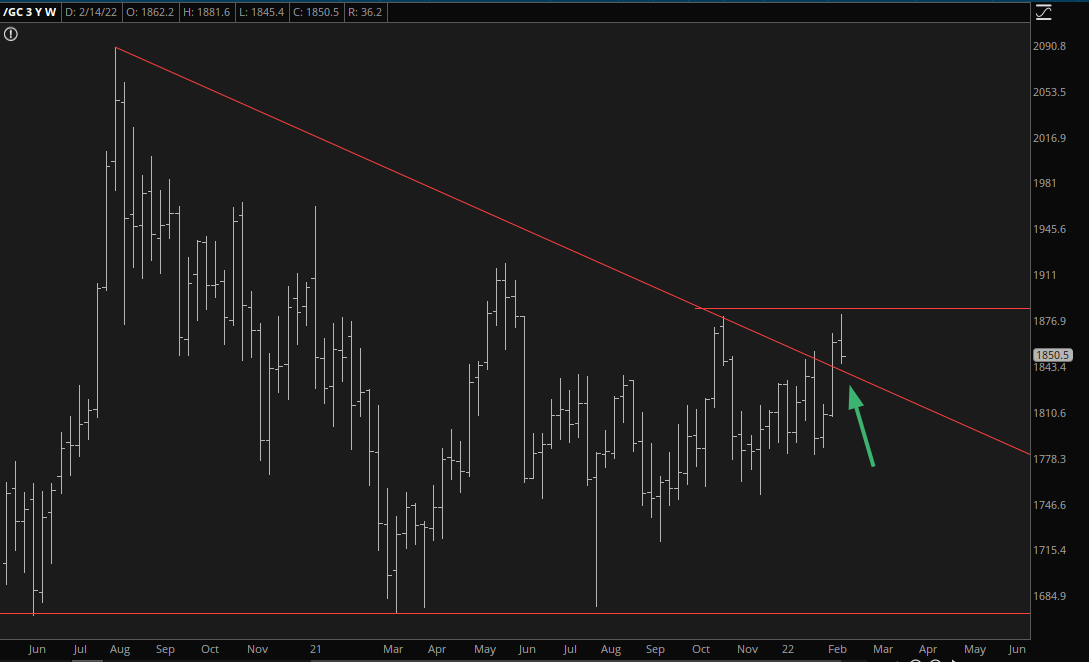

My enchantment with gold’s rise yesterday is unswayed, because, again, the chart is doing precisely what you would want to see. Gold is just about the only thing getting zapped this morning, thanks to the Ukraine nonsense vanishing, but the tumble is precisely to the former resistance line which, yes, is now support. In other words, this looks like a great buy point for gold.

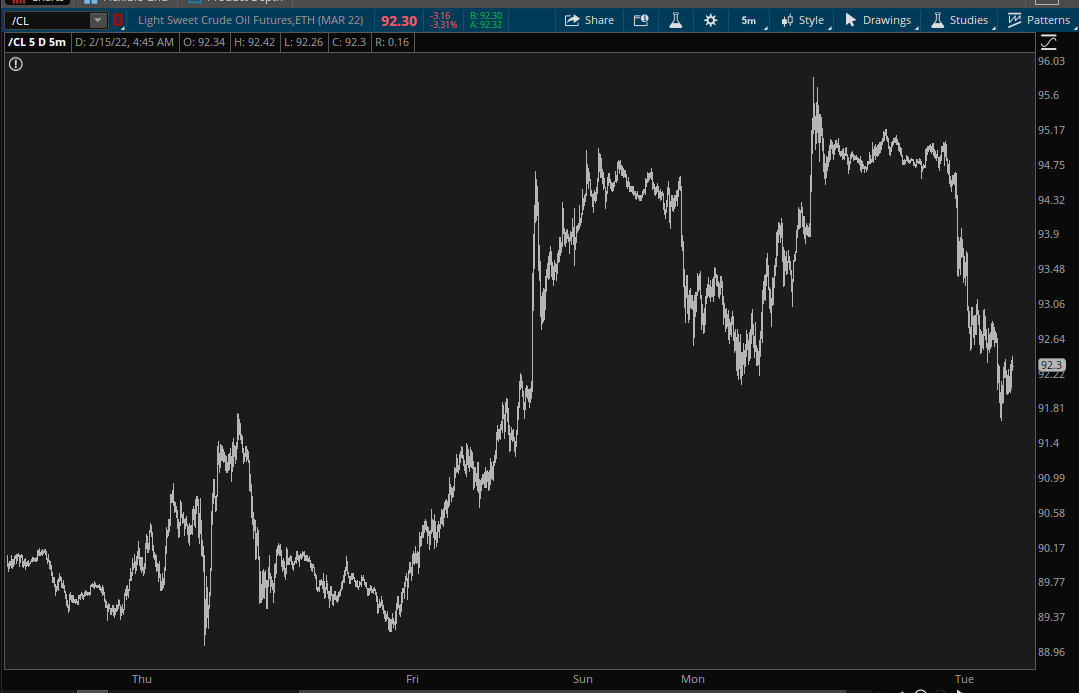

I’m particularly excited because on Monday I once again tilted at the energy windmill, and it looks like it’s going to work. I bought puts in Oil & Gas Exploration & Production ETF (NYSE:XOP), Occidental Petroleum Corporation (NYSE:OXY), Energy Select Sector Fund (NYSE:XLE), and APA (NASDAQ:APA), and thanks to crude oil's sudden reversal, I think that’s going to be a salve for the bump in equities. Here is crude oil:

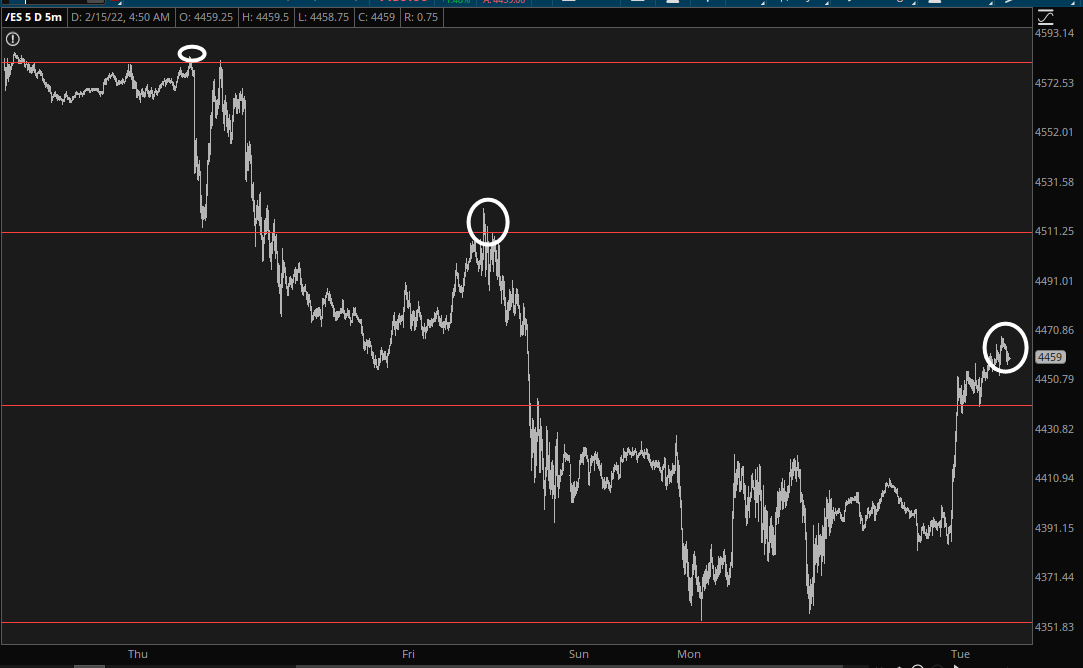

As for a “you are here” moment, I think the ES chart below tells the tale. We have, yet again, pushed above a small bullish pattern, and my intuition is that it will shortly sputter.