“When you get a range expansion, the market is sending you a very loud, clear signal that the market is getting ready to move in the direction of that expansion.” -Paul Tudor Jones

Back in September I suggested it looked like the oil price was getting ready to break out of its long-term downtrend. Shortly afterwards, it did just that, breaking out before falling back to test the breakout level.

If Paul Tudor Jones is correct, this expansion of the long-term range in oil prices heralds a much larger move higher. What’s more, the fundamentals of simple supply and demand would seem to confirm that thesis.

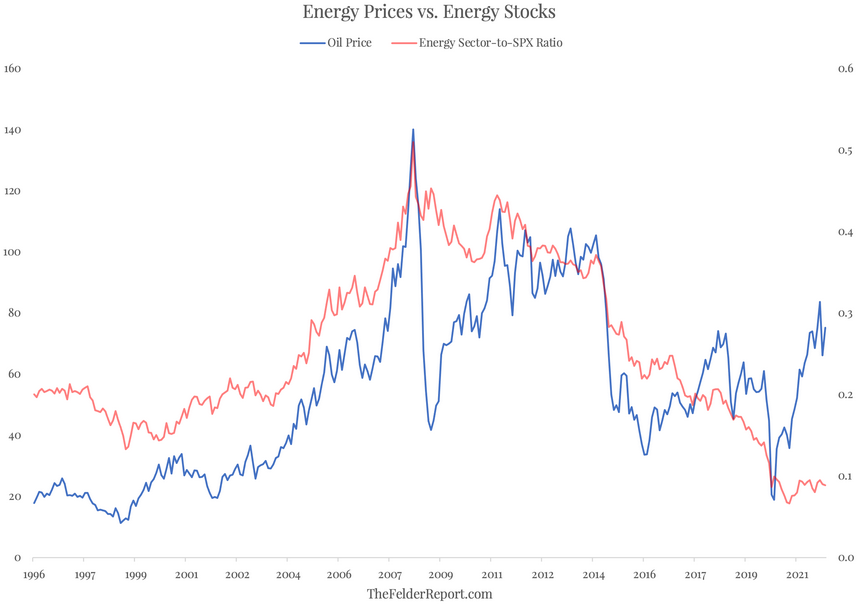

In reaction to the strong rally in oil prices last year, energy stocks were the best-performing sector in the S&P 500 Index. But you wouldn’t really know it by looking at the chart below.

If oil prices are, in fact, headed even higher, the relative performance of the energy sector has only just begun to reflect this bullish trend. And it’s still early but so far things are off to a pretty stellar start for the sector this year.

Of course, reversion in this relative performance metric can come one of two ways: Either energy stocks can outperform to the upside (during a continued uptrend for the S&P 500) or they can outperform to the downside (during a bear market in the index). Either way, the energy sector probably has a long way to go yet before this nascent bull market is over, no matter what ESG has to say about it.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Market Sending ‘Loud, Clear Signal’ Oil Prices Are Headed Higher

Published 01/06/2022, 12:29 AM

Updated 07/09/2023, 06:31 AM

Market Sending ‘Loud, Clear Signal’ Oil Prices Are Headed Higher

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Not until price fills orders left behind in the 40 dollar range. Still wont help our gas prices, and oil will eventually hit 140 ath's and more, the massive HS supported by bearish divergence structuring shows the retest cycle of the breakout is about to happen.

Lol

Bull market done, inflation rising, jobs burgeoning, too much household wealth, $100 oil by March 1 and 10% real inflation

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.